Sallie Mae 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

¥ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008 or

nTRANSITION REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file numbers 001-13251

SLM Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware 52-2013874

(State of Other Jurisdiction of

Incorporation or Organization)

(I.R.S. Employer

Identification No.)

12061 Bluemont Way, Reston, Virginia 20190

(Address of Principal Executive Offices) (Zip Code)

(703) 810-3000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act

Common Stock, par value $.20 per share.

Name of Exchange on which Listed:

New York Stock Exchange

6.97% Cumulative Redeemable Preferred Stock, Series A, par value $.20 per share

Floating Rate Non-Cumulative Preferred Stock, Series B, par value $.20 per share

Name of Exchange on which Listed:

New York Stock Exchange

Medium Term Notes, Series A, CPI-Linked Notes due 2017

Medium Term Notes, Series A, CPI-Linked Notes due 2018

6% Senior Notes due December 15, 2043

Name of Exchange on which Listed:

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¥No n

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes nNo ¥

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes ¥No n

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. ¥

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

Large accelerated filer ¥Accelerated filer nNon-accelerated filer n

(Do not check if a smaller reporting company)

Smaller reporting company n

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes nNo ¥

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2008 was $8.9 billion (based on closing

sale price of $19.35 per share as reported for the New York Stock Exchange — Composite Transactions).

As of February 27, 2009, there were 467,403,909 shares of voting common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement relating to the registrant’s Annual Meeting of Shareholders scheduled to be held May 22, 2009 are

incorporated by reference into Part III of this Report.

Table of contents

-

Page 1

...whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes n No ¥ The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2008 was $8.9 billion (based on closing sale price of $19.35 per share as reported for the New York... -

Page 2

...loans being originated or refinanced under non-FFELP programs, or may affect the terms upon which banks and others agree to sell FFELP loans to the Company. The Company could be affected by: various liquidity programs being implemented by the federal government; changes in the demand for educational... -

Page 3

... business is to originate, service and collect student loans. We provide funding, delivery and servicing support for education loans in the United States through our participation in the Federal Family Education Loan Program ("FFELP") and through our non-federally guaranteed Private Education Loan... -

Page 4

... to this debt issuance, the market for unsecured, non-U.S. government guaranteed debt issued by financial services companies materially deteriorated and became unavailable at profitable terms. The net interest margin earned on a newly-originated FFELP loan came under pressure as the asset yield was... -

Page 5

... through closing several work locations. The Company also curtailed less profitable FFELP student loan acquisitions such as from Lender Partners, spot purchases and consolidation lending. In our private education lending business, we curtailed high default lending programs, tightened credit... -

Page 6

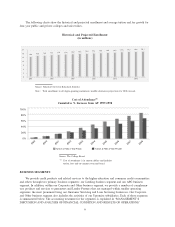

... loans to fund their tuition needs. Both federal and private loans as a percentage of total student aid were 52 percent of total student aid in AY 1997-1998 and 53 percent in AY 2007-2008. Private Education Loans accounted for 22 percent of total student loans - both federally guaranteed and Private... -

Page 7

...20 08 Tuition & Fees 4-Year Public Tuition & Fees 4-Year Private Source: The College Board (1) Cost of attendance is in current dollars and includes tuition, fees and on-campus room and board. BUSINESS SEGMENTS We provide credit products and related services to the higher education and consumer... -

Page 8

.... We are the largest servicer of student loans, servicing a portfolio of $139 billion of FFELP loans and $39 billion of Private Education Loans as of December 31, 2008. Sallie Mae's Lending Business Our primary marketing point-of-contact is the school's financial aid office. We deliver flexible and... -

Page 9

..., servicing, collecting and funding of Private Education Loans. These changes were made to increase the profitability and decrease the risk of the product. For example, the average FICO score for loans disbursed in the fourth quarter of 2008 was up 26 points to 738 and the percentage of co-signed... -

Page 10

...years. Our FFY 2008 FFELP originations totaled $17.1 billion, representing a 23 percent market share. ASSET PERFORMANCE GROUP BUSINESS SEGMENT In our APG business segment, we provide accounts receivable and collections services including student loan default aversion services, defaulted student loan... -

Page 11

... and non-profit guarantee agencies that provide third-party outsourcing to other guarantors. (See APPENDIX A, "FEDERAL FAMILY EDUCATION LOAN PROGRAM - Guarantor Funding" for details of the fees paid to guarantors.) Upromise Upromise provides a number of programs that encourage consumers to save for... -

Page 12

...applicable to our student loan business include: • the Truth-In-Lending Act; • the Fair Credit Reporting Act; • the Equal Credit Opportunity Act; • the Gramm-Leach Bliley Act; and • the U.S. Bankruptcy Code. APG's debt collection and receivables management activities are subject to federal... -

Page 13

... corporate governance listing standards, pursuant to Section 303A.12(a) of the NYSE Listed Company Manual. In addition, we filed as exhibits to the Company's Annual Report on Form 10-K for the years ended December 31, 2006 and 2007 and to this Annual Report on Form 10-K, the certifications required... -

Page 14

... profitable margins. If deposit funding is not available at profitable levels, the origination of our Private Education Loans will be limited. Recent market conditions have reduced our access to and increased the cost of borrowing for student loan asset-backed securities. If the government programs... -

Page 15

... common stock. There are no restrictions on entering into the sale of any equity securities in either public or private transactions, except that any private transaction involving more than 20 percent of shares outstanding requires shareholder approval. Under current market conditions, the terms of... -

Page 16

... fines, business sanctions, limitations on our ability to fund our Private Education Loans, which are currently funded by term deposits issued by Sallie Mae Bank, or restrictions on the operations of Sallie Mae Bank. A failure of our operational systems or infrastructure, or those of our third-party... -

Page 17

... brand name recognition. The market for federally-guaranteed student loans is shared among the Company and other private sector lenders who participate in the FFELP and the federal government through the FDLP. We compete based on our products and customer service. To the extent our competitors... -

Page 18

... financial services company, we would not have other product offerings to offset any loss of business in the education credit market. We may be adversely affected by deterioration in economic conditions. A recession or downturn in the economy could make it difficult for us to originate new business... -

Page 19

... by a mortgage. The Company believes that its headquarters, loan servicing centers data center, back-up facility and data management and collections centers are generally adequate to meet its long-term student loan and business goals. The Company's principal office is currently in owned space at... -

Page 20

... statements regarding the Company's business made during the 401(K) Class Period and investments in the Company's common stock by participants in the 401(K) Plan. On December 15, 2008, Plaintiffs filed a Consolidated Class Action Complaint. The plaintiffs seek unspecified damages, attorneys' fees... -

Page 21

... use of the simple daily interest method for calculating interest, the charging of late fees while charging simple daily interest, and setting the first payment date at 60 days after loan disbursement for consolidation and PLUS loans thereby alleging that the Company effectively capitalizes interest... -

Page 22

... first quarter of 2007. There were no cash dividends paid in 2008. Issuer Purchases of Equity Securities The following table summarizes the Company's common share repurchases during 2008 in connection with the exercise of stock options and vesting of restricted stock to satisfy minimum statutory tax... -

Page 23

Stock Performance The following graph compares the yearly percentage change in the Company's cumulative total shareholder return on its common stock to that of Standard & Poor's 500 Stock Index and Standard & Poor's Financials Index. The graph assumes a base investment of $100 at December 31, 2003 ... -

Page 24

...69) Dividends per common share ...- Return on common stockholders' equity ...(9)% Net interest margin...93 Return on assets ...(.14) Dividend payout ratio ...- Average equity/average assets ...3.45 Balance Sheet Data: Student loans, net ...$144,802 Total assets ...168,768 Total borrowings ...160,158... -

