Sallie Mae 2008 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

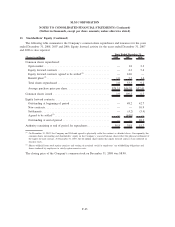

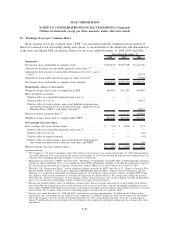

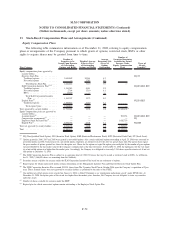

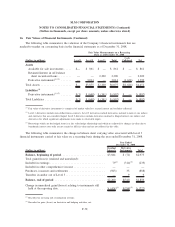

14. Other Income

The following table summarizes the components of “other income” in the consolidated statements of

income for the years ended December 31, 2008, 2007 and 2006.

2008 2007 2006

Years Ended December 31,

Late fees and forbearance fees ......................... $142,958 $135,627 $120,651

Asset servicing and other transaction fees ................. 108,292 110,215 42,053

Loan servicing fees ................................. 26,458 26,094 47,708

Gains on sales of mortgages and other loan fees ............ 2,832 10,737 15,325

Other............................................ 111,536 102,402 112,570

Total other income .................................. $392,076 $385,075 $338,307

Late Fees and Forbearance Fees

The Company recognizes late fees and forbearance fees on student loans when earned according to the

contractual provisions of the promissory notes, as well as the Company’s expectation of collectability.

Asset Servicing and Other Transaction Fees

The Company’s Upromise subsidiary has a number of programs that encourage consumers to save for the

cost of college education. Upromise has established a consumer savings network which is designed to promote

college savings by consumers who are members of this program by encouraging them to purchase goods and

services from the companies that participate in the program (“Participating Companies”). Participating

Companies generally pay Upromise transaction fees based on member purchase volume, either online or in

stores depending on the contractual arrangement with the Participating Company. Typically, a percentage of

the purchase price of the consumer members’ eligible purchases with Participating Companies is set aside in

an account maintained by Upromise on the behalf of its members. The Company recognizes transaction fee

revenue in accordance with Staff Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition,” as marketing

services focused on increasing member purchase volume are rendered based on contractually determined rates

and member purchase volumes.

Upromise, through its wholly owned subsidiaries, UII, a registered broker-dealer, and UIA, a registered

investment advisor, provides program management, transfer and servicing agent services, and administration

services for various 529 college-savings plans. The fees associated with the provision of these services are

recognized in accordance with SAB No. 104 based on contractually determined rates which are a combination

of fees based on the net asset value of the investments within the 529 college-savings plans and the number of

accounts for which UII and UIA provide record-keeping and account servicing functions.

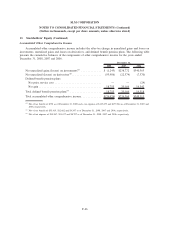

15. Restructuring Activities

During the fourth quarter of 2007, the Company initiated a restructuring program to reduce costs and

improve operating efficiencies in response to the impacts of the CCRAA and current challenges in the capital

markets. As part of this review the Company has refocused its lending activities, exited certain customer

relationships and product lines, and is on target to reduce its operating expenses by 20 percent by the year

ended December 31, 2009, as compared to the year ended December 31, 2007, before adjusting for growth

and other investments. In addition, in the third quarter of 2008, the Company concluded that its APG

purchased paper businesses no longer produce a strategic fit, and the Company decided to wind down these

businesses.

F-73

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)