Sallie Mae 2008 Annual Report Download - page 159

Download and view the complete annual report

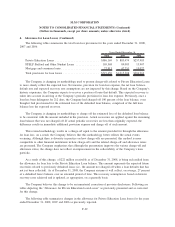

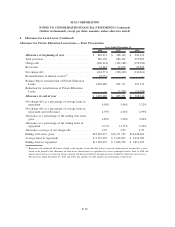

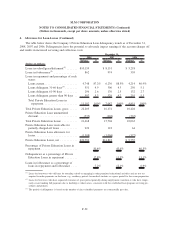

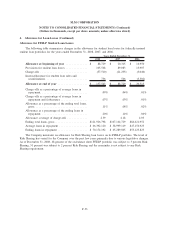

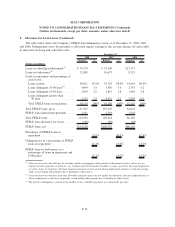

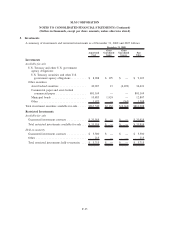

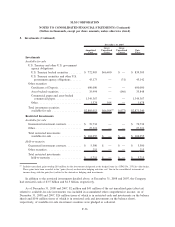

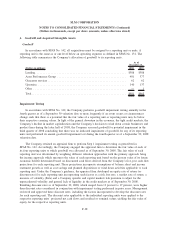

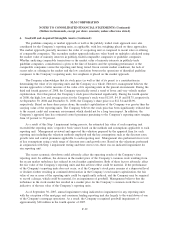

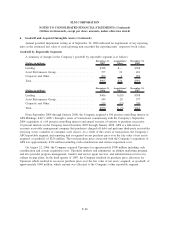

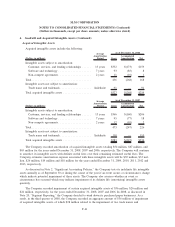

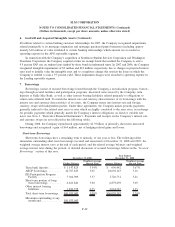

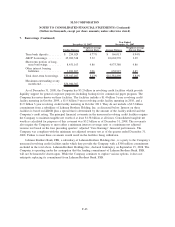

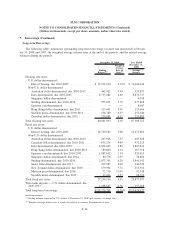

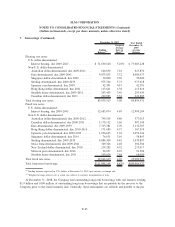

Please find page 159 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6. Goodwill and Acquired Intangible Assets (Continued)

The guideline company or market approach as well as the publicly traded stock approach were also

considered for the Company’s reporting units, as applicable, with less weighting placed on these approaches.

The market approach generally measures the value of a reporting unit as compared to recent sales or offering

of comparable companies. The secondary market approach indicates value based on multiples calculated using

the market value of minority interests in publicly-traded comparable companies or guideline companies.

Whether analyzing comparable transactions or the market value of minority interests in publicly-trade

guideline companies, consideration is given to the line of business and the operating performance or the

comparable companies versus the reporting unit being tested. Given current market conditions, the lack of

recent sales or offering in the market and the low correlation between the operations of identified guideline

companies to the Company’s reporting units, less emphasis is placed on the market approach.

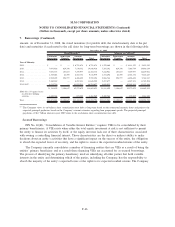

The Company acknowledges that its stock price (as well as that of its peers) is a consideration in

determining the value of its reporting units and the Company as a whole. However, management believes the

income approach is a better measure of the value of its reporting units in the present environment. During the

third and fourth quarters of 2008, the Company specifically noted a trend of lower and very volatile market

capitalization. Over this period, the Company’s stock prices fluctuated significantly. During the fourth quarter

of 2008, the high, low and average prices for the Company’s stock were $12.03, $4.19 and $8.75, respectively.

At September 30, 2008 and December 31, 2008, the Company’s share price was $12.34 and $8.90,

respectively. Based on these share prices alone, the market capitalization of the Company was greater than the

carrying value of the reporting units. The Company believes the stock price has been significantly reduced due

to the current credit and economic environment which should not be a long term impact. In addition, the

Company’s appraisal firm has estimated control premiums pertaining to the Company’s reporting units ranging

from 10 percent to 30 percent.

As a result of this Step 1 impairment testing process, the estimated fair value of each reporting unit

exceeded the reporting units’ respective book values based on the methods and assumptions applicable to each

reporting unit. Management reviewed and approved the valuation prepared by the appraisal firm for each

reporting unit including the valuation methods employed and the key assumptions such as the discount rates,

growth rates and control premiums applicable to each reporting unit. Management also performed stress tests

of key assumptions using a wide range of discount rates and growth rates. Based on the valuations performed

in conjunction with Step 1 impairment testing and these stress tests, there was no indicated impairment for

any reporting unit.

The recent economic slowdown could adversely affect the operating results of the Company’s four

reporting units. In addition, the decrease in the market price of the Company’s common stock resulting from

the recent market turbulence has reduced its total market capitalization. Both of these factors adversely affect

the fair value of the Company’s reporting units and this adverse effect could be material. If the performance

of the Company’s reporting units does not occur, or if the Company’s stock price remains at a depressed level

or declines further resulting in continued deterioration in the Company’s total market capitalization, the fair

value of one or more of the reporting units could be significantly reduced, and the Company may be required

to record a charge, which could be material, for an impairment of goodwill. Management believes that the

turbulence in the stock market has resulted in a market price for the Company’s common stock that is not

indicative of the true value of the Company’s reporting units.

As of September 30, 2007, annual impairment testing indicated no impairment for any reporting units

with the exception of the mortgage and consumer lending reporting unit due largely to the wind down of one

of the Company’s mortgage operations. As a result, the Company recognized goodwill impairment of

approximately $20 million in the fourth quarter of 2007.

F-39

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)