Sallie Mae 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

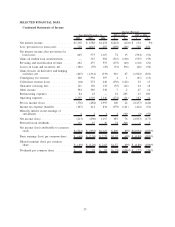

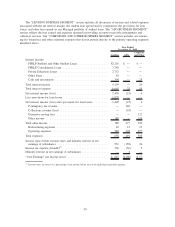

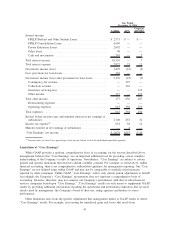

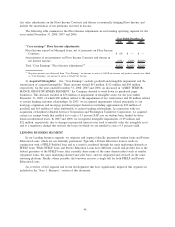

The following table summarizes “Core Earnings” securitization adjustments for the Lending operating

segment for the years ended December 31, 2008, 2007 and 2006.

2008 2007 2006

Years Ended December 31,

“Core Earnings” securitization adjustments:

Net interest income on securitized loans, before provisions for loan losses

and before intercompany transactions .......................... $(872) $(818) $(896)

Provisions for loan losses..................................... 309 380 16

Net interest income on securitized loans, after provisions for loan losses,

before intercompany transactions ............................. (563) (438) (880)

Intercompany transactions with off-balance sheet trusts ............... (141) (119) (43)

Net interest income on securitized loans, after provisions for loan losses . . (704) (557) (923)

Gains on student loan securitizations ............................ — 367 902

Servicing and securitization revenue ............................. 262 437 553

Total “Core Earnings” securitization adjustments

(1)

.................. $(442) $ 247 $ 532

(1)

Negative amounts are subtracted from “Core Earnings” net income to arrive at GAAP net income and positive amounts are added

to “Core Earnings” net income to arrive at GAAP net income.

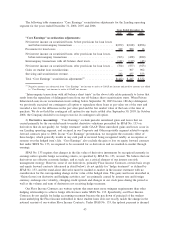

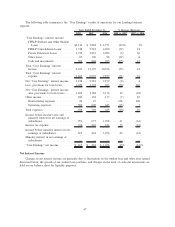

“Intercompany transactions with off-balance sheet trusts” in the above table relate primarily to losses that

result from the repurchase of delinquent loans from our off-balance sheet securitization trusts. When Private

Education Loans in our securitization trusts settling before September 30, 2005 became 180 days delinquent,

we previously exercised our contingent call option to repurchase these loans at par value out of the trust and

recorded a loss for the difference in the par value paid and the fair market value of the loan at the time of

purchase. We do not hold the contingent call option for any trusts settled after September 30, 2005. In October

2008, the Company decided to no longer exercise its contingent call option.

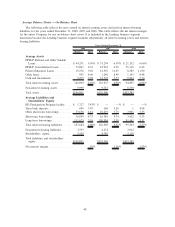

2) Derivative Accounting: “Core Earnings” exclude periodic unrealized gains and losses that are

caused primarily by the one-sided mark-to-market derivative valuations prescribed by SFAS No. 133 on

derivatives that do not qualify for “hedge treatment” under GAAP. These unrealized gains and losses occur in

our Lending operating segment, and occurred in our Corporate and Other reportable segment related to equity

forward contracts prior to 2008. In our “Core Earnings” presentation, we recognize the economic effect of

these hedges, which generally results in any cash paid or received being recognized ratably as an expense or

revenue over the hedged item’s life. “Core Earnings” also exclude the gain or loss on equity forward contracts

that under SFAS No. 133, are required to be accounted for as derivatives and are marked-to-market through

earnings.

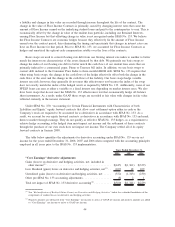

SFAS No. 133 requires that changes in the fair value of derivative instruments be recognized currently in

earnings unless specific hedge accounting criteria, as specified by SFAS No. 133, are met. We believe that our

derivatives are effective economic hedges, and as such, are a critical element of our interest rate risk

management strategy. However, some of our derivatives, primarily Floor Income Contracts, certain basis swaps

and equity forward contracts (discussed in detail below), do not qualify for “hedge treatment” as defined by

SFAS No. 133, and the stand-alone derivative must be marked-to-market in the income statement with no

consideration for the corresponding change in fair value of the hedged item. The gains and losses described in

“Gains (losses) on derivative and hedging activities, net” are primarily caused by interest rate and foreign

currency exchange rate volatility, changing credit spreads and changes in our stock price during the period as

well as the volume and term of derivatives not receiving hedge treatment.

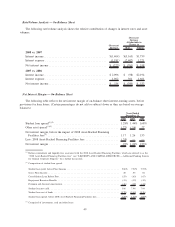

Our Floor Income Contracts are written options that must meet more stringent requirements than other

hedging relationships to achieve hedge effectiveness under SFAS No. 133. Specifically, our Floor Income

Contracts do not qualify for hedge accounting treatment because the pay down of principal of the student

loans underlying the Floor Income embedded in those student loans does not exactly match the change in the

notional amount of our written Floor Income Contracts. Under SFAS No. 133, the upfront payment is deemed

43