Sallie Mae 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

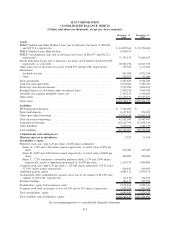

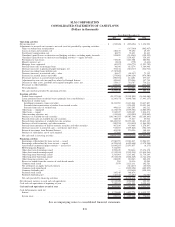

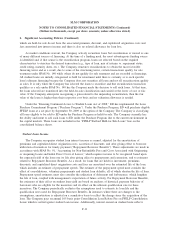

SLM CORPORATION

CONSOLIDATED BALANCE SHEETS

(Dollars and shares in thousands, except per share amounts)

December 31,

2008

December 31,

2007

Assets

FFELP Stafford and Other Student Loans (net of allowance for losses of $90,906

and $47,518, respectively) . ....................................... $ 44,025,361 $ 35,726,062

FFELP Stafford Loans Held-for-Sale . ................................. 8,450,976 —

FFELP Consolidation Loans (net of allowance for losses of $46,637 and $41,211,

respectively) . ................................................. 71,743,435 73,609,187

Private Education Loans (net of allowance for losses of $1,308,043 and $1,003,963,

respectively, as corrected). . ....................................... 20,582,298 14,817,725

Other loans (net of allowance for losses of $58,395 and $43,558, respectively) . . . . 729,380 1,173,666

Investments

Available-for-sale . . ............................................ 861,008 2,871,340

Other ....................................................... 180,397 93,040

Total investments ................................................ 1,041,405 2,964,380

Cash and cash equivalents . . . ....................................... 4,070,002 7,582,031

Restricted cash and investments ...................................... 3,535,286 4,600,106

Retained Interest in off-balance sheet securitized loans ..................... 2,200,298 3,044,038

Goodwill and acquired intangible assets, net . ............................ 1,249,219 1,300,689

Other assets . . . ................................................. 11,140,777 10,747,107

Total assets ..................................................... $168,768,437 $155,564,991

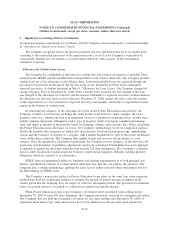

Liabilities

ED Participation Program . . . ....................................... $ 7,364,969 $ —

Term bank deposits . . . ............................................ 1,147,825 254,029

Other short-term borrowings . ....................................... 33,420,249 35,693,378

Total short-term borrowings . . ....................................... 41,933,043 35,947,407

Long-term borrowings . ............................................ 118,224,794 111,098,144

Other liabilities . ................................................. 3,604,260 3,284,545

Total liabilities . ................................................. 163,762,097 150,330,096

Commitments and contingencies

Minority interest in subsidiaries .................................... 7,270 11,360

Stockholders’ equity

Preferred stock, par value $.20 per share, 20,000 shares authorized

Series A: 3,300 and 3,300 shares issued, respectively, at stated value of $50 per

share ...................................................... 165,000 165,000

Series B: 4,000 and 4,000 shares issued, respectively, at stated value of $100 per

share ...................................................... 400,000 400,000

Series C, 7.25% mandatory convertible preferred stock; 1,150 and 1,000 shares,

respectively, issued at liquidation preference of $1,000 per share ........... 1,149,770 1,000,000

Common stock, par value $.20 per share, 1,125,000 shares authorized: 534,411 and

532,493 shares issued, respectively . ................................. 106,883 106,499

Additional paid-in capital . . . ....................................... 4,684,112 4,590,174

Accumulated other comprehensive income (loss) (net of tax benefit of $43,202 and

expense of $124,468, respectively) . ................................. (76,476) 236,364

Retained earnings ................................................ 426,175 557,204

Stockholders’ equity before treasury stock . . ............................ 6,855,464 7,055,241

Common stock held in treasury at cost: 66,958 and 65,951 shares, respectively . . . . 1,856,394 1,831,706

Total stockholders’ equity . . . ....................................... 4,999,070 5,223,535

Total liabilities and stockholders’ equity ................................ $168,768,437 $155,564,991

See accompanying notes to consolidated financial statements.

F-4