Page 25

... with access to unlimited funding to meet student demand through AY 2009-2010. Our Private Education Loan originations are being funded by term deposits issued by Sallie Mae Bank. The Company's primary funding challenge is to replace our short-term funding sources, principally the 2008 Asset-Backed... -

Page 26

... the year-ago quarter. The Company will seek to be a loan servicer for ED under the Loan Purchase Program. Purchased Paper Business We have decided to exit the debt purchased paper business (see "ASSET PERFORMANCE GROUP BUSINESS SEGMENT"). This line of business reported a $203 million after-tax loss... -

Page 27

... loan portfolio. When calculating the allowance for loan losses on Private Education Loans, we divide the portfolio into categories of similar risk characteristics based on loan program type, loan status (in-school, grace, forbearance, repayment, and delinquency), underwriting criteria (FICO scores... -

Page 28

... loan portfolio at the reporting date. We divide the portfolio into categories of similar risk characteristics based on loan program type, school type and loan status. We then apply the default rate projections, net of applicable Risk Sharing, to each category for the current period to perform our... -

Page 29

... Amortization For both federally insured and Private Education Loans, we account for premiums paid, discounts received, and capitalized direct origination costs incurred on the origination of student loans in accordance with the Financial Accounting Standards Board's ("FASB") Statement of Financial... -

Page 30

... the consolidated financial statements. Liquidity is impacted to the extent that a decrease in fair value would result in less cash being received upon a sale of an investment. Liquidity is also impacted to the extent that changes in capital and net income affect compliance with principal financial... -

Page 31

...pricing the asset in a current sale transaction would be acceptable (such as a discounted cash flow analysis). Regardless of the valuation technique applied, entities must include appropriate risk adjustments that market participants would make, including adjustments for non-performance risk (credit... -

Page 32

... securitization transaction. The Residual Interest is the right to receive cash flows from the student loans and reserve accounts in excess of the amounts needed to pay servicing, derivative costs (if any), other fees, and the principal and interest on the bonds backed by the student loans. We have... -

Page 33

... net" line in the consolidated statement of income with no consideration for the corresponding change in fair value of the hedged item. The derivative market value adjustment is primarily caused by interest rate and foreign currency exchange rate volatility, changing credit spreads during the period... -

Page 34

... DATA Condensed Statements of Income Increase (Decrease) Years Ended December 31, 2008 2007 2006 2008 vs. 2007 $ % 2007 vs. 2006 $ % Net interest income ...Less: provisions for loan losses ...Net interest income after provisions for loan losses ...Gains on student loan securitizations ...Servicing... -

Page 35

... Balance Sheets Increase (Decrease) 2008 vs. 2007 $ % December 31, 2008 2007 Assets FFELP Stafford and Other Student Loans, net ...FFELP Stafford Loans Held-for-Sale ...FFELP Consolidation Loans, net ...Private Education Loans, net ...Other loans, net ...Cash and investments...Restricted cash and... -

Page 36

... a decrease in the student loan spread (see "LENDING BUSINESS SEGMENT - Net Interest Income - Net Interest Margin - On-Balance Sheet"), an increase in the 2008 Asset-Backed Financing Facilities Fees, partially offset by a $25 billion increase in the average balance of on-balance sheet student loans... -

Page 37

... value paid and the fair market value of the loans at the time of purchase. We do not hold the contingent call option for any trusts that settled after September 30, 2005. Beginning in October 2008, we decided to no longer exercise our contingent call option. The loss in the fourth quarter of 2008... -

Page 38

... originated in the year-ago period. Other Income The following table summarizes the components of "Other income" in the consolidated statements of income for the years ended December 31, 2008, 2007 and 2006. Years Ended December 31, 2008 2007 2006 Late fees and forbearance fees ...Asset servicing... -

Page 39

... Our "Core Earnings" are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. "Core Earnings" net income reflects only current period adjustments to GAAP net income as described below. Unlike financial accounting, there is no comprehensive... -

Page 40

... fee businesses and other corporate expenses that do not pertain directly to the primary operating segments identified above. Year Ended December 31, 2008 Corporate Lending APG and Other Interest income: FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans ...Private Education Loans... -

Page 41

... 31, 2007 Corporate Lending APG and Other Interest income: FFELP Stafford and Other Student Loans...$ 2,848 FFELP Consolidation Loans ...5,522 Private Education Loans ...2,835 Other loans ...106 Cash and investments ...868 Total interest income ...Total interest expense ...Net interest income (loss... -

Page 42

... 31, 2006 Corporate Lending APG and Other Interest income: FFELP Stafford and Other Student Loans...$ 2,771 FFELP Consolidation Loans ...4,690 Private Education Loans ...2,092 Other loans ...98 Cash and investments ...705 Total interest income ...Total interest expense ...Net interest income (loss... -

Page 43

...establishing corporate performance targets and incentive compensation. Management believes this information provides additional insight into the financial performance of the Company's core business activities. "Core Earnings" net income reflects only current period adjustments to GAAP net income, as... -

Page 44

... currency exchange rate volatility, changing credit spreads and changes in our stock price during the period as well as the volume and term of derivatives not receiving hedge treatment. Our Floor Income Contracts are written options that must meet more stringent requirements than other hedging... -

Page 45

... changes in fair value reflected currently in the income statement. Under SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity," equity forward contracts that allow a net settlement option either in cash or the Company's stock are required... -

Page 46

... with changes in the Company's stock price. Unrealized gains and losses on basis swaps result from changes in the spread between indices and on changes in the forward interest rate curves that impact basis swaps hedging repricing risk between quarterly reset debt and daily reset assets. Other... -

Page 47

...to the federal guarantee of the FFELP loans, they currently share many of the same characteristics such as similar repayment terms, the same marketing channel and sales force, and are originated and serviced on the same servicing platform. Finally, where possible, the borrower receives a single bill... -

Page 48

...for our Lending business segment. Years Ended December 31, 2008 2007 2006 % Increase (Decrease) 2008 vs. 2007 2007 vs. 2006 "Core Earnings" interest income: FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans ...Private Education Loans ...Other loans ...Cash and investments ...Total... -

Page 49

...Lending business segment includes substantially all interest-earning assets and interestbearing liabilities. 2008 Balance Years Ended December 31, 2007 Balance Rate 2006 Balance Rate Rate Average Assets FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans ...Private Education Loans... -

Page 50

...Repayment Borrower Benefits ...Premium and discount amortization ...Student loan net yield ...5.60% .28 (.55) (.11) (.16) 5.06 7.92% .05 (.63) (.12) (.18) 7.04 (5.60) 1.44% 7.93% .04 (.67) (.12) (.14) 7.04 (5.36) 1.68% (2) Student loan cost of funds ...(3.78) Student loan spread, before 2008 Asset... -

Page 51

... to such purchases or originations. Premium and discount amortization is also impacted by prepayment behavior of the underlying loans. The student loan spread, before 2008 Asset-Backed Financing Facilities fees, for 2008 decreased 16 basis points from the prior year. The decrease was primarily... -

Page 52

... sheet student loan securitization trusts. This includes any related fees or costs such as the Consolidation Loan Rebate Fees, premium/discount amortization and Repayment Borrower Benefits yield adjustments; • includes the reclassification of certain derivative net settlement amounts. The net... -

Page 53

... student loan spread, before the 2008 Asset-Backed Financing Facilities fees, for 2007 decreased 17 basis points from the prior year primarily due to the interest income reserve on our Private Education loans. We estimate the amount of Private Education Loan accrued interest on our balance sheet... -

Page 54

..." net interest margin, before 2008 Asset-Backed Financing Facilities fees, for 2008 was unchanged from the prior year and decreased 20 basis points from 2006 to 2007. The increase in the Managed student loan portfolio as a percentage of the overall Managed interest-earning asset portfolio from... -

