Sallie Mae 2008 Annual Report Download - page 145

Download and view the complete annual report

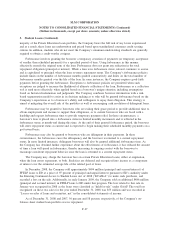

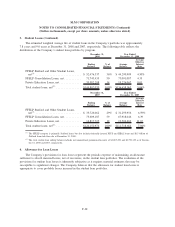

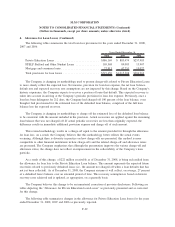

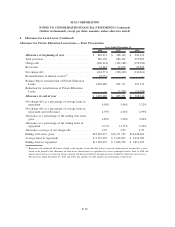

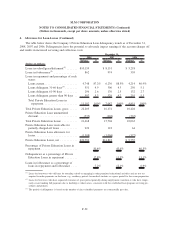

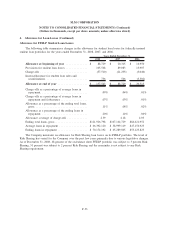

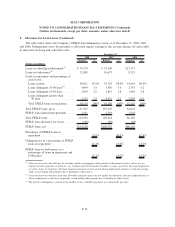

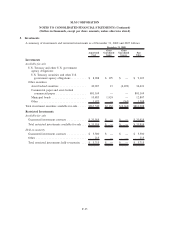

Please find page 145 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

consider its own historical experience in renewing or extending similar arrangements, regardless of whether

those arrangements have explicit renewal or extension provisions, when determining the useful life of an

intangible asset. In the absence of such experience, an entity shall consider the assumptions that market

participants would use about renewal or extension, adjusted for entity-specific factors. FSP SFAS No. 142-3

also requires an entity to disclose information regarding the extent to which the expected future cash flows

associated with an intangible asset are affected by the entity’s intent and/or ability to renew or extend the

arrangement. FSP SFAS No. 142-3 will be effective for qualifying intangible assets acquired by the Company

on or after January 1, 2009. The application of FSP SFAS No. 142-3 is not expected to have a material impact

on the Company’s results of operations, cash flows or financial positions; however, it could impact future

transactions entered into by the Company.

Accounting for Hedging Activities — An Amendment of FASB Statement No. 133

In June 2008, the FASB issued an exposure draft to amend the accounting for hedging activities in

SFAS No. 133. This proposed Statement is intended to simplify accounting for hedging activities, improve the

financial reporting of hedging activities, resolve major practice issues related to hedge accounting that have

arisen under SFAS No. 133, and address differences resulting from recognition and measurement anomalies

between the accounting for derivative instruments and the accounting for hedged items or transactions. While

the amendment as currently written may simplify the Company’s accounting model for hedging activities

under SFAS No. 133, the Company does not expect it to significantly impact its results of operations. The full

impact of this amendment, effective January 1, 2010, as currently written, cannot be evaluated until the final

statement is issued, which is expected to occur sometime in 2009.

Qualifying Special Purpose Entities (“QSPEs”) and Changes in the FIN No. 46(R) Consolidation Model

In September 2008, the FASB issued two separate but related exposure drafts for comment in connection

with amendments to (1) SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities — a replacement of FASB Statement No. 125,” which would impact the

accounting for QSPEs and (2) FASB’s FIN No. 46(R), “Consolidation of Variable Interest Entities — an

interpretation of ARB No. 51.”

Based on the Company’s preliminary review of these exposure drafts, it is likely that these changes will

lead in general to the consolidation of certain QSPEs that are currently not consolidated by the Company.

Assuming no changes to the Company’s current business model, the Company would most likely consolidate

its securitization trusts that are currently off-balance sheet on January 1, 2010, based on these exposure drafts

as currently written. These proposed new accounting rules would also be applied to new transactions entered

into from January 1, 2010 forward. However, the impact to the Company’s accounting for its QSPEs and VIEs

cannot be determined until the FASB issues the final amendments to SFAS No. 140 and FIN No. 46(R) which

is expected sometime in 2009.

Disclosures by Public Entities about Transfers of Financial Assets and Interest in Variable Interest

Entities

In December 2008, the FASB issued FSP SFAS No. 140-4 and FIN No. 46(R)-8, “Disclosures by Public

Entities about Transfers of Financial Assets and Interests in Variable Interest Entities.” This FSP significantly

increased disclosure requirements for transactions that fell under SFAS No. 140 and Fin No. 46(R). These new

disclosure requirements are effective for 2008 and are included as such.

F-25

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)