Sallie Mae 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

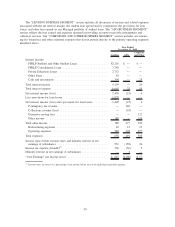

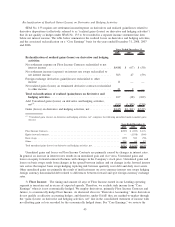

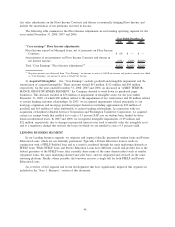

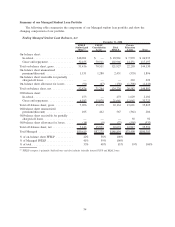

Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities

SFAS No. 133 requires net settlement income/expense on derivatives and realized gains/losses related to

derivative dispositions (collectively referred to as “realized gains (losses) on derivative and hedging activities”)

that do not qualify as hedges under SFAS No. 133 to be recorded in a separate income statement line item

below net interest income. The table below summarizes the realized losses on derivative and hedging activities,

and the associated reclassification on a “Core Earnings” basis for the years ended December 31, 2008, 2007

and 2006.

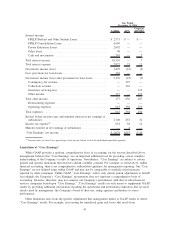

2008 2007 2006

Years Ended December 31,

Reclassification of realized gains (losses) on derivative and hedging

activities:

Net settlement expense on Floor Income Contracts reclassified to net

interest income ......................................... $(488) $ (67) $ (50)

Net settlement income (expense) on interest rate swaps reclassified to

net interest income ...................................... 563 47 (59)

Foreign exchange derivatives gains/(losses) reclassified to other

income ............................................... 11 — —

Net realized gains (losses) on terminated derivative contracts reclassified

to other income ......................................... 21 2 —

Total reclassifications of realized (gains)losses on derivative and

hedging activities ....................................... 107 (18) (109)

Add: Unrealized gains (losses) on derivative and hedging activities,

net

(1)

................................................. (552) (1,343) (230)

Gains (losses) on derivative and hedging activities, net .............. $(445) $(1,361) $(339)

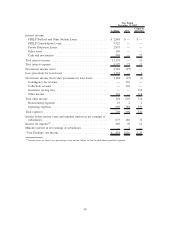

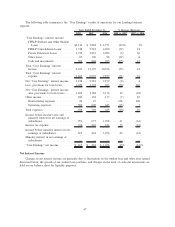

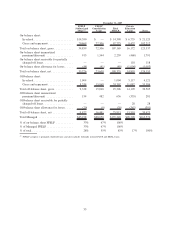

(1)

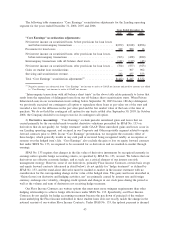

“Unrealized gains (losses) on derivative and hedging activities, net” comprises the following unrealized mark-to-market gains

(losses):

2008 2007 2006

Years Ended December 31,

Floor Income Contracts . . ................................................ $(529) $ (209) $ 176

Equity forward contracts . ................................................ — (1,558) (360)

Basis swaps ......................................................... (239) 360 (58)

Other.............................................................. 216 64 12

Total unrealized gains (losses) on derivative and hedging activities, net . .................. $(552) $(1,343) $(230)

Unrealized gains and losses on Floor Income Contracts are primarily caused by changes in interest rates.

In general, an increase in interest rates results in an unrealized gain and vice versa. Unrealized gains and

losses on equity forward contracts fluctuate with changes in the Company’s stock price. Unrealized gains and

losses on basis swaps result from changes in the spread between indices and on changes in the forward interest

rate curves that impact basis swaps hedging repricing risk between quarterly reset debt and daily reset assets.

Other unrealized gains are primarily the result of ineffectiveness on cross-currency interest rate swaps hedging

foreign currency denominated debt related to differences between forward and spot foreign currency exchange

rates.

3) Floor Income: The timing and amount (if any) of Floor Income earned in our Lending operating

segment is uncertain and in excess of expected spreads. Therefore, we exclude such income from “Core

Earnings” when it is not economically hedged. We employ derivatives, primarily Floor Income Contracts and

futures, to economically hedge Floor Income. As discussed above in “Derivative Accounting,” these derivatives

do not qualify as effective accounting hedges, and therefore, under GAAP, they are marked-to-market through

the “gains (losses) on derivative and hedging activities, net” line in the consolidated statement of income with

no offsetting gain or loss recorded for the economically hedged items. For “Core Earnings,” we reverse the

45