Page 55

... of our Managed student loan portfolio and show the changing composition of our portfolio. Ending Managed Student Loan Balances, net FFELP Stafford and Other(1) December 31, 2008 FFELP Consolidation Total Loans FFELP Private Education Loans Total On-balance sheet: In-school ...Grace and repayment... -

Page 56

... FFELP Consolidation Total Loans FFELP Private Education Loans Total On-balance sheet: In-school ...Grace and repayment ...Total on-balance sheet, gross ...On-balance sheet unamortized premium/(discount) ...On-balance sheet receivable for partially charged-off loans ...On-balance sheet allowance... -

Page 57

Student Loan Average Balances (net of unamortized premium/discount) The following tables summarize the components of our Managed student loan portfolio and show the changing composition of our portfolio. FFELP Stafford and Other(1) Year Ended December 31, 2008 FFELP Private Consolidation Education ... -

Page 58

...dates. December 31, 2008 Fixed Variable Borrower Borrower Rate Total Rate December 31, 2007 Variable Fixed Borrower Borrower Rate Rate Total (Dollars in billions) Student loans eligible to earn Floor Income: On-balance sheet student loans ...Off-balance sheet student loans ...Managed student loans... -

Page 59

...Sheet Private Education Loan Delinquencies December 31, December 31, December 31, 2008 2007 2006 Balance % Balance % Balance % Loans in-school/grace/deferment (1) ...Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...Loans delinquent 31-60 days(3) ...Loans... -

Page 60

...Sheet Private Education Loan Delinquencies December 31, December 31, December 31, 2008 2007 2006 Balance % Balance % Balance % Loans in-school/grace/deferment (1) ...Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...Loans delinquent 31-60 days(3) ...Loans... -

Page 61

Managed Basis Private Education Loan Delinquencies December 31, December 31, December 31, 2008 2007 2006 Balance % Balance % Balance % Loans in-school/grace/deferment (1) ...Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...Loans delinquent 31-60 days(3) ... -

Page 62

... period of time. This recovery assumption is based on historic recovery rates achieved and is updated, as appropriate, on a quarterly basis. The Company believes this change to be an immaterial correction of previous disclosures. Following are tables depicting the "Allowance for Private Education... -

Page 63

...table summarizes changes in the allowance for Private Education Loan losses for the years ended December 31, 2008, 2007 and 2006 as previously reported. Activity in the Allowance for Private Education Loan Losses - Prior Presentation Activity in Allowance for Private Education Loans On-Balance Sheet... -

Page 64

...in repayment . . Average coverage of net charge-offs(1) ...Delinquencies as a percentage of Private Education Loans in repayment ...Delinquencies greater than 90 days as a percentage of Private Education Loans in repayment ...Loans in forbearance as a percentage of loans in repayment and forbearance... -

Page 65

... The following table summarizes changes in the allowance for Private Education Loan losses for the years ended December 31, 2008, 2007 and 2006 as corrected and discussed above. Activity in Allowance for Private Education Loans On-Balance Sheet Off-Balance Sheet Managed Basis Years Ended December... -

Page 66

...percentage of loans in repayment and forbearance decreased from 13.9 percent at December 31, 2007 to 7.0 percent at December 31, 2008. Borrowers use the proceeds of Private Education Loans to obtain higher education, which increases the likelihood of obtaining employment at higher income levels than... -

Page 67

...the loan is returned to a current repayment status. As a result, the balance of loans in a forbearance status as of month end has decreased over the course of 2008, while the monthly average amount of loans granted forbearance in the fourth quarter of 2008 was consistent with the year-ago quarter at... -

Page 68

... Private Education Loans in forbearance status have been in active repayment status less than 25 months. December 31, 2008 Monthly Scheduled Payments Due 0 to 24 25 to 48 More than 48 Not Yet in Repayment Total Loans in-school/grace/deferment ...Loans in forbearance ...Loans in repayment - current... -

Page 69

...Repayment Total Loans in-school/grace/deferment ...Loans in forbearance ...Loans in repayment - current ...Loans in repayment - delinquent 31-60 days ...Loans in repayment - delinquent 61-90 days ...Loans in repayment - delinquent greater than 90 days ...Total ...Unamortized discount ...Receivable... -

Page 70

... Sheet FFELP Loan Delinquencies December 31, 2007 % Balance % (Dollars in millions) 2008 Balance 2006 Balance % Loans in-school/grace/deferment (1) ...$ 39,270 12,483 Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...58,811 Loans delinquent 31-60 days... -

Page 71

... 2008 Balance Off-Balance Sheet FFELP Loan Delinquencies December 31, 2007 2006 % Balance % Balance % Loans in-school/grace/deferment (1) ...Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...Loans delinquent 31-60 days(3) ...Loans delinquent 61-90 days... -

Page 72

...school or engaging in other permitted educational activities and are not yet required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation, as well as, loans for borrowers who have requested extension of grace period during employment... -

Page 73

... 2006 Managed Basis Years Ended December 31, 2008 2007 2006 Allowance at beginning of period ...Provision for FFELP Loan losses ...Charge-offs ...Student loan sales and securitization activity ...Allowance at end of period . . Charge-offs as a percentage of average loans in repayment ...Charge-offs... -

Page 74

... million. Total Loan Charge-offs - Corrected Presentation The following tables summarize the charge-offs for all loan types on-balance sheet and on a Managed Basis for the years ended December 31, 2008, 2007 and 2006, as corrected, for Private Education Loans. Total on-balance sheet loan charge-offs... -

Page 75

... of our loan originations. During the first half of 2008, the Company suspended participation in the federal consolidation loan program and also discontinued subsidizing on behalf of borrowers the federally mandated Stafford loan origination fee for loans guaranteed after May 2, 2008. As a result... -

Page 76

...Year Ended December 31, 2008 FFELP Private Total Internal lending brands and Lender Partners ...Other commitment clients ...Spot purchases ...Consolidations from third parties ...Consolidations and clean-up calls of off-balance sheet securitized loans ...Capitalized interest, premiums and discounts... -

Page 77

...-balance sheet asset information for our Lending business segment. 2008 December 31, 2007 2006 FFELP Stafford and Other Student Loans, net ...$ 44,025 FFELP Stafford Loans Held-for-Sale ...8,451 FFELP Consolidation Loans, net ...71,744 Managed Private Education Loans, net ...20,582 Other loans, net... -

Page 78

... $.5 billion of these FFELP loans are eligible for ED's Purchase and Participation Programs (see "LIQUIDITY AND CAPITAL RESOURCES - ED Funding Programs"). The following tables summarize our loan originations by type of loan and source. December 31, 2008 Years Ended December 31, 2007 December... -

Page 79

...2008 FFELP Stafford and Other(1) FFELP Consolidation Loans Total FFELP Total Private Education Loans Total OnBalance Sheet Portfolio Beginning balance ...Net consolidations: Incremental consolidations from third parties ...Consolidations to third parties ...Net consolidations ...Acquisitions ...Net... -

Page 80

... FFELP Stafford and Other(1) FFELP Consolidation Loans Total Private Education Loans Total OffBalance Sheet Portfolio Total FFELP Beginning balance ...Net consolidations: Incremental consolidations from third parties...Consolidations to third parties ...Net consolidations ...Acquisitions ...Net... -

Page 81

... FFELP Stafford and Other(1) FFELP Consolidation Loans Total Private Education Loans Total OffBalance Sheet Portfolio Total FFELP Beginning balance ...Net consolidations: Incremental consolidations from third parties...Consolidations to third parties ...Net consolidations ...Acquisitions ...Net... -

