Sallie Mae 2008 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

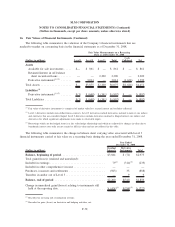

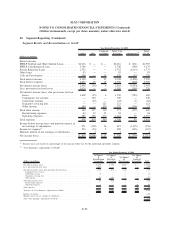

18. Benefit Plans (Continued)

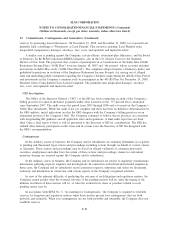

The weighted average assumptions used to determine the net periodic pension cost are as follows:

2008 2007

December 31,

Discount rate....................................................... 6.00% 5.75%

Expected return on plan assets .......................................... 5.25% 8.50%

Rate of compensation increase .......................................... 4.00% 4.00%

Management is assisted by third-party actuaries in measuring the pension liabilities and expense through

the use of various assumptions including discount rate, expected return on plan assets, salary increases,

employee turnover rates and mortality assumptions.

The year-end discount rate was selected based on a modeling process intended to match expected cash

flows from the plans to a yield curve constructed from a portfolio of non-callable Aa bonds with at least

$250 million of outstanding issue. Bonds are eliminated if they have maturities of less than six months or are

priced more than two standard errors from the market average.

The return on plan assets is based on the strategic asset allocation of the plan assets and a conservative

investment policy.

Assumption Sensitivity

Changes in the discount rate and the expected rate of return on plan assets impact expense. If the

discount rate increased/decreased by 50 basis points, expense would decrease/increase $.8 million from the

amount recorded at December 31, 2008. If the expected long-term rate of return on plan assets increased/

decreased by 50 basis points, expense would decrease/increase by $1 million.

Plan Assets

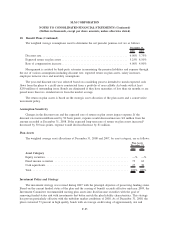

The weighted average asset allocations at December 31, 2008 and 2007, by asset category, are as follows:

2008 2007

Plan Assets

December 31,

Asset Category

Equity securities ..................................................... —% —%

Fixed income securities ............................................... 73 62

Cash equivalents..................................................... 27 38

Total ............................................................. 100% 100%

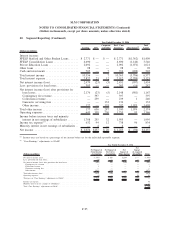

Investment Policy and Strategy

The investment strategy was revised during 2007 with the principal objective of preserving funding status.

Based on the current funded status of the plan and the ceasing of benefit accruals effective mid-year 2009, the

Investment Committee recommended moving plan assets into fixed income securities with the goal of

removing funded status risk with investments that better match the plan liability characteristics. This strategy

has proven particularly effective with the turbulent market conditions of 2008. As of December 31, 2008, the

plan is invested 73 percent in high quality bonds with an average credit rating of approximately AA and

F-85

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)