SunTrust 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

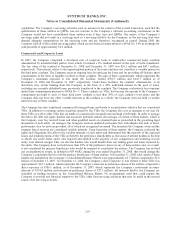

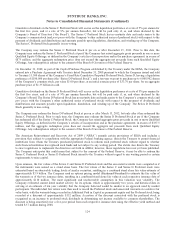

which was outstanding at December 31, 2008. Separate from the temporary disruption in the CP markets in September,

the Company held outstanding Three Pillars’ CP with a par amount of $400 million, all of which matured on January 9,

2009. At December 31, 2008, this CP is recorded on the Company’s Consolidated Balance Sheet as a trading asset,

carried at fair value. The Company held no amounts as of December 31, 2007.

During the third quarter of 2007, the Company, in its sole discretion, elected to purchase a limited amount of Three

Pillars’ CP due to the attractive market yield, limited credit risk, and liquidity of these securities and was under no

obligation, contractual or otherwise, to do so. The aggregate face amount of Three Pillars’ issued commercial paper

purchased in the third quarter totaled $775.1 million and was purchased at market rates ranging from 5.27% to 6.29%,

with maturities ranging from 7 days to 27 days. This amount represented less than 1% of Three Pillars’ total issuance for

the year ended December 31, 2007. None of the Company’s purchases of CP during 2008 and 2007 altered the

Company’s conclusion that it is not the primary beneficiary of Three Pillars.

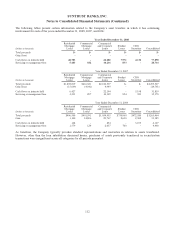

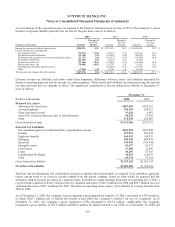

The Company has off-balance sheet commitments in the form of liquidity facilities and other credit enhancements that it

has provided to Three Pillars. These commitments are accounted for as financial guarantees by the Company in

accordance with the provisions of FIN 45. The liquidity commitments are revolving facilities that are sized based on the

current commitments provided by Three Pillars to its customers. The liquidity facilities are generally used if new

commercial paper cannot be issued by Three Pillars to repay maturing commercial paper. However, the liquidity

facilities are available in all circumstances, except certain bankruptcy-related events with respect to Three Pillars.

Draws on the facilities are subject to the purchase price (or borrowing base) formula that, in many cases, excludes

defaulted assets to the extent that they exceed available over-collateralization in the form of non-defaulted assets, and

may also provide the liquidity banks with loss protection equal to a portion of the loss protection provided for in the

related securitization agreement. Additionally, there are transaction specific covenants and triggers that are tied either to

the performance of the assets of the relevant seller/servicer that may result in a transaction termination event, which , if

continuing, would require funding through the related liquidity facility. Finally, in a termination event of Three Pillars,

such as if its tangible net worth falls below $5,000 for a period in excess of 15 days, Three Pillars would be unable to

issue CP which would likely result in funding through the liquidity facilities.

Draws under the credit enhancement are also available in all circumstances, but are generally used to the extent required

to make payment on any maturing commercial paper if there are insufficient funds from collections of receivables or the

use of liquidity facilities. The required amount of credit enhancement at Three Pillars will vary from time to time as new

receivable pools are purchased or removed from its asset portfolio, but is generally equal to 10% of the aggregate

commitments of Three Pillars.

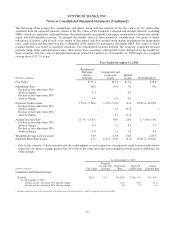

The Company manages the credit risk associated with these commitments by subjecting them and the underlying

collateral assets of Three Pillars to the Company’s normal credit approval and monitoring processes. Any losses on the

commitments provided to Three Pillars by the Company resulting from a loss due to nonpayment on the underlying

assets would be reimbursed to the Company from the subordinated note reserve account, which is the amount

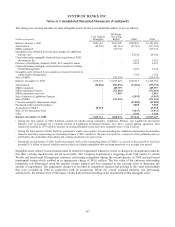

outstanding on the subordinated note agreement. The total notional amounts of the liquidity facilities and other credit

enhancements represent the Company’s maximum exposure to potential loss, which was $6.1 billion and $597.5

million, respectively, as of December 31, 2008, compared to $7.9 billion and $763.4 million, respectively, as of

December 31, 2007. The Company did not have any liability recognized on its Consolidated Balance Sheets related to

these liquidity facilities and other credit enhancements as of December 31, 2008 or 2007, as no amounts had been

drawn, nor were any draws probable to occur, such that a loss should have been accrued. In addition, no losses were

recognized by the Company in connection with these off-balance sheet commitments during the years ended

December 31, 2008 and 2007, respectively. There are no other contractual arrangements that the Company plans to enter

into with Three Pillars to provide it additional support.

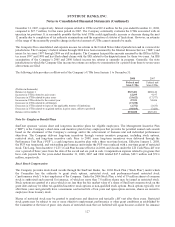

Prior to January 1, 2008, the Company had provided a separate liquidity facility to Three Pillars that supported Three

Pillars’ qualified ABS. During the year ended December 31, 2007, Three Pillars decided to exit those types of

investments due to continued deterioration in the performance of the underlying collateral and market illiquidity, which

resulted in a material decrease in the market value of those securities. In order to exit this business, Three Pillars drew

on this separate liquidity facility with the Company, under which the Company purchased the qualified ABS at

amortized cost plus the related unpaid CP interest used to fund that investment, which totaled $725.0 million.

Subsequent to this funding, Three Pillars and the Company canceled this separate liquidity agreement, as Three Pillars

had exited this business. Of the investments included in the purchase, only one security in the amount of $62 million

had experienced a decline in credit to such an extent that management believed a future principal loss on the ABS was

117