Page 82

... third-party consolidation of Private Education Loans. Other Income - Lending Business Segment The following table summarizes the components of other income, net, for our Lending business segment for the years ended December 31, 2008, 2007 and 2006. Years Ended December 31, 2008 2007 2006 Late fees... -

Page 83

...loan portfolio management services, contingency collections services for student loans and other asset classes, and accounts receivable management and collection for purchased portfolios of receivables that are delinquent or have been charged off by their original creditors as well as sub-performing... -

Page 84

...$157 Collections Revenue The Company has concluded that its APG purchased paper businesses no longer produce a mutual strategic fit. The Company finalized the sale of its international Purchased Paper - Non-Mortgage business in the first quarter of 2009. At December 31, 2008, the net assets of this... -

Page 85

... decrease in contingency fee income for the year ended December 31, 2007 versus 2006 was primarily due to a 2006 legislative change that reduced fees paid for collections via loan consolidation and direct cash collections. In addition, the 2006 legislation changed the policy governing rehabilitated... -

Page 86

... purchased paper (the basis we carry on our balance sheet) as a percentage of collateral fair value has decreased in 2008 as a result of the significant impairment recognized during the year. Contingency Inventory The following table presents the outstanding inventory of receivables serviced through... -

Page 87

... in the fourth quarter of 2007 of previously deferred guarantee account maintenance fee revenue related to a negotiated settlement with USA Funds as discussed further below, as well as to a decrease in the account maintenance fees earned in 2008 due to the legislative changes effective October... -

Page 88

... segment. Years Ended December 31, 2008 2007 2006 Operating expenses ...$ 90 Upromise ...91 General and administrative expenses ...96 Total ...$277 $109 94 136 $339 $148 33 69 $250 Operating expenses for our Corporate and Other business segment include direct costs incurred to service loans for... -

Page 89

... quarter of 2008, the Company began retaining its Private Education Loan originations in our banking subsidiary, Sallie Mae Bank, and funding these assets with term bank deposits. In the near term, we expect to continue to use ED's Purchase and Participation Programs to fund future FFELP Stafford... -

Page 90

... to funding FFELP loans through ED's Participation and Purchase Programs, the Company employs other financing sources for general corporate purposes, which includes originating Private Education Loans and repayments of unsecured debt obligations. During the fourth quarter of 2008, Sallie Mae Bank... -

Page 91

...needs and following its acceptance and funding under ED's Participation and Purchase Programs. The maximum amount the Company may borrow under the 2008 ABCP Facilities is limited based on certain factors, including market conditions and the fair value of student loans in the facility. As of December... -

Page 92

...from a subsidiary of Lehman Brothers Holding, Inc. The principal financial covenants in the unsecured revolving credit facilities require the Company to maintain tangible net worth of at least $1.38 billion at all times. Consolidated tangible net worth as calculated for purposes of this covenant was... -

Page 93

... unrestricted cash. At December 31, 2008, includes $1.1 billion of cash and liquid investments at Sallie Mae Bank, which Sallie Mae Bank was not authorized to dividend to the Company without FDIC approval. This cash primarily will be used to originate Private Education Loans in the first quarter of... -

Page 94

...September 2008, the Company requested redemption of all monies invested in The Fund prior to The Fund's announcement that it suspended distributions as a result of The Fund's exposure to Lehman Brothers Holdings Inc.'s bankruptcy filing and The Fund's net asset value being below one dollar per share... -

Page 95

... Company to return cash collateral posted or may require the Company to access primary liquidity to post collateral to counterparties. Additionally, when securities are posted as collateral to the Company, the Company generally has the right to re-pledge or sell the security. As of December 31, 2008... -

Page 96

... the option of paying off this amount with cash or by putting the loans to ED as previously discussed. (2) (3) Average Balances 2008 Average Average Balance Rate Years Ended December 31, 2007 Average Average Balance Rate 2006 Average Average Balance Rate Unsecured borrowings ...Term bank deposits... -

Page 97

... Fitch Short-term unsecured debt ...Long-term senior unsecured debt...(1) P-2 Baa2(1) (1) A-3 BBB- F3 BBB Under review for potential downgrade. The table below presents our unsecured on-balance sheet funding by funding source for the years ended December 31, 2008 and 2007. Debt Issued For The... -

Page 98

... for on-balance sheet as variable interest entities ("VIEs"). Terms that prevent sale treatment include: (1) allowing the Company to hold certain rights that can affect the remarketing of certain bonds, (2) allowing the trust to enter into interest rate cap agreements after initial settlement of the... -

Page 99

... 2008 and 2007. FFELP Stafford and PLUS As of December 31, 2008 Consolidation Private Loan Education (1) Trusts Loan Trusts Total Fair value of Residual Interests ...Underlying securitized loan balance ...Weighted average life ...Prepayment speed (annual rate)(3) Interim status ...Repayment status... -

Page 100

... - Managed Borrowings - Ending Balances," earlier in this section.) December 31, 2008 December 31, 2007 Off-Balance Sheet Assets: Total student loans, net ...Restricted cash and investments ...Accrued interest receivable ...Total off-balance sheet assets ...Off-Balance Sheet Liabilities: Debt, par... -

Page 101

... the consolidated income statement. As of December 31, 2008, the Company had changed the following significant assumptions compared to those used as of December 31, 2007, to determine the fair value of the Residual Interests: • Prepayment speed assumptions were decreased for all three asset types... -

Page 102

... positions outstanding after the contract settlement on January 9, 2008. See Note 11, "Stockholders' Equity," to the consolidated financial statements. 1 Year or Less 2 to 3 Years 4 to 5 Years Over 5 Years Total Long-term notes: Unsecured borrowings ...Term bank deposits ...Secured borrowings... -

Page 103

... originated loans (FFELP and Private Education Loans) in the pipeline that the Company is committed to purchase. MANAGEMENT OF RISKS Significant risks that affect the Company may be grouped in the following categories: financial and funding, credit, operations, legislation and regulation, and market... -

Page 104

... accommodate fluctuations in asset and liability levels due to changes in our business operations or unanticipated events. Sources of liquidity include wholesale market-based funding and deposits at Sallie Mae Bank. Through the Company's Asset and Liability Management Policy, the Finance Committee... -

Page 105

... more favorable terms, we generally require credit-worthy cosigners. We have defined underwriting and collection policies, and ongoing risk monitoring and review processes for all Private Education Loans. Potential credit losses are considered in our risk-based pricing model. The performance of the... -

Page 106

... of ED Purchase and Participation Program. Funding includes the 2008 Asset-Backed Loan Facility. Funding includes auction rate securities and the 2008 ABCP Facilities. Assets include restricted and non-restricted cash equivalents and other overnight-type instruments. Assets include receivables and... -

Page 107

... manage our interest rate exposure. Funding includes $7.4 billion of ED Purchase and Participation Program. Funding includes $2.5 billion of auction rate securities. Funding includes the 2008 Asset-Backed Loan Facility. Funding includes auction rate securities and the 2008 ABCP Facility. Assets... -

Page 108

... 31, 2008 and 2007. December 31, 2008 On-Balance Sheet Managed December 31, 2007 On-Balance Sheet Managed (Averages in Years) Earning assets Student loans ...Other loans ...Cash and investments ...Total earning assets ...Borrowings Short-term borrowings...Long-term borrowings...Total borrowings... -

Page 109

...between the contract purchase price and the previous market closing price on the 44,039,890 shares. Consequently, the common shares outstanding and shareholders' equity on the Company's year-end balance sheet reflect the shares issued in the public offerings and the physical settlement of the equity... -

Page 110

... $235 million decrease to retained earnings. The closing price of the Company's common stock on December 31, 2008 was $8.90. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS See Note 2 to the consolidated financial statements, "Significant Accounting Policies - Recently Issued Accounting Pronouncements... -

