Sallie Mae 2008 Annual Report Download - page 188

Download and view the complete annual report

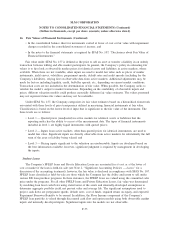

Please find page 188 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13. Stock-Based Compensation Plans and Arrangements

As of December 31, 2008 the Company has two stock-based compensation plans that provide for grants

of stock, stock options, restricted stock, and restricted stock units. The Company also makes grants of stock-

based awards under individually negotiated arrangements.

The SLM Corporation Incentive Plan (the “Incentive Plan”) was approved by shareholders in 2004 and

was amended in 2005 and 2006. A total of 17.7 million shares are authorized to be issued from this plan. The

Incentive Plan expires on May 31, 2009.

The Company maintains the Employee Stock Purchase Plan (the “ESPP”). The shares issued under the

Incentive Plan and the ESPP may be either shares reacquired by the Company or shares that are authorized

but unissued.

The Directors Stock Plan, under which stock options and restricted stock were granted to non-employee

members of the board of directors, expired in May 2008. The Company’s non-employee directors are

considered employees under the provisions of SFAS No. 123(R).

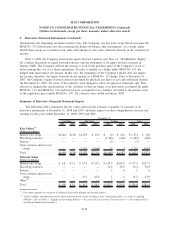

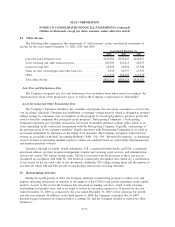

The total stock-based compensation cost recognized in the consolidated statements of income for the

years ended December 31, 2008, 2007 and 2006 was $86 million, $75 million, and $81 million, respectively.

The related income tax benefit for the years ended December 31, 2008, 2007 and 2006 was $32 million,

$28 million and $30 million, respectively. As of December 31, 2008, there was $37 million of total

unrecognized compensation cost related to stock-based compensation programs, which is expected to be

recognized over a weighted average period of 1.6 years.

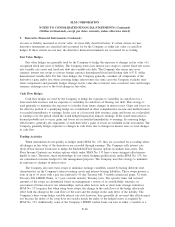

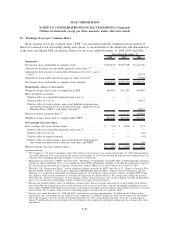

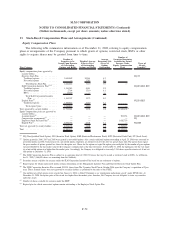

Stock Options

The maximum term for stock options is 10 years and the exercise price must be equal to or greater than

the market price of the Company’s common stock on the date of grant. Stock options granted prior to 2008 to

officers and management employees generally vest upon the Company’s common stock price reaching a

closing price equal to or greater than 20 percent above the fair market value of the common stock on the date

of grant for five days, but no earlier than 12 months from the grant date. Stock options granted in 2008 to

officers and management employees are price-vested with the grants vesting one-half upon the Company’s

common stock price reaching a closing price equal to or greater than 20 percent above the fair market value

of the common stock on the date of grant for five days but no earlier than 12 months from the grant date, and

the second one-half vesting upon the Company’s common stock price reaching a closing price equal to

40 percent above the fair market value of the common stock on the date of grant for five days but no earlier

than 24 months from the grant date. In any event, all price-vested options vest upon the eighth anniversary of

their grant date. Options granted to rank-and-file employees are time-vested with the grants vesting one-half in

18 months from their grant date and the second one-half vesting 36 months from their grant date.

Stock options granted to directors are generally subject to the following vesting schedule: all options vest

upon the Company’s common stock price reaching a closing price equal to or greater than 20 percent above

the fair market value of the common stock on the date of grant for five days or the director’s election to the

Board, whichever occurs later. In any event, all options vest upon the fifth anniversary of their grant date.

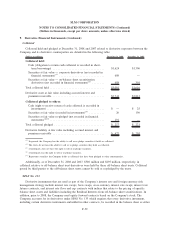

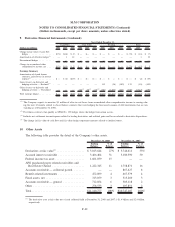

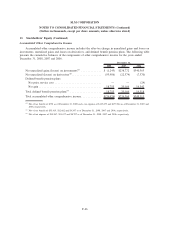

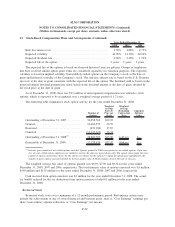

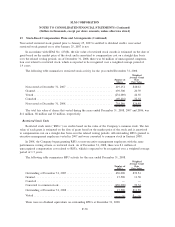

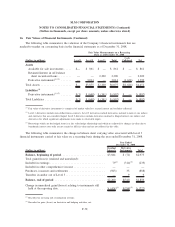

The fair values of the options granted in the years ended December 31, 2008, 2007 and 2006 were

estimated as of the date of grant using a Black-Scholes option pricing model with the following weighted

average assumptions.

F-68

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)