SunTrust 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

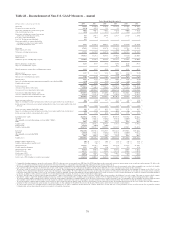

Provision for loan losses increased $4.8 million over 2006 primarily due to higher home equity and consumer mortgage net

charge-offs.

Total noninterest income decreased $287.6 million, or 26.1%, primarily due to a $250.5 million mark to market loss on SIV

securities in the fourth quarter of 2007 and a $112.8 million gain realized in 2006 on the sale of the Bond Trustee business.

Partially offsetting these items was a $32.3 million gain on sale upon merger of Lighthouse Partners, as well as strong growth

in retail investment income, which increased $44.0 million, or 19.3%, due to strong annuity sales and higher recurring

managed account fees. Trust income declined $5.1 million, or 0.7%, due to lost revenue from the Lighthouse Partners merger

and sale of the Bond Trustee business.

As of December 31, 2007, assets under management were approximately $142.8 billion compared to $141.3 billion as of

December 31, 2006. Approximately $5.3 billion in Lighthouse Partners assets were merged into Lighthouse Investment

Partners are not included in the December 31, 2007 total. Assets under management include individually managed assets, the

RidgeWorth (formally known as STI Classic) Funds, institutional assets managed by RidgeWorth (formally known as

Trusco) and participant-directed retirement accounts. SunTrust’s total assets under advisement were approximately $250.0

billion, which includes $142.8 billion in assets under management, $60.9 billion in non-managed corporate trust assets, $41.6

billion in retail brokerage assets, and $4.7 billion in non-managed corporate trust assets.

Total noninterest expense increased $6.2 million, or 0.6%, due to a $20.3 million, or 3.7%, increase in total personnel

expense. Higher variable compensation primarily associated with strong retail investment income was partially offset by a

$16.7 million, or 5.8%, decline in salary expense. Favorably impacting noninterest expense was lower Lighthouse Partners

related expenses as a result of the sale upon merger.

Corporate Other and Treasury

Corporate Other and Treasury’s net income for the twelve months ended December 31, 2007 was $256.7 million, an increase

of $219.9 million compared to the same period in 2006. The increase was mainly driven by a $234.8 million pre-tax gain on

sale of the Coke common stock, a gain of $118.8 million on the sale leaseback of real estate properties, net securities losses

of $54.4 million resulting primarily from the securities portfolio repositioning in 2006, and a net market valuation gain of

$64.3 million on trading assets and long-term corporate debt carried at fair value during 2007. These factors were partially

offset by a $116.2 million market valuation write-down on securities consolidated in the third quarter of 2007 in anticipation

of closing the Private Fund.

Net interest income decreased $23.4 million mainly due to a reduction in the size of the investment portfolio as a result of the

balance sheet management strategies. Total average assets decreased $6.8 billion, or 22.3%, mainly due to the reduction in

the size of the securities portfolio. Total average deposits decreased $4.9 billion, or 17.9% mainly due to decrease in

brokered and foreign deposits.

Provision for loan losses decreased $0.2 million.

Total noninterest income increased $490.2 million. This was mainly driven by the $234.8 million pre-tax gain on sale of

Coke common stock, net securities losses of $54.4 million in 2006, a gain of $118.8 million on sale leaseback of real estate

properties, and $78.1 million increase in trading income due to net market valuation gains recorded on trading assets and our

long-term corporate debt carried at fair value. Noninterest income was also impacted by a $132.5 million market valuation

write-down on securities consolidated in the third quarter of 2007 in anticipation of closing of Private Fund.

Total noninterest expense increased $58.6 million compared to the same period in 2006. Included in the twelve months ended

December 31, 2007, was a $76.9 million accrual for VISA litigation and $50.7 million in initial implementation cost

associated with the E² Program, of which $45.0 million was severance. Positively impacting noninterest expense was a $33.6

million decrease in the accrued liability associated with a capital instrument that we called in the fourth quarter of 2007.

Additionally, reflected in total noninterest expenses are reductions in total staff expense in support functions and consulting

expenses.

78