Page 111

... the cash flows if long-term interest rates increased. See Note 8, "Student Loan Securitization," which details the potential decrease to the fair value of the Residual Interest that could occur under the referenced interest rate environment. Year Ended December 31, 2008 Interest Rates: Change from... -

Page 112

... is to minimize our sensitivity to changing interest rates by generally funding our floating rate student loan portfolio with floating rate debt. However, as discussed under "LENDING BUSINESS SEGMENT - Summary of our Managed Student Loan Portfolio - Floor Income - Managed Basis," we can have a fixed... -

Page 113

... tables above, called "Asset and Funding Index Mismatches," the main driver of the decrease in pre-tax income before unrealized gains (losses) on derivative and hedging activities is the result of LIBOR-based debt funding commercial paper-indexed assets. See "Market and Interest Rate Risk Management... -

Page 114

... processed, summarized and reported within the time periods specified in the SEC's rules and forms and (b) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer as appropriate to allow timely decisions regarding required disclosure. Changes... -

Page 115

... into this Annual Report by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters The information set forth in Note 13, "Stock-Based Compensation Plans and Arrangements," to the consolidated financial statements, and listed under the... -

Page 116

...the Company's Current Report on Form 8-K filed on August 6, 2008. Board of Directors Stock Option Plan (Incorporated by reference to the "Company" Definitive Proxy Statement on Schedule 14A, as filed with the Securities and Exchange Commission on April 10, 1998.†SLM Holding Corporation Management... -

Page 117

...Fitzpatrick, President and Chief Executive Officer, effective as of June 1, 2005, incorporated by reference to Exhibit 10.23 of the Company's Quarterly Report on Form 10-Q filed on November 8, 2005.†SLM Corporation Incentive Plan Performance Stock Term Sheet "Core" Net Income Target, incorporated... -

Page 118

... with this Form 10-K.†SLM Corporation Incentive Plan Performance Stock Term Sheet, "Core Earnings" Net Income Target -Sustained Performance, 2009, filed with this Form 10-K.†Code of Business Conduct (Filed with the Securities and Exchange Commission with the "Company" Annual Report on Form 10... -

Page 119

... Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. Dated: March 2, 2009 SLM CORPORATION By: /s/ ALBERT L. LORD Albert L. Lord Vice Chairman and Chief Executive Officer Pursuant to the requirement of the Securities Exchange Act of 1934... -

Page 120

Signature Title Date /s/ HOWARD H. NEWMAN Howard H. Newman /s/ A. ALEXANDER PORTER, JR. A. Alexander Porter, Jr. /s/ FRANK C. PULEO Frank C. Puleo Director March 2, 2009 Director March 2, 2009 Director March 2, 2009 /s/ WOLFGANG SCHOELLKOPF ... -

Page 121

...Page Management's Annual Report on Internal Control over Financial Reporting ...Report of Independent Registered Public Accounting Firm...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Changes in Stockholders' Equity ...Consolidated Statements of Cash... -

Page 122

... over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may... -

Page 123

...on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the... -

Page 124

SLM CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars and shares in thousands, except per share amounts) December 31, 2008 December 31, 2007 Assets FFELP Stafford and Other Student Loans (net of allowance for losses of $90,906 and $47,518, respectively) ...FFELP Stafford Loans Held-for-Sale ...FFELP... -

Page 125

SLM CORPORATION CONSOLIDATED STATEMENTS OF INCOME (Dollars and shares in thousands, except per share amounts) 2008 Years Ended December 31, 2007 2006 Interest income: FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans...Private Education Loans...Other loans ...Cash and investments... -

Page 126

...Tax benefit related to employee stock option and purchase plans Stock-based compensation cost ...Repurchase of common shares: Open market repurchases ...Equity forwards: Settlement cost, cash ...(Gain)/loss on settlement ...Benefit plans ...Balance at December 31, 2006 ...Comprehensive income: Net... -

Page 127

SLM CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (Dollars in thousands, except share and per share amounts) Preferred Stock Shares Common Stock Shares Issued Treasury Outstanding Preferred Stock Common Stock Retained Earnings Treasury Stock Additional Paid-In Capital ... -

Page 128

... assets, net ...(Decrease) in other liabilities ...Total adjustments ...Net cash (used in) provided by operating activities ...Investing activities Student loans acquired ...Loans purchased from securitized trusts (primarily loan consolidations) ...Reduction of student loans: Installment payments... -

Page 129

...federally guaranteed Private Education Loans. The Company primarily markets its FFELP Stafford and Private Education Loans through on-campus financial aid offices. The Company has expanded into a number of fee-based businesses, most notably its Asset Performance Group ("APG"), formerly known as Debt... -

Page 130

...), and derivative accounting. Loans Loans, consisting of federally insured student loans, Private Education Loans, student loan participations, lines of credit, academic facilities financings, and other private consumer and mortgage loans that the Company has the ability and intent to hold for the... -

Page 131

... Loan Income The Company recognizes student loan interest income as earned, adjusted for the amortization of premiums and capitalized direct origination costs, accretion of discounts, and after giving effect to borrower utilization of incentives for timely payment ("Repayment Borrower Benefits... -

Page 132

...permitted non-paying status), months since initially entering repayment, delinquency status, type of program, trends in program completion/graduation rates, and trends in defaults in the portfolio based on Company, industry and economic data. When calculating the Private Education Loan allowance for... -

Page 133

... the trust assets and when principal and interest is paid on trust liabilities. In connection with the Company's tuition payment plan product, the Company receives cash from students and parents that in turn is owed to schools. This cash, a majority of which has been deposited at Sallie Mae Bank, is... -

Page 134

...cash flow hedges. Amortization of debt issue costs, premiums, discounts and terminated hedge basis adjustments are recognized using the effective interest rate method. Transfer of Financial Assets The Company accounts for the transfer of financial assets under SFAS No. 140, "Accounting and Servicing... -

Page 135

... option held by the Company to buy certain delinquent loans from certain Private Education Loan securitization trusts. • The option to exercise the clean-up call and purchase the student loans from the trust when the asset balance is 10 percent or less of the original loan balance. • The option... -

Page 136

... a discounted cash flow calculation that considers the current borrower rate, Special Allowance Payment ("SAP") spreads and the term for which the loan is eligible to earn Floor Income as well as time value, forward interest rate curve and volatility factors. Variable Rate Floor Income received is... -

Page 137

...foreign exchange rates, and the closing price of the Company's stock (related to its equity forward contracts). Inputs are generally from active financial markets; however, adjustments are made to derivative valuations for inputs from illiquid markets, and for credit for both when the Company has an... -

Page 138

... lock-in the purchase price of the Company's stock related to share repurchases. As a result, the Company marks its equity forward contracts to market through earnings in the "gains (losses) on derivative and hedging activities, net" line item in the consolidated statements of income along with the... -

Page 139

...with United Student Aid Funds, Inc. ("USA Funds"), which accounted for 85 percent, 86 percent and 83 percent of guarantor servicing fees for the years ended December 31, 2008, 2007, and 2006, respectively. Contingency Fee Revenue The Company receives fees for collections of delinquent debt on behalf... -

Page 140

...-time employees in the Company's APG subsidiaries. The Employee Severance Plan and the DMO Employee Severance Plan (collectively, the "Severance Plan") establishes specified benefits based on base salary, job level immediately preceding termination and years of service upon termination of employment... -

Page 141

... for Stock Issued to Employees," and no compensation cost related to its stock option grants was recognized in its consolidated statements of income. The adoption of SFAS No. 123(R) reduced the Company's net earnings by $47 million, $36 million and $39 million for the years ended December 31, 2008... -

