SunTrust 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

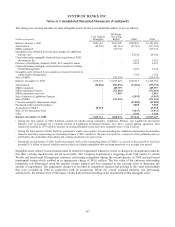

SUNTRUST BANKS, INC.

Notes to consolidated financial statements (Continued)

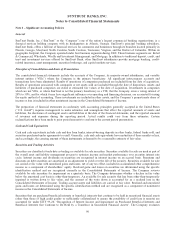

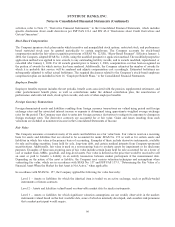

Note 2 - Acquisitions/Dispositions

During the three year period ended December 31, 2008, SunTrust consummated the following acquisitions and dispositions:

(in millions) Date

Cash or other

consideration

(paid)/received Goodwill

Other

Intangibles

Gain/

(Loss) Comments

2008

Acquisition of assets of Cymric Family Office Services 212/31/08 ($2.9) $1.4 $1.4 $- Goodwill and intangibles recorded are tax-deductible.

Sale of majority interest in Zevenbergen Capital Investments, LLC (“ZCI”) 10/1/08 7.9 (15.4) 0.9 (2.7) Goodwill and intangibles recorded are tax-deductible.

Purchase of remaining interest in ZCI 9/30/08 (22.6) 20.7 - - Goodwill recorded is tax-deductible.

Sale of TransPlatinum Service Corp. 9/2/08 100.0 (10.5) - 81.8

Sale of First Mercantile Trust Company 5/30/08 59.1 (11.7) (3.0) 29.6

Acquisition of GB&T Bancshares, Inc 15/1/08 (154.6) 143.0 29.5 - Goodwill and intangibles recorded are non tax-deductible.

Sale of 24.9% interest in Lighthouse Investment Partners, LLC (“Lighthouse

Investment Partners”) 1/2/08 155.0 - (6.0) 89.4 SunTrust will continue to earn a revenue share based upon client referrals to the funds.

2007

Acquisition of Inlign Wealth Management, LLC212/31/07 (13.0) 7.3 4.1 - Goodwill and intangibles recorded are non tax-deductible.

Acquisition of TBK Investments, Inc.28/31/07 (19.2) 10.6 6.5 - Goodwill and intangibles recorded are non tax-deductible.

Lighthouse Partners, LLC, a wholly owned subsidiary, was merged with and

by GenSpring Holdings, Inc., a wholly owned subsidiary of SunTrust into

Lighthouse Investment Partners 3/30/07 - (48.5) 24.1 32.3 SunTrust received a 24.9% interest in Lighthouse Investment Partners.

GenSpring Holdings, Inc. (formerly “AMA Holdings, Inc.”) called minority

member owned interests in GenSpring Family Offices, LLC (formerly

“Asset Management Advisors, LLC”) 3Various (12.4) 10.2 2.2 -

Contingent consideration paid to the former owners of Prime Performance ,

Inc. (“Prime Performance”), a company formerly acquired by National

Commerce Financial Corporation (“NCF”) 3/12/07 (7.0) 7.0 - - Obligations to the former owners of Prime Performance were fully discharged.

Contingent consideration paid to the former owners of Seix Investment

Advisors, Inc. (“Seix”) 2/23/07 (42.3) 42.3 - - Goodwill recorded is tax-deductible.

Contingent consideration paid to the former owners of Sun America

Mortgage (“SunAmerica”) 2/13/07 (1.4) 1.4 - - Goodwill recorded is tax-deductible.

2006

Sale of Bond Trustee Business to U.S. Bank, N.A. (“U.S. Bank”) 9/29/06 113.8 - - 112.8 Transferred $21 billion in non-managed corporate trust assets to U.S. Bank.

AMA Holdings Inc., called minority member owned interests in AMA, LLC Various (14.6) 9.5 5.1 - Goodwill and intangibles recorded are both tax-deductible.

Contingent consideration paid to the former owners of Prime Performance 4/4/06 (1.3) 1.3 - - Goodwill recorded is tax-deductible.

Sale of minority interest in First Market Bank, FSB 3/31/06 82.6 - - 3.6

Contingent consideration paid to the former owners of BancMortgage

Financial Corporation (a company formerly acquired by NCF) 3/30/06 (22.5) 22.5 - -

Consideration included $15 million in SunTrust common stock (202,866 shares) and $7.5

million in cash. Goodwill recorded is non tax-deductible.

Acquisition of 11 Florida Wal-Mart banking branches from Community

Bank of Florida 3/17/06 51.3 - 1.1 -

Acquired $5.1 million in assets and $56.4 million in deposits and related liabilities. Other

intangibles recorded are tax-deductible.

Contingent consideration paid to the former owners of SunAmerica 3/10/06 (3.9) 3.9 - - Goodwill recorded is tax-deductible.

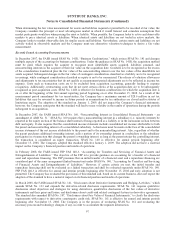

1On May 1, 2008, SunTrust acquired GB&T Bancshares, Inc. (“GB&T”), a North Georgia-based financial institution serving commercial and retail customers, for $154.6 million, including cash paid for fractional shares, via the merger of GB&T with and

into SunTrust. In connection therewith, GB&T shareholders received 0.1562 shares of the Company’s common stock for each share of GB&T’s common stock, resulting in the issuance of approximately 2.2 million shares of SunTrust common stock. As a

result of the acquisition, SunTrust acquired approximately $1.4 billion of loans, primarily commercial real estate loans, and assumed approximately $1.4 billion of deposit liabilities. SunTrust elected to account for $171.6 million of the acquired loans at

fair value in accordance with SFAS No. 159. The remaining loans are accounted for at amortized cost and had a carryover reserve for loan and lease losses of $158.7 million. The acquisition was accounted for under the purchase method of accounting

with the results of operations for GB&T included in SunTrust’s results beginning May 1, 2008.

2Acquisition by GenSpring Family Offices, LLC a majority owned subsidiary of SunTrust.

3As of December 31, 2008, GenSpring Holdings, Inc. owned 65% of the member interests of GenSpring Family Offices, LLC, while 35% were owned by employees. The employee interests are subject to certain vesting requirements. If an employee’s

interests vest, they may be called by GenSpring Holdings, Inc. (and some of the interests may be put to GenSpring Holdings, Inc. by the employees) at certain dates in the future in accordance with the applicable plan or agreement pursuant to which their

interests were granted.

99