Sallie Mae 2008 Annual Report Download - page 201

Download and view the complete annual report

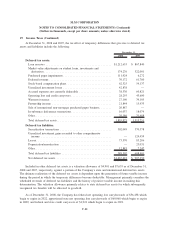

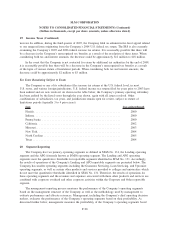

Please find page 201 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17. Commitments, Contingencies and Guarantees (Continued)

reserves by promoting loan forbearances. On December 19, 2008, and December 31, 2008, two rejected lead

plaintiffs filed a challenge to Westchester as Lead Plaintiff. That motion is pending. Lead Plaintiff seeks

unspecified compensatory damages, attorneys’ fees, costs, and equitable and injunctive relief.

A similar case is pending against the Company, certain officers, retirement plan fiduciaries, and the Board

of Directors, In Re SLM Corporation ERISA Litigation, also in the U.S. District Court for the Southern

District of New York. The proposed class consists of participants in or beneficiaries of the Sallie Mae 401(K)

Retirement Savings Plan (“401K Plan”) between January 18, 2007 and “the present” whose accounts included

investments in Sallie Mae stock (“401K Class Period”). The complaint alleges breaches of fiduciary duties and

prohibited transactions in violation of the Employee Retirement Income Security Act arising out of alleged

false and misleading public statements regarding the Company’s business made during the 401(K) Class Period

and investments in the Company’s common stock by participants in the 401(K) Plan. On December 15, 2008,

Plaintiffs filed a Consolidated Class Action Complaint. The plaintiffs seek unspecified damages, attorneys’

fees, costs, and equitable and injunctive relief.

OIG Investigation

The Office of the Inspector General (“OIG”) of the ED has been conducting an audit of the Company’s

billing practices for special allowance payments under what is known as the “9.5 percent floor calculation”

since September 2007. The audit covers the period from 2003 through 2006 and is focused on the Company’s

Nellie Mae subsidiaries. While the audit is not yet complete and there has been no definitive determination by

the OIG auditors, initial indications are that the OIG disagrees with the Company’s billing practices on an

immaterial portion of the Company’s bills. The Company continues to believe that its practices are consistent

with longstanding ED guidance and all applicable rules and regulations. A final audit report has not been

filed. Once a final report is filed, it will be presented to the Secretary of ED for consideration. The OIG has

audited other industry participants on this issue and in certain cases the Secretary of ED has disagreed with

the OIG’s recommendation.

Contingencies

In the ordinary course of business, the Company and its subsidiaries are routinely defendants in or parties

to pending and threatened legal actions and proceedings including actions brought on behalf of various classes

of claimants. These actions and proceedings may be based on alleged violations of consumer protection,

securities, employment and other laws. In certain of these actions and proceedings, claims for substantial

monetary damage are asserted against the Company and its subsidiaries.

In the ordinary course of business, the Company and its subsidiaries are subject to regulatory examinations,

information gathering requests, inquiries and investigations. In connection with formal and informal inquiries in

these cases, the Company and its subsidiaries receive numerous requests, subpoenas and orders for documents,

testimony and information in connection with various aspects of the Company’s regulated activities.

In view of the inherent difficulty of predicting the outcome of such litigation and regulatory matters, the

Company cannot predict what the eventual outcome of the pending matters will be, what the timing or the

ultimate resolution of these matters will be, or what the eventual loss, fines or penalties related to each

pending matter may be.

In accordance with SFAS No. 5, “Accounting for Contingencies,” the Company is required to establish

reserves for litigation and regulatory matters when those matters present loss contingencies that are both

probable and estimable. When loss contingencies are not both probable and estimable, the Company does not

establish reserves.

F-81

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)