Page 142

... net change in the deferred tax asset or liability balance during the year plus any change in a valuation allowance, and (ii) current tax expense, which represents the amount of tax currently payable to or receivable from a tax authority plus amounts accrued for unrecognized tax benefits. Income tax... -

Page 143

... pricing the asset in a current sale transaction would be acceptable (such as a discounted cash flow analysis). Regardless of the valuation technique applied, entities must include appropriate risk adjustments that market participants would make, including adjustments for nonperformance risk (credit... -

Page 144

...) 2. Significant Accounting Policies (Continued) 2008. Changes in fair value of Residual Interests on and after January 1, 2008 are recorded through the statement of income. The Company has not elected the fair value option for any other financial instruments at this time. Business Combinations In... -

Page 145

...lead in general to the consolidation of certain QSPEs that are currently not consolidated by the Company. Assuming no changes to the Company's current business model, the Company would most likely consolidate its securitization trusts that are currently off-balance sheet on January 1, 2010, based on... -

Page 146

... disbursement date-based guarantee rates of 98 percent or 97 percent. In addition to FFELP loan programs, which place statutory limits on per year and total borrowing, the Company offers a variety of Private Education Loans. Private Education Loans for post-secondary education and loans for career... -

Page 147

... the loan is returned to a current repayment status. The Company may charge the borrower fees on certain Private Education Loans, either at origination, when the loan enters repayment, or both. Such fees are deferred and recognized into income as a component of interest over the estimated average... -

Page 148

...Company's student loan portfolio by program. December 31, 2008 Ending Balance % of Balance Year Ended December 31, 2008 Average Effective Average Interest Balance Rate FFELP Stafford and Other Student Loans, net(1) ...$ 52,476,337 FFELP Consolidation Loans, net ...71,743,435 Private Education Loans... -

Page 149

... Company is changing its methodology used to present charge-offs related to Private Education Loans to more clearly reflect the expected loss. Net income, provision for loan loss expense, the net loan balance, default rate and expected recovery rate assumptions are not impacted by this change. Based... -

Page 150

... before securitization of Private Education Loans ...Reduction for securitization of Private Education Loans ...Allowance at end of year ...Net charge-offs as a percentage of average loans in repayment ...Net charge-offs as a percentage of average loans in repayment and forbearance ...Allowance as... -

Page 151

... following table summarizes changes in the allowance for Private Education Loan losses for the years ended December 31, 2008, 2007 and 2006 as corrected and discussed above. 2008 Years Ended December 31, 2007 2006 Allowance at beginning of year ...Total provision ...Charge-offs ...Reclassification... -

Page 152

...school/grace/deferment (1) ...Loans in forbearance(2) ...Loans in repayment and percentage of each status: Loans current ...Loans delinquent 31-60 days(3) ...Loans delinquent 61-90 days ...Loans delinquent greater than 90 days . . Total Private Education Loans in repayment ...Total Private Education... -

Page 153

... changes in the allowance for student loan losses for federally insured student loan portfolios for the years ended December 31, 2008, 2007, and 2006. 2008 Years Ended December 31, 2007 2006 Allowance at beginning of year ...$ Provisions for student loan losses ...Charge-offs ...Increase/decrease... -

Page 154

...school or engaging in other permitted educational activities and are not yet required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation, as well as, loans for borrowers who have requested extension of grace period during employment... -

Page 155

... and other U.S. government agency obligations ...Other securities: Asset-backed securities ...Commercial paper and asset-backed commercial paper ...Municipal bonds ...Other ...Total investment securities available-for-sale ...Restricted Investments Available-for sale Guaranteed investment contracts... -

Page 156

... derivative hedging activities, net" line in the consolidated statements of income along with the gain (loss) related to the derivatives hedging such investments. In addition to the restricted investments detailed above, at December 31, 2008 and 2007, the Company had restricted cash of $3.5 billion... -

Page 157

..., that are general obligations of American Airlines and Federal Express Corporation. The direct financing leases are carried in other assets on the balance sheet. At December 31, 2008, other investments also included the Company's remaining investment in The Reserve Primary Fund totaling $97... -

Page 158

...of its future economic benefit determined based on discounted cash flows derived from the Company's five-year cash flow projections for each reporting unit. These projections incorporate assumptions of balance sheet and income statement growth as well as cost savings and planned dispositions or wind... -

Page 159

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 6. Goodwill and Acquired Intangible Assets (Continued) The guideline company or market approach as well as the publicly traded stock approach were also ... -

Page 160

...management company that purchases charged off debt and performs third-party receivables servicing across a number of consumer asset classes. As a result of this series of transactions, the Company's APG reportable segment and reporting unit recognized excess purchase price over the fair value of net... -

Page 161

... million, respectively, for the years ended December 31, 2008, 2007 and 2006. In 2008, as discussed in Note 20, "Segment Reporting," the Company decided to wind down its purchased paper businesses. As a result, in the third quarter of 2008, the Company recorded an aggregate amount of $36 million of... -

Page 162

...securitization program, borrowings through secured facilities and participation programs, unsecured notes issued by the Company, term deposits at Sallie Mae Bank, as well as other interest bearing liabilities related primarily to obligations to return cash collateral held. To match the interest rate... -

Page 163

...the facility utilized and the Company's credit rating. The principal financial covenants in the unsecured revolving credit facilities require the Company to maintain tangible net worth of at least $1.38 billion at all times. Consolidated tangible net worth as calculated for purposes of this covenant... -

Page 164

...share amounts, unless otherwise stated) 7. Borrowings (Continued) Long-term Borrowings The following tables summarize outstanding long-term borrowings (secured and unsecured) at December 31, 2008 and 2007, the weighted average interest rates at the end of the periods...fixed rate notes ...Term bank ... -

Page 165

...spot currency exchange rate. Weighted average interest rate is stated rate relative to currency denomination of note. At December 31, 2008, the Company had outstanding long-term borrowings with call features totaling $1.9 billion and $100 million of outstanding long-term borrowings that are putable... -

Page 166

...paydowns based on the Company's current estimates regarding loan prepayment speeds. The projected principal paydowns of $6.7 billion shown in year 2009 relate to the on-balance sheet securitization trust debt. Secured Borrowings FIN No. 46(R), "Consolidation of Variable Interest Entities," requires... -

Page 167

... in millions) Secured Borrowings: Short Term Debt Outstanding Long Term Total Carrying Amount of Assets Securing Debt Outstanding Loans Cash Other Assets Total ED Participation Program ...2008 Asset-Backed Financing Facilities ...On-balance sheet securitizations Indentured trusts ... ... $ 7,365 24... -

Page 168

...of the assets securing these facilities as of December 31, 2008 was $33.2 billion. Loans within the facility are periodically marked to market. The mark-to-market process could require the Company to post additional collateral within one business day of receiving a margin call. The 2008 Asset-Backed... -

Page 169

... Company has secured assets and outstanding bonds in indentured trusts resulting from the acquisition of various student loan providers in prior periods. The indentures were created and bonds issued to finance the acquisition of student loans guaranteed under the Higher Education Act. The bonds are... -

Page 170

... off-balance sheet securitized loans. The Residual Interest is the right to receive cash flows from the student loans and reserve accounts in excess of the amounts needed to pay servicing, derivative costs (if any), other fees, and the principal and interest on the bonds backed by the student loans... -

Page 171

... Education Loans FFELP Stafford and PLUS 2006 FFELP Consolidation Loans Private Education Loans Prepayment speed (annual rate)(2) ...Interim status ...Repayment status ...Life of loan repayment status . . Weighted average life ...Expected credit losses (% of principal securitized) ...Residual cash... -

