Sallie Mae 2008 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

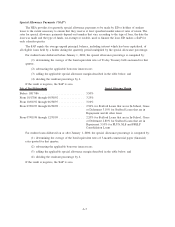

Date of First Disbursement Special Allowance Margin

From 01/01/00 through 09/30/07 ................ 1.74% for Stafford Loans that are in In-School, Grace

or Deferment

2.34% for Stafford Loans that are in Repayment

2.64% for PLUS and FFELP Consolidation Loans

From 10/01/07 and after ...................... 1.19% for Stafford Loans that are in In-School, Grace

or Deferment

1.79% for Stafford Loans that are in Repayment and

PLUS

2.09% for FFELP Consolidation Loans

Note: The margins for loans held by an eligible not-

for-profit holder is higher by 15 basis points.

• Special Allowance Payments are available on variable rate PLUS Loans and SLS Loans only if the

variable rate, which is reset annually, exceeds the applicable maximum borrower rate. Effective July 1,

2006, this limitation on special allowance for PLUS loans made on and after January 1, 2000 is

repealed. The variable rate is based on the weekly average one-year constant maturity Treasury yield

for loans made before July 1, 1998 and based on the 91-day Treasury bill for loans made on or after

July 1, 1998. The maximum borrower rate for these loans is between 9 percent and 12 percent.

Fees

Origination Fee. An origination fee must be paid to ED for all Stafford and PLUS loans originated in

the FFELP. An origination fee is not paid on a Consolidation loan.

A 3% origination fee must be deducted from the amount of each PLUS loan.

An origination fee may be, but is not required to be deducted from the amount of a Stafford loan

according to the following table:

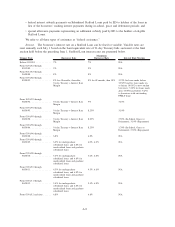

Date of First Disbursement Maximum Origination Fee

Before 07/01/06 ............................................. 3%

From 7/01/06 through 06/30/07 ................................. 2%

From 7/01/07 through 06/30/08 ................................. 1.5%

From 7/01/08 through 06/30/09 ................................. 1%

From 7/01/09 through 06/30/10 ................................. .5%

From 7/01/10 and after ....................................... 0%

Federal Default Fee. A federal default fee up to 1% (previously called an insurance premium) may be,

but is not required to be deducted from the amount of a Stafford and PLUS loan. A federal default fee is not

deducted from the amount of a Consolidation loan.

Lender Loan Fee. A lender loan fee is paid to ED on the amount of each loan disbursement of all

FFELP loans. For loans disbursed from October 1, 1993 to September 30, 2007, the fee was .50% of the loan

amount. The fee increased to 1.0% of the loan amount for loans disbursed on or after October 1, 2007.

Loan Rebate Fee. A loan rebate fee of 1.05% is paid annually on the unpaid principal and interest of

each Consolidation loan disbursed on or after October 1, 1993. This fee was reduced to .62% for loans made

from October 1, 1998 to January 31, 1999.

Stafford Loan Program

For Stafford Loans, the HEA provides for:

• federal reinsurance of Stafford Loans made by eligible lenders to qualified students;

A-8