Sallie Mae 2008 Annual Report Download - page 132

Download and view the complete annual report

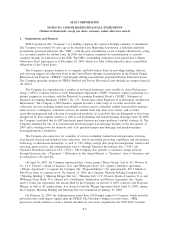

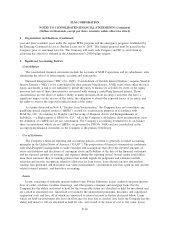

Please find page 132 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

potential non-payment adjustments in accordance with the Company’s non-accrual policy as discussed further

in “Allowance for Student Loan Losses” below.

The Company recognizes certain fee income (primarily late fees and forbearance fees) on student loans

according to the contractual provisions of the promissory notes, as well as the Company’s expectation of

collectability. Student loan fee income is recorded when earned in “other income” in the consolidated

statements of income.

Allowance for Student Loan Losses

The Company has established an allowance for student loan losses that is an estimate of probable losses

incurred in the FFELP and Private Education Loan portfolios at the balance sheet date. The Company presents

student loans net of the allowance on the balance sheet. Estimated probable losses are expensed through the

provision for loan losses in the period that the loss event occurs. Estimated probable losses contemplate

expected recoveries. As further discussed in Note 4, “Allowance for Loan Losses,” the Company changed its

charge-off policy. Prior to December 31, 2008, when a default event occurred, the face amount of the loan

was charged to the allowance for loan loss and the amount attributable to expected recoveries would remain in

the allowance for loan loss until received. Effective December 31, 2008, charge-offs reflect only the amount

of the expected loss (i.e. face amount less expected recovery) and amounts attributable to expected recoveries

remain in the balance of student loans.

In evaluating the adequacy of the allowance for losses on the Private Education Loan portfolio, the

Company considers several factors including the credit profile of the borrower and/or cosigner, the loan’s

payment status (e.g., whether the loan is in repayment versus in a permitted non-paying status), months since

initially entering repayment, delinquency status, type of program, trends in program completion/graduation

rates, and trends in defaults in the portfolio based on Company, industry and economic data. When calculating

the Private Education Loan allowance for losses, the Company’s methodology, based on a migration analysis,

divides the portfolio into categories of similar risk characteristics based on loan program type, underwriting

criteria and the existence or absence of a cosigner, with a further breakdown for each of the factors mentioned

above within these categories. The Company then applies default and recovery rate projections to each

category. Once the quantitative calculation is performed, the Company reviews adequacy of the allowance for

loan losses and determines if qualitative adjustments need to be considered. Private Education Loan principal

is charged off against the allowance when the loan exceeds 212 days delinquency. The Company’s collection

policies allow for periods of nonpayment for borrowers experiencing temporary difficulty meeting payment

obligations which are referred to as forbearance.

FFELP loans are guaranteed (subject to legislative risk sharing requirements) as to both principal and

interest, and therefore continue to accrued interest until such time that they are paid by the guarantor. The

Company uses a similar methodology applying the same factors (where relevant) when estimating losses for

the Risk Sharing on FFELP loans.

The Company’s non-accrual policy for Private Education Loans relies on the same loan status migration

methodology used for its principal balances to estimate the amount of interest income recognized in the

current period that the Company does not expect to collect in subsequent periods. The provision for estimated

losses on accrued interest is classified as a reduction in student loan interest income.

When Private Education Loans in the Company’s off-balance sheet securitized trusts settling before

September 30, 2005 become 180 days delinquent, the Company previously exercised its contingent call option

(the Company does not hold the contingent call option for any trusts settling after September 30, 2005) to

repurchase these loans at par value and record a loss for the difference in the par value paid and the fair

F-12

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)