Page 172

... to Residual Interests ...Servicing fees received(1) ...Purchases of previously transferred financial assets for representation and warranty violations ...Reimbursements of borrower benefits(2) ...Purchases of delinquent Private Education Loans from securitization trusts using delinquent loan call... -

Page 173

..., 2008 Private Consolidation Education Loan (1) Loan Trusts Trusts Total Fair value of Residual Interests ...Underlying securitized loan balance ...Weighted average life ...Prepayment speed (annual rate)(3) ...Interim status ...Repayment status ...Life of loan - repayment status ...Expected credit... -

Page 174

... CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 8. Student Loan Securitization (Continued) The Company adopted SFAS No. 159 on January 1, 2008, and has elected the fair value option on all of the Residual... -

Page 175

... 31, 2008 FFELP FFELP Stafford/PLUS Consolidation Private Education (5) Loan Trusts(5) Loan Trusts Loan Trusts(5) (Dollars in millions) Fair value of Residual Interest ...Weighted-average life ...Prepayment speed assumptions(2) Interim status ...Repayment status ...Life of loan - repayment status... -

Page 176

... established loan program servicing policies and procedures. The period of delinquency is based on the number of days scheduled payments are contractually past due. The following table summarizes net charge-off activity for Private Education Loans in the off-balance sheet trusts for the years ended... -

Page 177

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 8. Student Loan Securitization (Continued) The following table summarizes charge-off activity for Private Education Loans in the off-balance sheet trusts ... -

Page 178

...-rated counterparties. As of December 31, 2008, the net positive exposure on these swaps is $926 million. As previously discussed, the Company's corporate derivatives contain provisions which require collateral to be posted on a regular basis for changes in market values. The on-balance sheet trusts... -

Page 179

...)(1) ...Securities at fair value - on-balance sheet securitization derivatives (not recorded in financial statements)(2) ...Total collateral held ...Derivative asset at fair value including accrued interest and premium receivable ...Collateral pledged to others: Cash (right to receive return of cash... -

Page 180

... they are accounted for as trading where all changes in fair value of the derivatives are recorded through earnings. The Company sells interest rate floors (Floor Income Contracts) to hedge the Embedded Floor Income options in student loan assets. The Floor Income Contracts are written options which... -

Page 181

... of all equity forward contracts in January 2008). The Company utilized the strategy to lock in the purchase price of the Company's stock to better manage the cost of its share repurchases. In order to qualify as a hedge under SFAS No. 133, the hedged item must impact net income. In this case, the... -

Page 182

... Derivatives at fair value(1) ...Accrued interest receivable ...Federal income tax asset ...APG purchased paper related receivables and Real Estate Owned ...Accounts receivable - collateral posted...Benefit-related investments ...Fixed assets, net ...Accounts receivable - general ...Other ...Total... -

Page 183

... the Company's common stock based on a conversion rate calculated using the average of the closing prices per share of the Company's common stock during the 20 consecutive trading day period ending on the third trading day immediately preceding the mandatory conversion date. If the applicable market... -

Page 184

...(recorded at the present value of the repurchase price) under SFAS No. 150. Consequently, the common shares outstanding and shareholders' equity on the Company's year-end balance sheet reflect the shares issued in the public offerings and the physical settlement of the equity forward contract. As of... -

Page 185

... reflected in treasury stock. Shares withheld from stock option exercises and vesting of restricted stock for employees' tax withholding obligations and shares tendered by employees to satisfy option exercise costs. (2) The closing price of the Company's common stock on December 31, 2008 was $8.90... -

Page 186

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 11. Stockholders' Equity (Continued) Accumulated Other Comprehensive Income Accumulated other comprehensive income includes the after-tax change in ... -

Page 187

... weighted average number of shares of common stock outstanding during each period. A reconciliation of the numerators and denominators of the basic and diluted EPS calculations follows for the years ended December 31, 2008, 2007 and 2006. Years Ended December 31 2008 2007 2006 Numerator: Net income... -

Page 188

... average period of 1.6 years. Stock Options The maximum term for stock options is 10 years and the exercise price must be equal to or greater than the market price of the Company's common stock on the date of grant. Stock options granted prior to 2008 to officers and management employees generally... -

Page 189

... over a weighted average period of 1.7 years. The following table summarizes stock option activity for the year ended December 31, 2008. Weighted Average Exercise Price per Share Weighted Average Remaining Contractual Term Aggregate Intrinsic Value Number of Options Outstanding at December 31... -

Page 190

...date of grant based on the market price of the stock and is amortized to compensation cost on a straight-line basis over the related vesting periods. All outstanding RSUs granted to executive management employees vested in 2007 and were converted to common stock in January 2008. In 2008, the Company... -

Page 191

... 2007. Employee Stock Purchase Plan Under the ESPP, employees can purchase shares of the Company's common stock at the end of a 12-month offering period at a price equal to the share price at the beginning of the 12-month period, less 15 percent, up to a maximum purchase price of $7,500 plus accrued... -

Page 192

..., 2008, the option price of the award was higher than the market price; therefore, the Company was not obligated to issue any securities under the award. Number of shares available for issuance under the ESPP. Expired plan for which unexercised options remain outstanding is the Employee Stock Option... -

Page 193

... college savings by consumers who are members of this program by encouraging them to purchase goods and services from the companies that participate in the program ("Participating Companies"). Participating Companies generally pay Upromise transaction fees based on member purchase volume, either... -

Page 194

... various accounting standards for its financial statements. Under GAAP, fair value measurements are used in one of four ways: • In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of income; • In the consolidated balance sheet with changes in... -

Page 195

... speeds, default rates, cost of funds, required return on equity, and expected Repayment Borrower Benefits to be earned. In addition, the Floor Income component of the Company's FFELP loan portfolio is valued through discounted cash flow and option models using both observable market inputs and... -

Page 196

... bond pricing models and option models (when applicable) using the stated terms of the borrowings, and observable yield curves, foreign currency exchange rates and volatilities from active markets; or from quotes from broker-dealers. Credit adjustments for unsecured corporate debt are made based... -

Page 197

... rates, certain bonds' costs of funds and discount rates, are used in determining the fair value and require significant judgment. These unobservable inputs are internally determined based upon analysis of historical data and expected industry trends. On a quarterly basis the Company back tests... -

Page 198

... in this table. (3) The following table summarizes the change in balance sheet carrying value associated with Level 3 financial instruments carried at fair value on a recurring basis during the year ended December 31, 2008. Year Ended December 31, 2008 Residual Derivative Interests Instruments... -

Page 199

...-term borrowings ...Long-term borrowings ...Total interest-bearing liabilities ...Derivative financial instruments Floor Income/Cap contracts ...Interest rate swaps ...Cross currency interest rate swaps ...Futures contracts ...Other Residual interest in securitized assets ... ... Excess of net asset... -

Page 200

... officers violated federal securities laws by issuing a series of materially false and misleading statements and that the statements had the effect of artificially inflating the market price for the Company's securities. The complaint alleges that defendants caused the Company's results for year... -

Page 201

... statements regarding the Company's business made during the 401(K) Class Period and investments in the Company's common stock by participants in the 401(K) Plan. On December 15, 2008, Plaintiffs filed a Consolidated Class Action Complaint. The plaintiffs seek unspecified damages, attorneys' fees... -

Page 202

...age and service criteria, the participant will receive the greater of the benefits calculated under the prior plan, which uses a final average pay plan method, or the current plan under the cash balance formula. The Company adopted SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and... -

Page 203

...of year Service cost ...Interest cost ...Actuarial (gain)/loss ...Plan curtailment ...Plan settlement ...Special termination benefits ...Benefits paid ...Benefit obligation at end of year ...Change in Plan Assets Fair value of plan assets at beginning of year Actual return on plan assets ...Employer... -

