Sallie Mae 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

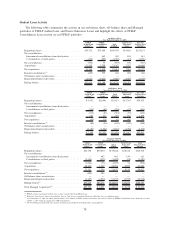

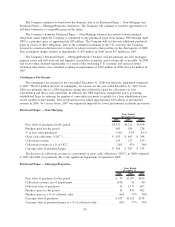

The Company continues to wind down the domestic side of its Purchased Paper — Non-Mortgage and

Purchased Paper — Mortgage/Properties businesses. The Company will continue to consider opportunities to

sell these businesses at acceptable prices in the future.

The Company’s domestic Purchased Paper — Non-Mortgage business has certain forward purchase

obligations under which the Company is committed to buy purchased paper from January 2009 through April

2009 at a purchase price of approximately $28 million. The Company will not buy any additional purchased

paper in excess of these obligations. Due to the continued weakening of the U.S. economy, the Company

lowered its assumed collection rates it expects to achieve related to this portfolio in the third quarter of 2008.

This assumption change resulted in impairments of $55 million in 2008 versus $17 million in 2007.

The Company’s Purchased Paper — Mortgage/Properties business will not purchase any new mortgage/

property assets and will work-out and liquidate its portfolio as quickly and economically as possible. In 2008,

real estate values declined significantly as a result of the weakening U.S. economy and expected future

resolution time-frames were extended, resulting in impairments of $262 million in 2008 versus $4 million in

2007.

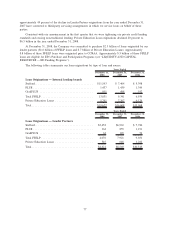

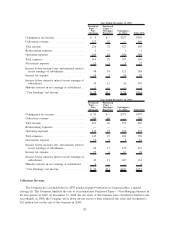

Contingency Fee Income

The contingency fee income for the year ended December 31, 2008 was relatively unchanged compared

to 2007. The $61 million decrease in contingency fee income for the year ended December 31, 2007 versus

2006 was primarily due to a 2006 legislative change that reduced fees paid for collections via loan

consolidation and direct cash collections. In addition, the 2006 legislation changed the policy governing

rehabilitated loans by reducing the number of consecutive payments to qualify for a loan rehabilitation from

twelve months to nine months. This accelerated process added approximately $36 million of incremental

revenue in 2006. To a lesser extent, 2007 was negatively impacted by lower performance in default prevention.

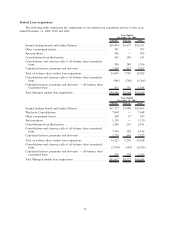

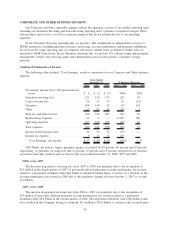

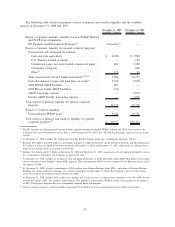

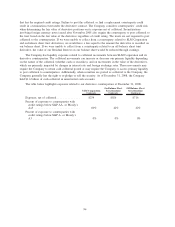

Purchased Paper — Non-Mortgage

2008 2007 2006

Years Ended

December 31,

Face value of purchases for the period ......................... $5,353 $6,111 $3,438

Purchase price for the period ................................ 483 556 278

% of face value purchased .................................. 9.0% 9.1% 8.1%

Gross cash collections (“GCC”) .............................. $ 655 $ 463 $ 348

Collections revenue ....................................... 129 217 199

Collections revenue as a % of GCC ........................... 20% 47% 56%

Carrying value of purchased paper ............................ $ 544 $ 587 $ 274

The decrease in collections revenue as a percentage of gross cash collections (“GCC”) in 2008 compared

to 2007 and 2006 was primarily due to the significant impairment recognized in 2008.

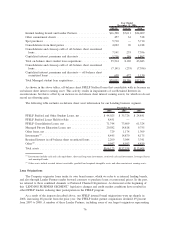

Purchased Paper — Mortgage/Properties

2008 2007 2006

Years Ended

December 31,

Face value of purchases for the period ........................... $ 39 $1,307 $556

Collections revenue, net of impairments .......................... (192) 52 40

Collateral value of purchases .................................. 29 1,171 607

Purchase price for the period .................................. 19 855 462

Purchase price as a % of collateral value ......................... 66% 73% 76%

Carrying value of purchases................................... $675 $1,162 $518

Carrying value of purchased paper as a % of collateral value . ......... 69% 77% 75%

84