Sallie Mae 2008 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17. Commitments, Contingencies and Guarantees

The Company offers a line of credit to certain financial institutions and other institutions in the higher

education community for the purpose of originating student loans. In connection with these agreements, the

Company also enters into a participation agreement with the institution to participate in the loans as they are

originated. In the event that a line of credit is drawn upon, the loan is collateralized by underlying student

loans and is usually participated in on the same day. The contractual amount of these financial instruments

represents the maximum possible credit risk should the counterparty draw down the commitment, the

Company not participate in the loan and the counterparty subsequently fail to perform according to the terms

of its contract with the Company.

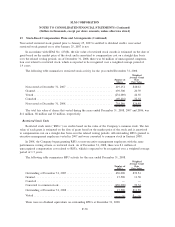

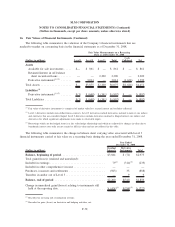

Commitments outstanding are summarized below:

2008 2007

December 31,

Lines of credit ............................................ $1,021,398 $2,035,638

The following schedule summarizes expirations of commitments to the earlier of call date or maturity

date outstanding at December 31, 2008.

Lines of

Credit

2009 .............................................................. $ 221,398

2010 .............................................................. 800,000

Total .............................................................. $1,021,398

In addition, the Company maintains forward contracts to purchase loans from its lending partners at

contractual prices. These contracts typically have a maximum amount the Company is committed to buy, but

lack a fixed or determinable amount as it ultimately is based on the lending partner’s origination activity. FFELP

forward purchase contracts typically contain language relieving the Company of most of its responsibilities under

the contract due to, among other things, changes in student loan legislation. These commitments are not

accounted for as derivatives under SFAS No. 133 as they do not meet the definition of a derivative due to the

lack of a fixed and determinable purchase amount. At December 31, 2008, there were $2.3 billion of originated

loans (FFELP and Private Education Loans) in the pipeline that the Company is committed to purchase.

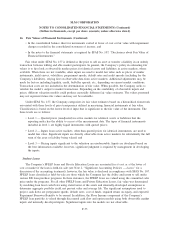

Investor Litigation

On January 31, 2008, a putative class action lawsuit was filed against the Company and certain officers

in U. S. District Court for the Southern District of New York. This case and other actions arising out the same

circumstances and alleged acts have been consolidated and are now identified as In Re SLM Corporation

Securities Litigation. The case purports to be brought on behalf of those who acquired common stock of the

Company between January 18, 2007 and January 23, 2008 (the “Securities Class Period”). The complaint

alleges that the Company and certain officers violated federal securities laws by issuing a series of materially

false and misleading statements and that the statements had the effect of artificially inflating the market price

for the Company’s securities. The complaint alleges that defendants caused the Company’s results for year-end

2006 and for the first quarter of 2007 to be materially misstated because the Company failed to adequately

provide for loan losses, which overstated the Company’s net income, and that the Company failed to

adequately disclose allegedly known trends and uncertainties with respect to its non-traditional loan portfolio.

On July 23, 2008, the court appointed Westchester Capital Management (“Westchester”) Lead Plaintiff. On

December 8, 2008, Lead Plaintiff filed a consolidated amended complaint. In addition to the prior allegations,

the consolidated amended complaint alleges that the Company understated loan delinquencies and loan loss

F-80

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)