Sallie Mae 2008 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

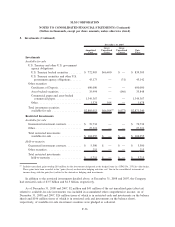

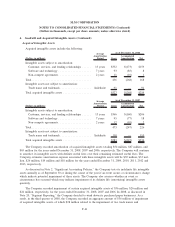

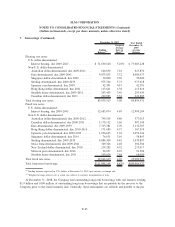

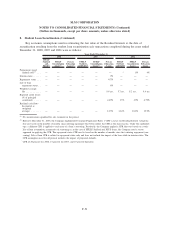

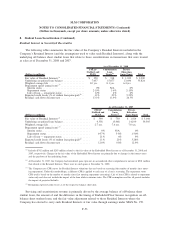

7. Borrowings (Continued)

amount. As of December 31, 2008, the stated maturities (for putable debt, the stated maturity date is the put

date) and maturities if accelerated to the call dates for long-term borrowings are shown in the following table:

Unsecured

Borrowings

Term Bank

Deposits

Secured

Borrowings Total

Unsecured

Borrowings

Term Bank

Deposits

Secured

Borrowings Total

Stated Maturity

(1)

Maturity to Call Date

(1)

December 31, 2008

Year of Maturity

2009 . . . ............. $ — $ — $6,721,874 $ 6,721,874 $ 1,322,460 $ — $ 8,111,522 $ 9,433,982

2010 . . . ............. 7,091,836 624,248 7,130,332 14,846,416 7,205,102 624,248 7,066,784 14,896,134

2011 . . . ............. 7,091,335 103,023 7,259,977 14,454,335 7,244,961 103,023 7,259,977 14,607,961

2012 . . . ............. 2,329,048 82,599 6,765,332 9,176,979 2,374,496 82,599 6,765,332 9,222,427

2013 . . . ............. 2,995,195 298,777 6,496,422 9,790,394 2,968,748 298,777 6,496,422 9,763,947

2014 . . . ............. 5,360,369 — 6,287,831 11,648,200 5,457,677 — 6,287,831 11,745,508

2015-2047 ............ 6,313,716 — 41,910,911 48,224,627 4,608,055 — 40,584,811 45,192,866

31,181,499 1,108,647 82,572,679 114,862,825 31,181,499 1,108,647 82,572,679 114,862,825

SFAS No. 133 (gains) losses

on derivative hedging

activities ............ 2,489,764 — 872,205 3,361,969 2,489,764 — 872,205 3,361,969

Total . . . ............. $33,671,263 $1,108,647 $83,444,884 $118,224,794 $33,671,263 $1,108,647 $83,444,884 $118,224,794

(1)

The Company views its on-balance sheet securitization trust debt as long-term based on the contractual maturity dates and projects the

expected principal paydowns based on the Company’s current estimates regarding loan prepayment speeds. The projected principal

paydowns of $6.7 billion shown in year 2009 relate to the on-balance sheet securitization trust debt.

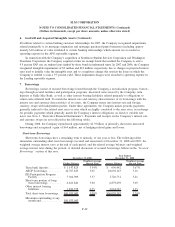

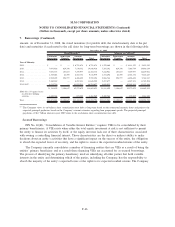

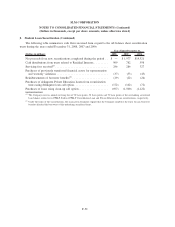

Secured Borrowings

FIN No. 46(R), “Consolidation of Variable Interest Entities,” requires VIEs to be consolidated by their

primary beneficiaries. A VIE exists when either the total equity investment at risk is not sufficient to permit

the entity to finance its activities by itself, or the equity investors lack one of three characteristics associated

with owning a controlling financial interest. Those characteristics are the direct or indirect ability to make

decisions about an entity’s activities that have a significant impact on the success of the entity, the obligation

to absorb the expected losses of an entity, and the rights to receive the expected residual returns of the entity.

The Company currently consolidates a number of financing entities that are VIEs as a result of being the

entities’ primary beneficiary and as a result these financing VIEs are accounted for as secured borrowings.

The process of identifying the primary beneficiary involves identifying all other parties that hold variable

interests in the entity and determining which of the parties, including the Company, has the responsibility to

absorb the majority of the entity’s expected losses or the rights to its expected residual returns. The Company

F-46

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)