Sallie Mae 2008 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

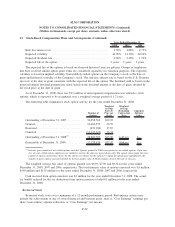

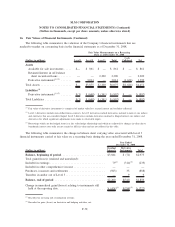

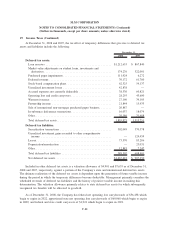

16. Fair Values of Financial Instruments (Continued)

The following table summarizes the valuation of the Company’s financial instruments that are

marked-to-market on a non-recurring basis by the above SFAS No. 157 pricing observable levels as of

December 31, 2008.

(Dollars in millions) Level 1 Level 2 Level 3 Total

Fair Value Measurements on a Non-Recurring

Basis as of December 31, 2008

FFELP Stafford Loans Held-for-Sale

(1)

.............. $462 $— $— $462

Total ....................................... $462 $— $— $462

(1)

Level 1 valuations reflect FFELP Stafford Loans Held-for-Sale under the various ED loan purchase programs.

In accordance with the provisions of SOP 01-6, “Accounting by Certain Entities (Including Entities with

Trade Receivables) That Lend to or Finance the Activities of Others,” FFELP Stafford Loans Held-for-Sale

with a carrying amount of $488 million were written down to their fair value of $462 million, resulting in an

impairment charge of $26 million which was included in earnings for the period.

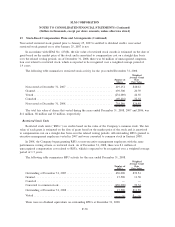

The following table summarizes the fair values of the Company’s financial assets and liabilities, including

derivative financial instruments.

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

December 31, 2008 December 31, 2007

Earning assets

FFELP loans . . . . . . . . . . . . . . . . . . . . . . . . $107,319 $124,220 $(16,901) $111,552 $109,335 $ 2,217

Private Education Loans . . . . . . . . . . . . . . . . 14,141 20,582 (6,441) 17,289 14,818 2,471

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . 619 729 (110) 1,175 1,173 2

Cash and investments . . . . . . . . . . . . . . . . . . 8,646 8,646 — 15,146 15,146 —

Total earning assets . . . . . . . . . . . . . . . . . . . 130,725 154,177 (23,452) 145,162 140,472 4,690

Interest-bearing liabilities

Short-term borrowings . . . . . . . . . . . . . . . . . 41,608 41,933 325 35,828 35,947 119

Long-term borrowings . . . . . . . . . . . . . . . . . 93,462 118,225 24,763 105,227 111,099 5,872

Total interest-bearing liabilities . . . . . . . . . . . 135,070 160,158 25,088 141,055 147,046 5,991

Derivative financial instruments

Floor Income/Cap contracts . . . . . . . . . . . . . (1,466) (1,466) — (442) (442) —

Interest rate swaps . . . . . . . . . . . . . . . . . . . . 1,374 1,374 — 320 320 —

Cross currency interest rate swaps . . . . . . . . . 2,116 2,116 — 3,643 3,643 —

Futures contracts . . . . . . . . . . . . . . . . . . . . . (3) (3) — — — —

Other

Residual interest in securitized assets . . . . . . . 2,200 2,200 — 3,044 3,044 —

Excess of net asset fair value over carrying

value . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,636 $10,681

F-79

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)