SunTrust 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

See Note 21, “Contingencies,” to the Consolidated Financial Statements for information concerning auction rate securities

(“ARS”) added to trading assets in 2008.

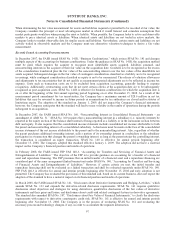

The Company utilized trading securities for balance sheet management purposes and manages the potential market volatility

of these securities with appropriate duration and/or hedging strategies. The size, volume and nature of the trading securities

can vary based on economic and Company specific asset liability conditions. During 2007, the Company replaced $4.6

billion of trading securities that were pledged as collateral with letters of credit issued by the Federal Home Loan Bank

(“FHLB”). The Company elected to record these letters of credit at fair value pursuant to the provisions of SFAS No. 159. As

of December 31, 2008, $1.8 billion of these letters of credit remained outstanding.

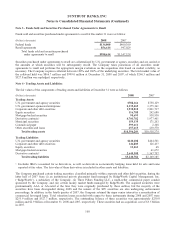

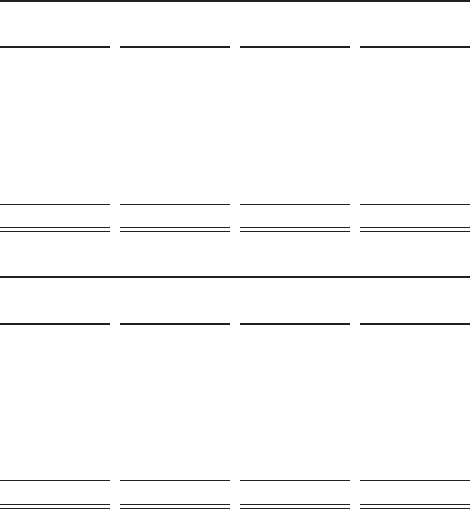

Note 5 - Securities Available for Sale

Securities available for sale at December 31 were as follows:

2008

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $125,585 $1,539 $1 $127,123

U.S. government-sponsored enterprises 338,981 20,350 301 359,030

States and political subdivisions 1,018,906 24,621 6,098 1,037,429

Asset-backed securities 54,139 3,062 7,633 49,568

Mortgage-backed securities 15,022,074 142,215 117,989 15,046,300

Corporate bonds 275,492 3,274 12,994 265,772

Common stock of The Coca-Cola Company 69 1,358,031 - 1,358,100

Other securities11,447,961 5,254 - 1,453,215

Total securities available for sale $18,283,207 $1,558,346 $145,016 $19,696,537

2007

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $139,159 $1,557 $- $140,716

U.S. government-sponsored enterprises 244,000 5,597 1 249,596

States and political subdivisions 1,052,621 16,142 1,453 1,067,310

Asset-backed securities 241,700 33 31,383 210,350

Mortgage-backed securities 10,085,802 71,727 16,327 10,141,202

Corporate bonds 232,230 708 1,649 231,289

Common stock of The Coca-Cola Company 100 2,674,305 - 2,674,405

Other securities11,543,852 5,387 - 1,549,239

Total securities available for sale $13,539,464 $2,775,456 $50,813 $16,264,107

1Includes $493.2 million and $452.2 million of Federal Home Loan Bank of Cincinnati and Federal Home Loan Bank of Atlanta stock stated at

par value and $360.9 and $340.2 million of Federal Reserve Bank stock stated at par value as of December 31, 2008 and December 31, 2007,

respectively.

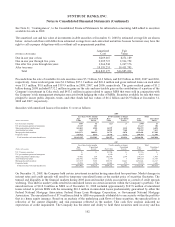

In June 2008, the Company sold 10 million shares of its holdings in The Coca-Cola Company (“Coke”). The sale of these

shares generated $548.8 million in net cash proceeds and before-tax gains, and an after-tax gain of approximately $345

million that was recorded in the Company’s financial results. In addition, these sales resulted in an increase of approximately

$345 million, or approximately 20 basis points, to Tier 1 Capital as of the transaction date.

In July 2008, the Company contributed 3.6 million shares of its holdings in Coke to a charitable foundation. The contribution

resulted in a $183.4 million non-taxable gain that was recorded in the Company’s financial results. In addition, the

contribution increased Tier 1 Capital by approximately 4 basis points as of the transaction date, and will reduce ongoing

charitable contribution expense.

101