Sallie Mae 2008 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

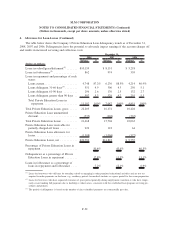

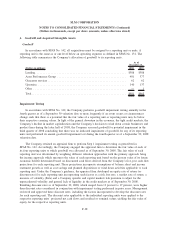

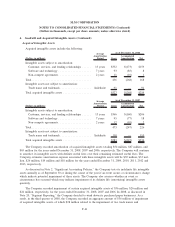

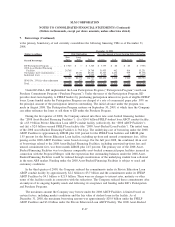

6. Goodwill and Acquired Intangible Assets (Continued)

$8 million related to certain banking customer relationships. In 2007, the Company recognized impairments

related principally to its mortgage origination and mortgage purchased paper businesses including approx-

imately $10 million of value attributed to certain banking relationships which amount was recorded as

operating expense in the APG reportable segment.

In connection with the Company’s acquisition of Southwest Student Services Corporation and Washington

Transferee Corporation, the Company acquired certain tax exempt bonds that enabled the Company to earn a

9.5 percent SAP rate on student loans funded by those bonds in indentured trusts. In 2007 and 2006, the Company

recognized intangible impairments of $9 million and $21 million, respectively, due to changes in projected interest

rates used to initially value the intangible asset and to a regulatory change that restricts the loans on which the

Company is entitled to earn a 9.5 percent yield. These impairment charges were recorded to operating expense in

the Lending reportable segment.

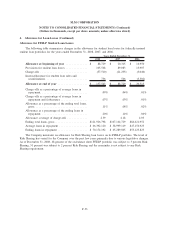

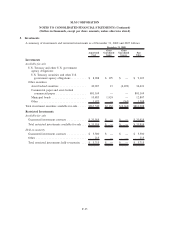

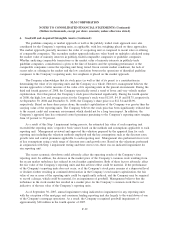

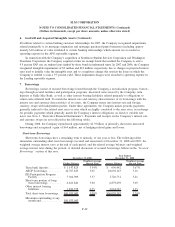

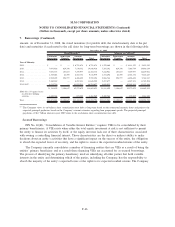

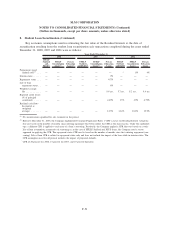

7. Borrowings

Borrowings consist of secured borrowings issued through the Company’s securitization program, borrow-

ings through secured facilities and participation programs, unsecured notes issued by the Company, term

deposits at Sallie Mae Bank, as well as other interest bearing liabilities related primarily to obligations to

return cash collateral held. To match the interest rate and currency characteristics of its borrowings with the

interest rate and currency characteristics of its assets, the Company enters into interest rate and foreign

currency swaps with independent parties. Under these agreements, the Company makes periodic payments,

generally indexed to the related asset rates or rates which are highly correlated to the asset rates, in exchange

for periodic payments which generally match the Company’s interest obligations on fixed or variable rate

notes (see Note 9, “Derivative Financial Instruments”). Payments and receipts on the Company’s interest rate

and currency swaps are not reflected in the following tables.

During 2008, the Company repurchased approximately $1.9 billion of primarily short-term unsecured

borrowings and recognized a gain of $64 million, net of hedging-related gains and losses.

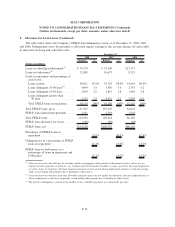

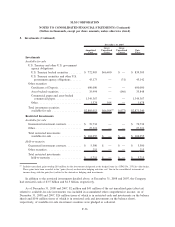

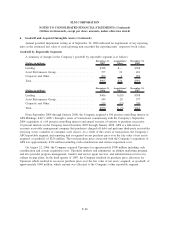

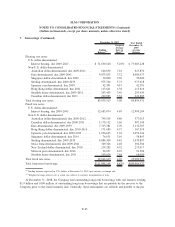

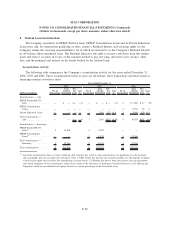

Short-term Borrowings

Short-term borrowings have a remaining term to maturity of one year or less. The following tables

summarize outstanding short-term borrowings (secured and unsecured) at December 31, 2008 and 2007, the

weighted average interest rates at the end of each period, and the related average balances and weighted

average interest rates during the periods. A detailed discussion of secured borrowings follows in the “Secured

Borrowings” section of this note.

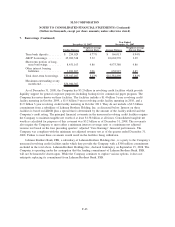

Ending Balance

Weighted Average

Interest Rate Average Balance

Weighted Average

Interest Rate

December 31, 2008

Year Ended

December 31, 2008

Term bank deposits ........ $ 1,147,825 3.34% $ 696,442 3.67%

ABCP borrowings ......... 24,767,825 3.05 24,692,143 3.16

ED Participation Program

Facility ............... 7,364,969 3.37 1,726,751 3.41

Short-term portion of long-

term borrowings ........ 6,821,846 3.60 6,879,459 3.69

Other interest bearing

liabilities .............. 1,830,578 0.55 2,064,547 2.35

Total short-term borrowings. . $41,933,043 3.09% $36,059,342 3.24%

Maximum outstanding at any

month end............. $41,933,043

F-42

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)