Sallie Mae 2008 Annual Report Download - page 147

Download and view the complete annual report

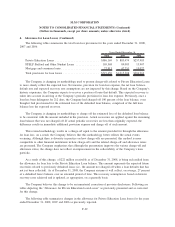

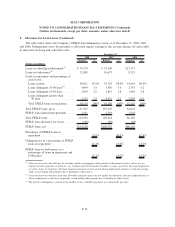

Please find page 147 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

majority of the Private Education Loan portfolio, the Company bears the full risk of any losses experienced

and as a result, these loans are underwritten and priced based upon standardized consumer credit scoring

criteria. In addition, students who do not meet the Company’s minimum underwriting standards are generally

required to obtain a credit-worthy cosigner.

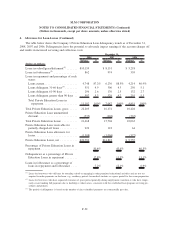

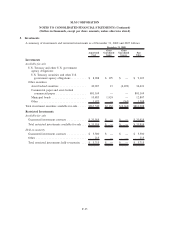

Forbearance involves granting the borrower a temporary cessation of payments (or temporary acceptance

of smaller than scheduled payments) for a specified period of time. Using forbearance in this manner

effectively extends the original term of the loan. Forbearance does not grant any reduction in the total

repayment obligation (principal or interest). While a loan is in forbearance status, interest continues to accrue

and is capitalized to principal when the loan re-enters repayment status. The Company’s forbearance policies

include limits on the number of forbearance months granted consecutively and limits on the total number of

forbearance months granted over the life of the loan. In some instances, the Company requires good-faith

payments before granting the forbearance. Exceptions to forbearance policies are permitted when such

exceptions are judged to increase the likelihood of ultimate collection of the loan. Forbearance as a collection

tool is used most effectively when applied based on a borrower’s unique situation, including assumptions

based on historical information and judgments. The Company combines borrower information with a risk-

based segmentation model to assist in its decision making as to who will be granted forbearance based on the

Company’s expectation as to a borrower’s ability and willingness to repay their obligation. This strategy is

aimed at mitigating the overall risk of the portfolio as well as encouraging cash resolution of delinquent loans.

Forbearance may be granted to borrowers who are exiting their grace period to provide additional time to

obtain employment and income to support their obligations, or to current borrowers who are faced with a

hardship and request forbearance time to provide temporary payment relief. In these circumstances, a

borrower’s loan is placed into a forbearance status in limited monthly increments and is reflected in the

forbearance status at month-end during this time. At the end of their granted forbearance period, the borrower

will enter repayment status as current and is expected to begin making their scheduled monthly payments on a

go-forward basis.

Forbearance may also be granted to borrowers who are delinquent in their payments. In these

circumstances, the forbearance cures the delinquency and the borrower is returned to a current repayment

status. In more limited instances, delinquent borrowers will also be granted additional forbearance time. As

the Company has obtained further experience about the effectiveness of forbearance, it has reduced the amount

of time a loan will spend in forbearance, thereby increasing its ongoing contact with the borrower to

encourage consistent repayment behavior once the loan is returned to a current repayment status.

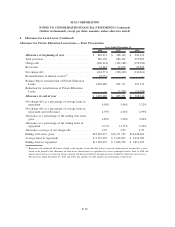

The Company may charge the borrower fees on certain Private Education Loans, either at origination,

when the loan enters repayment, or both. Such fees are deferred and recognized into income as a component

of interest over the estimated average life of the related pool of loans.

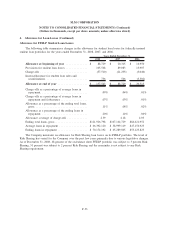

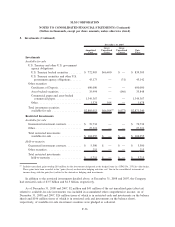

In December 2008, the Company sold approximately $494 million (principal and accrued interest) of

FFELP loans to ED at a price of 97 percent of principal and unpaid interest pursuant to ED’s authority under

the Ensuring Continued Access to Student Loans Act of 2008 (“ECASLA”) to make such purchases, and

recorded a loss on the sale. Additionally, in early January 2009, the Company sold an additional $486 million

(principal and accrued interest) in FFELP loans to ED under this program. The loss related to this sale in

January was recognized in 2008 as the loans were classified as “held-for-sale” under GAAP. The total loss

recognized on these two sales for the year ended December 31, 2008 was $53 million and was recorded in

“Losses on sales of loans and securities, net” in the consolidated statements of income.

As of December 31, 2008 and 2007, 56 percent and 58 percent, respectively, of the Company’s on-

balance sheet student loan portfolio was in repayment.

F-27

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)