Page 204

... nature of the plans; the corporate assets used to pay these benefits are included above in employer contributions. Components of Net Periodic Pension Cost Net periodic pension cost included the following components: Years Ended December 31, 2008 2007 2006 Service cost - benefits earned during the... -

Page 205

... funded status risk with investments that better match the plan liability characteristics. This strategy has proven particularly effective with the turbulent market conditions of 2008. As of December 31, 2008, the plan is invested 73 percent in high quality bonds with an average credit rating... -

Page 206

... percent by the Company after one year of service and certain eligible employees received a 2 percent core employer contribution. The Sallie Mae 401(k) Retirement Savings Plan covers substantially all employees of Asset Performance Group, and after August 1, 2007, the Retirement Savings Plan covers... -

Page 207

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 19. Income Taxes Reconciliations of the statutory U.S. federal income tax rates to the Company's effective tax rate follow: Years Ended December 31, 2008 ... -

Page 208

...Deferred tax assets: Loan reserves ...Market value adjustments on student loans, investments and derivatives ...Purchased paper impairments ...Deferred revenue ...Stock-based compensation plans ...Unrealized investment losses ...Accrued expenses not currently deductible ...Operating loss and credit... -

Page 209

..., would impact the effective tax rate. During 2008, the Company adjusted its federal unrecognized tax benefits to incorporate new information received from the IRS as a part of the 2005-2006 exam cycle for several carryover issues related to the timing of certain income and deduction items. Several... -

Page 210

...-level appeal related to one unagreed item originating from the Company's 2004 U.S. federal tax return. The IRS is also currently examining the Company's 2005 and 2006 federal income tax returns. It is reasonably possible that there will be a decrease in the Company's unrecognized tax benefits... -

Page 211

... collections services for student loans and other asset classes, and accounts receivable management and collection for purchased portfolios of receivables that are delinquent or have been charged off by their original creditors, and sub-performing and non-performing mortgage loans. The Company... -

Page 212

... sending out payment coupons to borrowers, processing borrower payments, originating and disbursing FFELP Consolidation Loans on behalf of the lender, and other administrative activities required by ED. Upromise markets and administers a consumer savings network and also provides program management... -

Page 213

... to GAAP Year Ended December 31, 2008 Lending (Dollars in millions) APG Corporate and Other Total "Core Earnings" Adjustments(2) Total GAAP Interest income: FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans...Private Education Loans ...Other loans ...Cash and investments... -

Page 214

... Lending (Dollars in millions) APG Corporate and Other Total "Core Earnings" Adjustments(2) Total GAAP Interest income: FFELP Stafford and Other Student Loans ...$ 2,848 FFELP Consolidation Loans ...5,522 Private Education Loans ...2,835 Other loans ...106 Cash and investments ...868 Total interest... -

Page 215

... Interest income: FFELP Stafford and Other Student Loans ...FFELP Consolidation Loans ...Private Education Loans ...Other loans ...Cash and investments ...Total interest income ...Total interest expense ...Net interest income (loss) ...Less: provisions for loan losses ...Net interest income (loss... -

Page 216

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, except per share amounts, unless otherwise stated) 20. Segment Reporting (Continued) Summary of "Core Earnings" Adjustments to GAAP The adjustments required to reconcile from the Company's "Core Earnings" ... -

Page 217

...(3.98) Net income (loss) attributable to common stock ...$ 107,060 Basic earnings (loss) per common share ...$ Diluted earnings (loss) per common share ...$ .26 .26 The following table summarizes the Private Education Loan allowance for loan loss balance at the end of each quarter in 2008 and 2007... -

Page 218

... and corrected for the change in methodology, discussed further in Note 4, "Allowance for Loan Losses." 2008 First Quarter Second Quarter Third Quarter Fourth Quarter Prior Presentation Allowance for Private Education Loan Losses ...Net charge-offs for Private Education Loan Losses . . Corrected... -

Page 219

... Stafford Loans; • Federal PLUS Loans to graduate or professional students (effective July 1, 2006) or parents of dependent students whose estimated costs of attending school exceed other available financial aid; and • FFELP Consolidation Loans, which consolidate into a single loan a borrower... -

Page 220

... upon the three-month commercial paper (financial) rate plus 2.34 percent (1.74 percent during in-school, grace and deferment periods) for Stafford Loans and 2.64 percent for PLUS and FFELP Consolidation Loans. The 1999 act did not change the rate that the borrower pays on FFELP loans. The 2000 act... -

Page 221

... fees that are paid to guaranty agencies in the FFELP. Major changes made by the CCRAA, which were effective October 1, 2007 (unless stated otherwise), include: • Reduces special allowance payments to for-profit lenders and not-for-profit lenders for both Stafford and Consolidation Loans disbursed... -

Page 222

... certain public service jobs who make 120 monthly payments. • Expands the deferment authority for borrowers due to an economic hardship and military service. • Establishes a new income-based repayment program starting July 1, 2009 for all loans except for parent PLUS loans or Consolidation loans... -

Page 223

...based repayment to plans the lender must offer (except for parent PLUS loans or Consolidation loans that discharged such loans) and adds income-based repayment for FFELP borrowers to repay defaulted loans to ED. • Permits borrower eligibility for in-school deferment to be based on National Student... -

Page 224

... a loan transfer changes the party with which the borrower needs to communicate or send payments. • Introduces a forgiveness program to repay FFELP loans and to cancel FDLP (except no parent PLUS loans) at $2000 per year up to an aggregate of $10,000, for non-defaulted borrowers employed full time... -

Page 225

... For student loans disbursed on or after January 1, 2000, the special allowance percentage is computed by: (1) determining the average of the bond equivalent rates of 3-month commercial paper (financial) rates quoted for that quarter; (2) subtracting the applicable borrower interest rate; (3) adding... -

Page 226

... Loans and SLS Loans only if the variable rate, which is reset annually, exceeds the applicable maximum borrower rate. Effective July 1, 2006, this limitation on special allowance for PLUS loans made on and after January 1, 2000 is repealed. The variable rate is based on the weekly average one-year... -

Page 227

... paid by ED to the holders of eligible Stafford Loans. We refer to all three types of assistance as "federal assistance." Interest. The borrower's interest rate on a Stafford Loan can be fixed or variable. Variable rates are reset annually each July 1 based on the bond equivalent rate of 91-day... -

Page 228

... loans in at least two equal disbursements. The HEA limits the amount a student can borrow in any academic year. The following chart shows loan limits applicable to loans first disbursed on or after July 1, 2008. Dependent Student Subsidized and Unsubsidized Additional Unsubsidized Maximum Annual... -

Page 229

... repayment plan on July 1, 2009 that a student borrower may elect during a period of partial financial hardship and have annual payments that do not exceed 15% of the amount by which adjusted gross income exceeds 150% of the poverty line. The Secretary repays or cancels any outstanding principal... -

Page 230

... the borrower returns to school at least half-time. Additional deferrals are available, when the borrower is: • enrolled in an approved graduate fellowship program or rehabilitation program; or • seeking, but unable to find, full-time employment (subject to a maximum deferment of 3 years); or... -

Page 231

... for the in-school period and the 6-month post enrollment period. Deferment and forbearance provisions, maximum loan repayment periods, repayment plans and minimum payment amounts for PLUS and SLS Loans are generally the same as those for Stafford Loans. Consolidation Loan Program The HEA also... -

Page 232

... July 1, 2009) repayment plans, and loans are repaid over periods determined by the sum of the Consolidation Loan and the amount of the borrower's other eligible student loans outstanding. The maximum maturity schedule is 30 years for indebtedness of $60,000 or more. Guarantee Agencies under the... -

Page 233