Sallie Mae 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

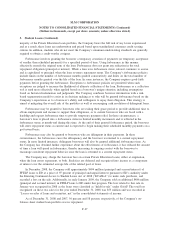

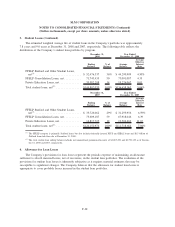

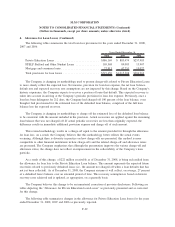

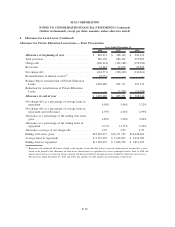

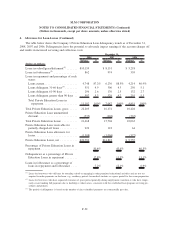

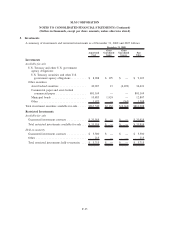

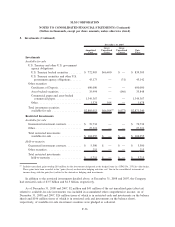

4. Allowance for Loan Losses (Continued)

The following tables summarize the total loan loss provisions for the years ended December 31, 2008,

2007 and 2006.

2008 2007 2006

Years Ended December 31,

Private Education Loans ............................ $586,169 $ 883,474 $257,983

FFELP Stafford and Other Student Loans ............... 105,568 89,083 13,907

Mortgage and consumer loans ........................ 27,913 42,751 15,072

Total provisions for loan losses ....................... $719,650 $1,015,308 $286,962

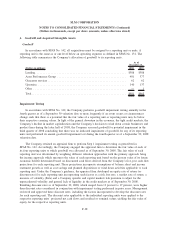

The Company is changing its methodology used to present charge-offs related to Private Education Loans

to more clearly reflect the expected loss. Net income, provision for loan loss expense, the net loan balance,

default rate and expected recovery rate assumptions are not impacted by this change. Based on the Company’s

historic experience, the Company expects to recover a portion of loans that default. This expected recovery is

taken into account in arriving at the Company’s periodic provision for loan loss expense. Previously, once a

loan has been delinquent for 212 days, the Company had charged off 100 percent of the loan balance, even

though it had provisioned for the estimated loss of the defaulted loan balance, comprised of the full loan

balance less the expected recovery.

The Company is changing its methodology to charge off the estimated loss of the defaulted loan balance

to be consistent with the amount included in the provision. Actual recoveries are applied against the remaining

loan balance that was not charged off. If actual periodic recoveries are less than originally expected, the

difference results in immediate additional provision expense and charge off of such amount.

This revised methodology results in a charge-off equal to the amount provided for through the allowance

for loan loss. As a result, the Company believes that this methodology better reflects the actual events

occurring. Although there is diversity in practice on how charge-offs are presented, this method is more

comparable to other financial institutions in how charge-offs and the related charge-off and allowance ratios

are presented. The Company emphasizes that although the presentation improves the various charge-off and

allowance ratios, the change does not reflect an improvement in the collectability of the Company’s loan

portfolio.

As a result of this change, a $222 million receivable as of December 31, 2008, is being reclassified from

the allowance for loan loss to the Private Education Loan balance. This amount represents the expected future

recoveries related to previously defaulted loans (i.e., the amount not charged off when a loan defaults that has

not yet been collected). As of December 31, 2008, the Company assumes it will collect, on average, 27 percent

of a defaulted loan’s balance over an extended period of time. This recovery assumption is based on historic

recovery rates achieved and is updated, as appropriate, on a quarterly basis.

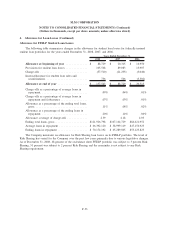

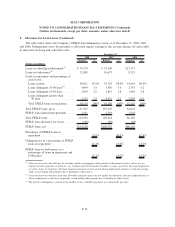

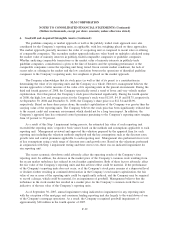

The Company believes this change to be an immaterial correction of previous disclosures. Following are

tables depicting the “Allowance for Private Education Loan Losses” as previously presented and as corrected

for this change.

The following table summarizes changes in the allowance for Private Education Loan losses for the years

ended December 31, 2008, 2007 and 2006 as previously reported.

F-29

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)