Sallie Mae 2008 Annual Report Download - page 211

Download and view the complete annual report

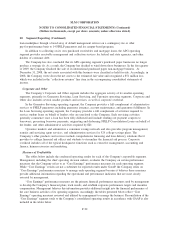

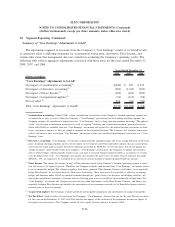

Please find page 211 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20. Segment Reporting (Continued)

on “Core Earnings” net income. Accordingly, information regarding the Company’s reportable segments is

provided based on a “Core Earnings” basis. The Company’s “Core Earnings” performance measures are not

defined terms within GAAP and may not be comparable to similarly titled measures reported by other

companies. “Core Earnings” net income reflects only current period adjustments to GAAP net income as

described below. Unlike financial accounting, there is no comprehensive, authoritative guidance for manage-

ment reporting. The management reporting process measures the performance of the operating segments based

on the management structure of the Company and is not necessarily comparable with similar information for

any other financial institution. The Company’s operating segments are defined by the products and services

they offer or the types of customers they serve, and they reflect the manner in which financial information is

currently evaluated by management. Intersegment revenues and expenses are netted within the appropriate

financial statement line items consistent with the income statement presentation provided to management.

Changes in management structure or allocation methodologies and procedures may result in changes in

reported segment financial information.

The Company’s principal operations are located in the United States, and its results of operations and

long-lived assets in geographic regions outside of the United States are not significant. In the Lending

segment, no individual customer accounted for more than 10 percent of its total revenue during the years

ended December 31, 2008, 2007 and 2006. USA Funds is the Company’s largest customer in both the APG

and Corporate and Other segments. During the years ended December 31, 2008, 2007 and 2006, USA Funds

accounted for 46 percent, 35 percent and 31 percent, respectively, of the aggregate revenues generated by the

Company’s APG and Corporate and Other business segments. No other customers accounted for more than

10 percent of total revenues in those segments for the years mentioned.

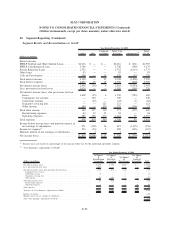

Lending

In the Company’s Lending operating segment, the Company originates and acquires both FFELP loans

and Private Education Loans. As of December 31, 2008, the Company managed $180.4 billion of student

loans, of which $146.9 billion or 81 percent are federally insured, and has 10 million student and parent

customers. In addition to education lending, the Company also originates mortgage and consumer loans with

the intent of selling the majority of such loans. In the year ended December 31, 2008, the Company originated

$205 million in mortgage and consumer loans and its mortgage and consumer loan portfolio totaled

$503 million at December 31, 2008.

Private Education Loans consist of two general types: (1) those that are designed to bridge the gap

between the cost of higher education and the amount financed through either capped federally insured loans or

the borrowers’ resources, and (2) those that are used to meet the needs of students in alternative learning

programs such as career training, distance learning and lifelong learning programs. Most higher education

Private Education Loans are made in conjunction with a FFELP loan and as such are marketed through the

same channel as FFELP loans by the same sales force. Unlike FFELP loans, Private Education Loans are

subject to the full credit risk of the borrower. The Company manages this additional risk through historical

risk-performance underwriting strategies, the addition of qualified cosigners and a combination of higher

interest rates and loan origination fees that compensate the Company for the higher risk.

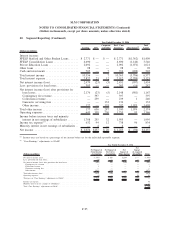

APG

The Company’s APG operating segment provides a wide range of accounts receivable and collections services

including student loan default aversion services, defaulted student loan portfolio management services, contingency

collections services for student loans and other asset classes, and accounts receivable management and collection

for purchased portfolios of receivables that are delinquent or have been charged off by their original creditors, and

sub-performing and non-performing mortgage loans. The Company’s APG operating segment serves the student

F-91

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)