Sallie Mae 2008 Annual Report Download - page 113

Download and view the complete annual report

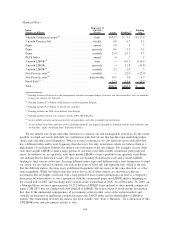

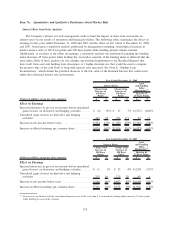

Please find page 113 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the above table, under the scenario where interest rates increase 100 and 300 basis points, the change

in pre-tax net income before the unrealized gains (losses) on derivative and hedging activities is primarily due

to the impact of (i) our off-balance sheet hedged FFELP Consolidation Loan securitizations and the related

Embedded Floor Income recognized as part of the gain on sale, which results in a decrease in payments on the

written Floor contracts that more than offset impairment losses on the Embedded Floor Income in the Residual

Interest; (ii) in low interest rate environments, our unhedged on-balance sheet loans being in a fixed-rate mode

due to Embedded Floor Income while being funded with a variable debt; (iii) a portion of our fixed rate assets

being funded with variable debt and (iv) a portion of our variable assets being funded with fixed debt. Items

(i) and (iv) will generally cause income to increase when interest rates increase from a low interest rate

environment, whereas, items (ii) and (iii) will generally offset this increase. In the 100 basis point scenario for

the year ended December 31, 2008, item (ii) had a greater impact than items (i) and (iv) resulting in a net

loss. However, in the 300 basis point scenario, the impact of item (ii) was less relative to item (iv). In the 100

and 300 basis point scenario for the year ended December 31, 2007, items (i) and (iv) had a greater impact

than item (ii) resulting in a net gain.

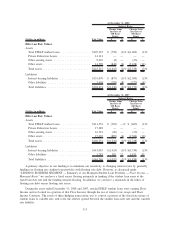

Under the scenario in the tables above, called “Asset and Funding Index Mismatches,” the main driver of

the decrease in pre-tax income before unrealized gains (losses) on derivative and hedging activities is the result

of LIBOR-based debt funding commercial paper-indexed assets. See “Market and Interest Rate Risk

Management — Asset and Liability Funding Gap” for a further discussion. Increasing the spread between

indices will also impact the unrealized gains (losses) on derivatives and hedging activities as it relates to basis

swaps. Basis swaps used to convert LIBOR-based debt to indices that we believe are economic hedges of the

indices of the assets being funded resulted in unrealized losses of $(134) million and $(175) million for the

years ended December 31, 2008 and 2007, respectively. Offsetting this unrealized loss are basis swaps that

economically hedge our off-balance sheet Private Credit securitization trusts. Unrealized gains for these basis

swaps totaled $229 million and $255 million for the years ended December 31, 2008 and 2007, respectively.

The net impact of both of these items was an unrealized gain for all periods presented.

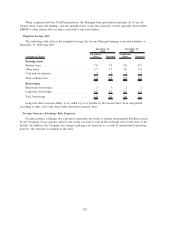

In addition to interest rate risk addressed in the preceding tables, the Company is also exposed to risks

related to foreign currency exchange rates. Foreign currency exchange risk is primarily the result of foreign

denominated debt issued by the Company. As it relates to the Company’s corporate unsecured and securitiza-

tion debt programs used to fund the Company’s business, the Company’s policy is to use cross currency

interest rate swaps to swap all foreign denominated debt payments (fixed and floating) to U.S. dollar LIBOR

using a fixed exchange rate. In the tables above, there would be an immaterial impact on earnings if exchange

rates were to decrease or increase, due to the terms of the hedging instrument and hedged items matching. The

balance sheet interest bearing liabilities would be affected by a change in exchange rates; however, the change

would be materially offset by the cross currency interest rate swaps in other assets or other liabilities. In

addition, the Company has foreign exchange risk as a result of international operations; however, the exposure

is minimal at this time.

Item 8. Financial Statements and Supplementary Data

Reference is made to the financial statements listed under the heading ‘‘(a) 1.A. Financial Statements” of

Item 15 hereof, which financial statements are incorporated by reference in response to this Item 8.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Nothing to report.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of December 31,

2008. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of

112