Sallie Mae 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

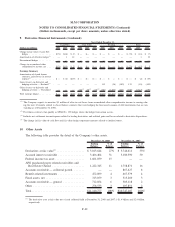

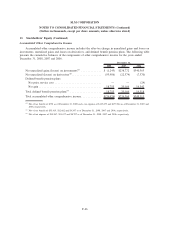

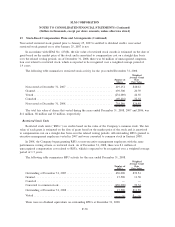

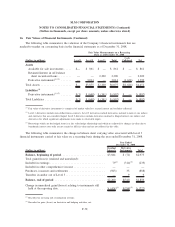

13. Stock-Based Compensation Plans and Arrangements (Continued)

Equity Compensation Plans

The following table summarizes information as of December 31, 2008, relating to equity compensation

plans or arrangements of the Company pursuant to which grants of options, restricted stock, RSUs or other

rights to acquire shares may be granted from time to time.

Plan Category

Number of

Securities to be

Issued Upon Exercise

of Outstanding

Options and Rights

Weighted Average

Exercise Price

of Outstanding

Options and Rights

Average

Remaining Life

(Years) of

Options

Outstanding

Number of

Securities Remaining

Available for Future

Issuance Under

Equity Compensation

Plans

Types of

Awards

Issuable

(1)

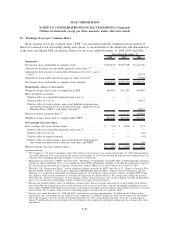

Equity compensation plans approved by

security holders:

Directors Stock Plan ............. NQ,ST

Traditional options ............. 2,644,862 $33.61 4.2

Net-settled options ............. — 17.83 9.0

TotalDirectorsStockPlan........ 2,644,862 31.10 5.0 —

SLM Corporation Incentive Plan

(2)(3)

... NQ,ISO,RES, RSU

Traditional options ............. 1,544,043 44.81 5.9

Net-settled options ............. 2,764 35.10 8.1

RSUs . . . .................. 15,500 — —

Total SLM Corporation Incentive

Plan. .................. 1,562,307 35.73 8.0

Expired Plans

(5)

................ NQ,ISO,RES

Traditional options ............. 7,584,832 32.40 3.7

Total expired plans . . . ........ 7,584,832 32.40 3.7 —

Total approved by security holders . . . . . . 11,792,001 34.58 6.8 12,969,458

(4)

Equity compensation plans not approved by

security holders:

Assumed shares

(6)

............... — — — 502,934 NQ,ISO,RES, RSU

Compensation arrangements

(7)

....... — — — — NQ

Employee Stock Purchase Plan

(8)

. . . . . . — — — 1,082,739

Expired Plan

(9)

................. 4,098,196 28.08 3.2 — NQ,RES

Total not approved by security holders . . . . 4,098,196 28.08 3.2 1,585,673

Total . . ...................... 15,890,197 $33.90 6.4 14,555,131

(1)

NQ (Non-Qualified Stock Option), ISO (Incentive Stock Option), RES (Restricted/Performance Stock), RSU (Restricted Stock Unit), ST (Stock Grant).

(2)

Options granted in 2006, 2007 and 2008 were granted as net-settled options. Also, certain traditional options outstanding at April 29, 2006 were converted to

net-settled options in 2006. Upon exercise of a net-settled option, employees are entitled to receive the after-tax spread shares only. The spread shares equal

the gross number of options granted less shares for the option cost. Shares for the option cost equal the option price multiplied by the number of gross options

exercised divided by the fair market value of the Company’s common stock at the time of exercise. At December 31, 2008, the option price for the vast major-

ity of net-settled options was higher than the market price. Accordingly, the Company was obligated to issue only 2,764 shares upon the exercise of all net-set-

tled options at December 31, 2008.

(3)

The SLM Corporation Incentive Plan is subject to an aggregate limit of 2,502,934 shares that may be issued as restricted stock or RSUs. As of Decem-

ber 31, 2008, 1,166,698 shares are remaining from this authority.

(4)

Securities remain available for issuance under the SLM Corporation Incentive Plan based on net-settlement of options.

(5)

Expired plans for which unexercised options remain outstanding are the Management Incentive Plan and Board of Directors Stock Option Plan.

(6)

The SLM Corporation Incentive Plan assumed 502,934 shares from The Upromise Stock Plan in October 2006 upon the Company’s acquisition of Upro-

mise. These assumed shares were not approved by securities holders as permitted by the rules of the NYSE.

(7)

One million net-settled options were awarded on January 8, 2008, to John F. Remondi as an “employment inducement award” under NYSE rules. At

December 31, 2008, the option price of the award was higher than the market price; therefore, the Company was not obligated to issue any securities

under the award.

(8)

Number of shares available for issuance under the ESPP.

(9)

Expired plan for which unexercised options remain outstanding is the Employee Stock Option Plan.

F-72

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)