Sallie Mae 2008 Annual Report Download - page 168

Download and view the complete annual report

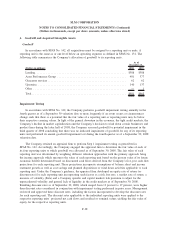

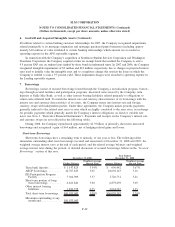

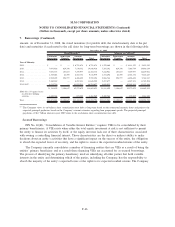

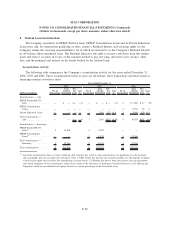

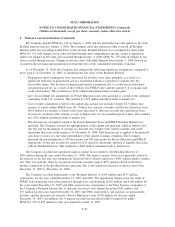

Please find page 168 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

Financing Facilities are subject to termination under certain circumstances, including the Company’s failure to

comply with the principal financial covenants in its unsecured revolving credit facilities.

Borrowings under the 2008 Asset-Backed Financing Facilities are nonrecourse to the Company; however,

the Company has indemnified the other parties to the facilities in cases of breaches of representations and

warranties. As of December 31, 2008, the Company had $24.8 billion outstanding in connection with the 2008

Asset-Backed Financing Facilities. The book basis of the assets securing these facilities as of December 31,

2008 was $33.2 billion. Loans within the facility are periodically marked to market. The mark-to-market

process could require the Company to post additional collateral within one business day of receiving a margin

call.

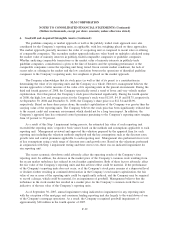

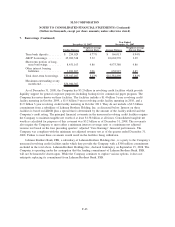

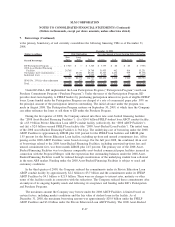

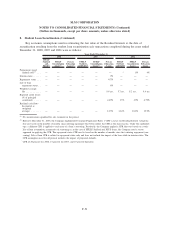

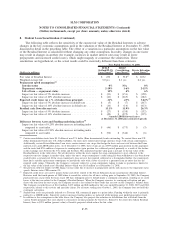

The 2008 Asset-Backed Financing Facilities were scheduled to mature on February 28, 2009. On

February 2, 2009, the Company extended the maturity date of the 2008 ABCP Facilities to April 28, 2009 for

a $61 million upfront fee. The other terms of the facilities remain materially unchanged. The Company

expects to refinance the 2008 ABCP Facilities at a lower aggregate commitment than the $25.6 billion

committed as of December 31, 2008. If the Company does not pay off all outstanding amounts of the 2008

ABCP Facilities at maturity, the facilities will extend by 90 days with the interest rate increasing each month

during the 90-day period. On February 27, 2009, the Company extended the maturity date of the 2008 Asset-

Backed Loan Facility from February 28, 2009 to April 28, 2009 for a $4 million upfront fee. The other terms

of this facility remain materially unchanged.

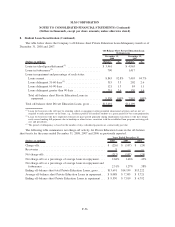

As disclosed, the Company has extended the 2008 Asset-Backed Financing Facilities to mature on

April 28, 2009. The Company believes that it will be successful in its effort to refinance the facility at a lower

balance at such time. If the Company is unable to refinance the 2008 Asset-Backed Financing Facilities and if

its obligation was settled through the lenders possession of posted collateral the Company would incur a

charge of $8.4 billion, ($5.3 billion after tax) representing the difference between the Company’s cost basis in

the collateral and current borrowings under the facility as of December 31, 2008. As a result, the Company

would no longer meet the covenants related to its lines of credit and its ability to conduct business could be

materially changed. While the Company would still be able to originate loans into the ED Participation and

Purchase program, its ability to originate Private Education Loans could be limited or curtailed. However,

even if the Company is unsuccessful in this renegotiation, it believes that its current investment portfolio,

when combined with its net expected cash inflows (principally from loan repayments) and the ED Conduit

Program borrowing it expects to begin using in the first quarter of 2009 will provide sufficient liquidity to

meet its short term obligations.

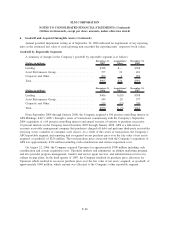

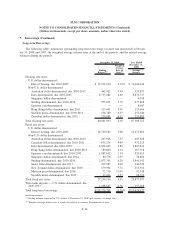

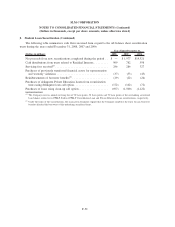

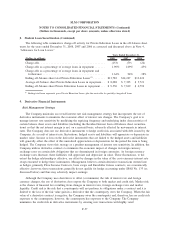

In certain of the Company’s securitizations, there are terms within the deal structure that result in such

securitization not qualifying for SFAS No. 140 sale treatment and are accounted for as secured borrowings as

a result. Terms that prevent sale treatment include: (1) allowing the Company to hold certain rights that can

affect the remarketing of certain bonds, (2) allowing the trust to enter into interest rate cap agreements after

the initial settlement of the securitization, which do not relate to the reissuance of third-party beneficial

interests or (3) allowing the Company to hold an unconditional call option related to a certain percentage of

the securitized assets. In certain of these on-balance sheet securitizations, the Company holds the option of

purchasing remarketing bonds prior to a failed remarketing. The Company exercised this option in 2008 and

purchased $839 million of these notes.

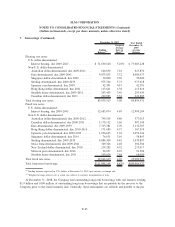

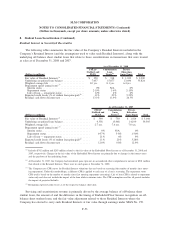

In the fourth quarter of 2008, two of the Company’s off-balance sheet securitization trusts were re-

evaluated using the guidance in SFAS No. 140 and it was determined that they no longer met the criteria to be

considered QSPEs, thus violating the sale criteria in SFAS No. 140. These trusts were then evaluated as VIEs

using the guidance in FIN No. 46(R) and it was determined that they should be consolidated and accounted

for as secured borrowings as the Company is the primary beneficiary. The trusts had reached their 10 percent

F-48

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)