SunTrust 2008 Annual Report Download - page 74

Download and view the complete annual report

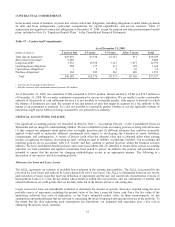

Please find page 74 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.General allowances are established for loans and leases grouped into pools that have similar characteristics, including smaller

balance homogeneous loans. The ALLL Committee estimates probable losses by evaluating quantitative and qualitative

factors, including net charge-off trends, internal risk ratings, changes in internal risk ratings, loss forecasts, collateral values,

geographic location, borrower FICO scores, delinquency rates, nonperforming and restructured loans, origination channel,

product mix, underwriting practices, industry conditions, and economic trends.

Unallocated allowances relate to inherent losses that are not included elsewhere in the ALLL. The qualitative factors

associated with unallocated allowances are subjective and require a high degree of management judgment. These factors

include the inherent imprecision in mathematical models and credit quality statistics, recent economic uncertainty, losses

incurred from recent events not reflected in general or specific allowances, and lagging or incomplete data. During 2008,

additional analysis was performed to identify the loan pools most susceptible to the imprecision risk being captured by the

unallocated allowance. As of December 31, 2008, all of the unallocated allowance was assigned to specific loan pools.

Our financial results are affected by the changes in and the absolute level of the ALLL. This process involves our analysis of

complex internal and external variables, and it requires that we exercise judgment to estimate an appropriate ALLL. As a

result of the uncertainty associated with this subjectivity, we cannot assure the precision of the amount reserved, should we

experience sizeable loan or lease losses in any particular period. For example, changes in the financial condition of individual

borrowers, economic conditions, or the condition of various markets in which collateral may be sold could require us to

significantly decrease or increase the level of the ALLL. Such an adjustment could materially affect net income as a result of

the change in provision for loan losses. During 2007 and 2008, we experienced increases in delinquencies and net charge-offs

in residential real estate loans due to the deterioration of the housing market. During 2008, we began to identify and realize

loan-related losses that were due to borrower misrepresentations and insurance claim denials. We classify these loans as

operating losses instead of net charge-offs applied against the ALLL, since the circumstances leading to the loss were the

result of reasons other than a decline in the borrower’s credit conditions. Reserves for this type of loss were estimated using

recent historical loss experience data. The ALLL and operating loss reserve considered the current market conditions in

deriving the estimated reserves; however, given the continued economic uncertainty, the ultimate amount of loss, as well as

classification of loss, could vary from that estimate. For additional discussion of the ALLL see the “Provision for Loan

Losses” and “Allowance for Loan and Lease Losses” section in this MD&A, and for additional discussion of operating losses

see the “Noninterest Expense” section in this MD&A.

Estimates of Fair Value

We measure or monitor many of our assets and liabilities on a fair value basis. Fair value is used on a recurring basis for

certain assets and liabilities in which fair value is the primary basis of accounting. The extent to which we use fair value on a

recurring basis was significantly expanded upon the adoption of SFAS No. 159 during the first quarter of 2007. Examples of

recurring uses of fair value include derivative instruments, available for sale and trading securities, certain investment

portfolio and held for sale loans, certain issuances of long-term debt, and certain residual interests from Company-sponsored

securitizations. Additionally, fair value is used on a non-recurring basis to evaluate assets or liabilities for impairment or for

disclosure purposes in accordance with SFAS No. 107. Examples of these non-recurring uses of fair value include loans held

for sale accounted for at the lower of cost or market, MSRs, OREO, goodwill, intangible assets, nonmarketable equity

securities, and long-lived assets. Depending on the nature of the asset or liability, we use various valuation techniques and

assumptions when estimating fair value. These valuation techniques and assumptions are in accordance with SFAS No. 157

and when applicable, FASB Staff Position (“FSP”) FAS 157-3.

Fair value is the price that could be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants. Estimating fair value in accordance with SFAS No. 157 requires that we make a number of significant

judgments. Where observable market prices for identical assets or liabilities are not available, SFAS No. 157 requires that we

identify, what we believe to be, similar assets or liabilities. If observable market prices are unavailable or impracticable to

obtain for any such similar assets or liabilities, then fair value is estimated using modeling techniques, such as discounted

cash flow analyses. These modeling techniques incorporate our assessments regarding assumptions that market participants

would use in pricing the asset or the liability, including market-based assumptions, such as interest rates, as well as

assumptions about the risks inherent in a particular valuation technique, the effect of a restriction on the sale or use of an

asset, and the risk of nonperformance. In certain cases, our assessments with respect to assumptions that market participants

would make may be inherently difficult to determine and the use of different assumptions could result in material changes to

these fair value measurements. The use of significant, unobservable inputs in our models is described in Note 20, “Fair Value

Election and Measurement,” to the Consolidated Financial Statements.

In instances where required by U.S. GAAP, we use discount rates in our determination of the fair value of certain assets and

liabilities such as retirement and other postretirement benefit obligations, loans carried at fair value, MSRs, and residual

interests from Company-sponsored securitizations. Discount rates used are those considered to be commensurate with the

risks involved. A change in these discount rates could increase or decrease the values of those assets and liabilities. The fair

62