SunTrust 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

certain asset-backed commercial paper (“ABCP”) from certain money market mutual funds (the “MMMF”). These purchases

will be made by the participating institution at a price equal to the MMMF’s amortized cost. The Fed will then make a fixed

rate non-recourse loan to the participating institution that will mature on the same date as the ABCP that was purchased with

a specific draw. As of December 31, 2008, SunTrust Robinson Humphrey (“STRH”) owned $400 million of eligible ABCP

at a fair value of $399.6 million. At December 31, 2008, this ABCP had a weighted average maturity of 9 days and a risk

weighting of 0% for regulatory capital purposes. Per the terms of the Program, STRH also had outstanding loans from the

Fed in the amount of $399.6 million at fixed interest rates ($199.8 million at 2.25% and $199.8 million at 1.75%).

Subsequent to December 31, 2008, all of this ABCP matured, STRH collected 100% of the par amount of this ABCP from

the issuer and repaid the loan to the Fed. At December 31, 2008, this ABCP was classified within trading assets and carried

at fair value, and the loans from the Fed were elected to be carried at fair value pursuant to the provisions of SFAS No. 159

and classified within other short-term borrowings. Because of the non-recourse nature of the loan, we did not recognize

through earnings any differences in fair value between the loans and the ABCP.

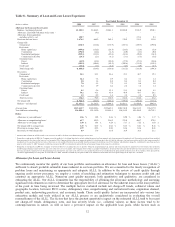

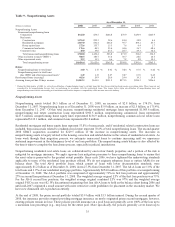

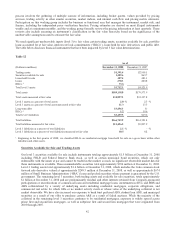

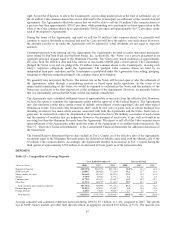

Table 11 – Securities Available for Sale

As of December 31

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities

2008 $125.6 $1.5 $- $127.1

2007 139.2 1.6 - 140.8

2006 143.7 1.5 0.1 145.1

U.S. government-sponsored enterprises

2008 $339.0 $20.3 $0.3 $359.0

2007 244.0 5.6 - 249.6

2006 1,464.3 7.1 16.0 1,455.4

States and political subdivisions

2008 $1,018.9 $24.6 $6.1 $1,037.4

2007 1,052.6 16.2 1.5 1,067.3

2006 1,032.3 13.4 4.6 1,041.1

Asset-backed securities

2008 $54.1 $3.1 $7.6 $49.6

2007 241.7 - 31.4 210.3

2006 1,128.0 1.9 17.6 1,112.3

Mortgage-backed securities

2008 $15,022.1 $142.2 $118.0 $15,046.3

2007 10,085.8 71.7 16.3 10,141.2

2006 17,337.3 37.4 243.8 17,130.9

Corporate bonds

2008 $275.5 $3.3 $13.0 $265.8

2007 232.2 0.7 1.6 231.3

2006 468.9 1.5 7.6 462.8

Other securities1

2008 $1,448.0 $1,363.3 $- $2,811.3

2007 1,544.0 2,679.6 - 4,223.6

2006 1,423.9 2,330.2 - 3,754.1

Total securities available for sale

2008 $18,283.2 $1,558.3 $145.0 $19,696.5

2007 13,539.5 2,775.4 50.8 16,264.1

2006 22,998.4 2,393.0 289.7 25,101.7

1Includes our investment in 30.0 million, 43.6 million, and 48.2 million shares of common stock of The Coca-Cola Company, $493.2 million, $452.2

million, and $389.2 million of Federal Home Loan Bank of Cincinnati and Federal Home Loan Bank of Atlanta stock stated at par value, and $360.9

million, $340.2 million, and $340.2 million of Federal Reserve Bank stock stated at par value as of December 31, 2008, 2007, and 2006, respectively.

39