SunTrust 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

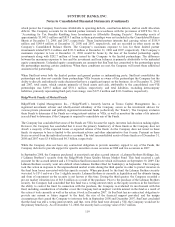

Student Loans

In 2006, the Company completed one securitization of student loans through a transfer of loans to a QSPE and retained

the corresponding residual interest in the QSPE trust. Because the entity is a QSPE, the Company does not consolidate

it. The Company is the master servicer for the securitized student loans and subservices its servicing responsibilities to a

third party. The Company’s servicing responsibilities did not result in a servicing asset or servicing liability for the

Company, as the servicing fees were deemed to be adequate compensation for the servicing costs and, therefore, are

recognized as earned. No arrangements exist that could require the Company to provide any financial support to the

QSPE, other than servicing advances that may be made in the normal course of its servicing activities.

CDO Securities

The Company has historically transferred bank trust preferred and subordinated debt securities in securitization

transactions. The majority of these transfers occurred between 2002 and 2005 with one transaction completed in 2007.

These securitization entities are considered VIEs under FIN 46(R). The Company retains an indirect equity interest in

certain of the entities, which has generally been limited to 26% of the equity or less, as well as a nominal cost method

investment in the collateral manager of certain of the entities. The Company does not directly serve as manager of the

entities and does not hold a majority of the expected losses in any of the entities. As such, the Company does not

consolidate the entities. The Company believes the majority of the expected loss of each entity is held by the equity

holders at the time the transaction closes, as credit losses are the most significant contributor to the variability of the

entity. As reconsideration events occur, a variable interest holder will have to reassess whether the losses in each entity

have increased to such an extent that subordinate note holders and other debt holders now hold a majority of the

expected losses. During 2008, the Company recognized impairment losses, net of distributions received, of $15.9

million related to the ownership of its equity interests in these VIEs. As of December 31, 2008, these equity interests

have all been written down to a fair value of zero due to increased losses in the underlying collateral. During 2007 and

2008, the Company acquired additional interests in certain of these entities in conjunction with its acquisition of assets

from Three Pillars Funding, LLC and the pending ARS issue discussed in Note 21, “Contingencies,” to the Consolidated

Financial Statements. The classes that have been, or are expected to be, purchased are the senior, non-deferrable notes

that have priority in the waterfall of payments commensurate with their initial public ratings and, therefore, are

protected from credit losses by the subordinate note holders. The Company reconsidered its involvement with the VIEs

in conjunction with each of these purchases and continues to show that the interests acquired do not result in the

Company being exposed to a majority of the expected losses in any of the VIEs. The total assets of the trust preferred

CDO entities in which the Company has continuing involvement is approximately $2.0 billion at December 31, 2008.

The Company is not obligated to provide any support to these entities and its maximum exposure to loss at

December 31, 2008 is limited to (1) the current positions held in trading securities with a fair value of $45.0 million and

(2) the remaining securities expected to be purchased in conjunction with the ARS issue, which have a total fair value of

$9.7 million.

In 2006, the Company received $472.6 million in proceeds from the transfer of debt securities into a securitization of

CDO securities of ABS and residential MBS. The securitization entity was considered a VIE under FIN 46(R). The

Company retained 20% of the preference shares as well as other subordinated interests in the transaction and collateral

manager responsibilities over the collateral, all of which are variable interests for the Company. However, a third party

held the majority of the expected losses and, therefore, the Company did not consolidate the entity. All of the interests

the Company retained from the securitization were classified as trading securities and were written down to a fair value

of zero in 2007, resulting in a loss of $9.3 million during the year ended 2007. The securitization entity had total assets

of $606.5 million at December 31, 2007 and was liquidated in 2008. The Company did not incur any additional losses

related to the liquidation, nor did it receive any liquidating distributions.

111