Sallie Mae 2008 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

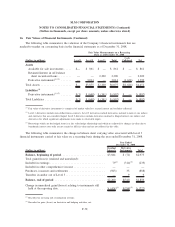

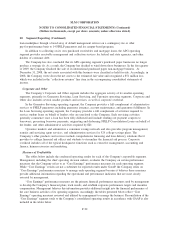

18. Benefit Plans (Continued)

nonqualified plans due to the nature of the plans; the corporate assets used to pay these benefits are included

above in employer contributions.

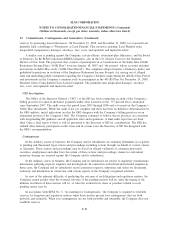

Components of Net Periodic Pension Cost

Net periodic pension cost included the following components:

2008 2007 2006

Years Ended December 31,

Service cost — benefits earned during the period ............ $ 6,566 $ 7,100 $ 8,291

Interest cost on project benefit obligations . ................ 12,908 12,337 11,445

Expected return on plan assets .......................... (11,709) (17,975) (16,277)

Curtailment loss .................................... 114 — —

Settlement (gain)/loss ................................ (5,074) 1,265 —

Special termination benefits ............................ — 912 —

Net amortization and deferral ........................... (1,447) (719) 494

Net periodic pension cost (benefit) ....................... $ 1,358 $ 2,920 $ 3,953

Special accounting is required when lump sum payments exceed the sum of the service and interest cost

components, and when the average future working lifetime of employees is significantly curtailed. This special

accounting requires an accelerated recognition of unrecognized gains or losses and unrecognized prior service

costs, creating adjustments to the pension expense. During the year ended December 31, 2008, the Company

recorded a net settlement gain associated with lump-sum distributions from the qualified plan and a

curtailment loss for previously unrecognized losses associated with executive non-qualified benefits. During

the year ended December 31, 2007, the Company recorded net settlement losses, including a portion related to

employees who were involuntarily terminated in the fourth quarter, associated with lump-sum distributions

from the supplemental pension plan. These amounts were recorded in accordance with SFAS No. 88,

“Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termina-

tion Benefits,” which requires that settlement losses be recorded once prescribed payment thresholds have

been reached.

Amortization of unrecognized net gains or losses are included as a component of net periodic pension

cost to the extent that the unrecognized gain or loss exceeds 10 percent of the greater of the projected benefit

obligation or the market value of plan assets. Gains or losses not yet includible in pension cost are amortized

over the average remaining service life of active participants which is approximately 8 years.

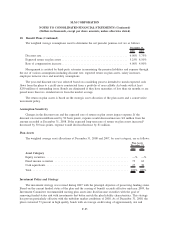

Assumptions

The weighted average assumptions used to determine the projected accumulated benefit obligations are as

follows:

2008 2007

December 31,

Discount rate....................................................... 6.25% 6.00%

Expected return on plan assets .......................................... 5.25% 8.50%

Rate of compensation increase .......................................... 4.00% 4.00%

F-84

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)