SunTrust 2008 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

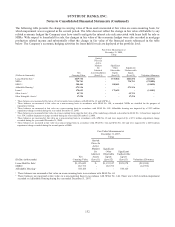

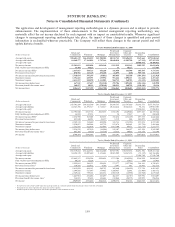

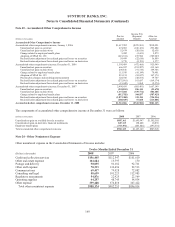

The following tables show a reconciliation of the beginning and ending balances for fair valued other assets/(liabilities),

which are IRLCs on residential mortgage loans held for sale, measured using significant unobservable inputs:

(Dollars in thousands)

Other Assets/

(Liabilities), net

Beginning balance January 1, 2008 ($19,603)

Included in earnings: 1

Issuances (inception value) 491,170

Fair value changes (71,127)

Expirations (143,701)

Settlements of IRLCs and transfers into closed loans (184,318)

Ending balance December 31, 2008 2$72,421

1Amounts included in earnings are recorded in mortgage production related income.

2The amount of total gains/(losses) for the period included in earnings attributable to the change in unrealized gains or losses relating to

IRLCs still held at December 31, 2008.

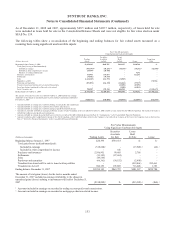

(Dollars in thousands)

Other Assets/

(Liabilities), net

Beginning balance January 1, 2007 ($29,633)

Included in earnings: 1

Issuances (inception value) (183,336)

Fair value changes (115,563)

Expirations 91,458

Settlements of IRLCs and transfers into closed loans 217,471

Ending balance December 31, 2007 2($19,603)

1Amounts included in earnings are recorded in mortgage production related income.

2The amount of total gains/(losses) for the period included in earnings attributable to the change in unrealized gains or losses

relating to IRLCs still held at December 31, 2007.

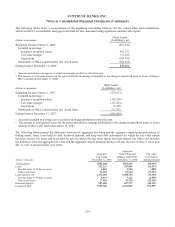

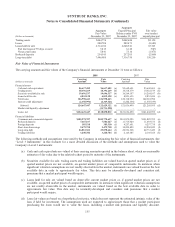

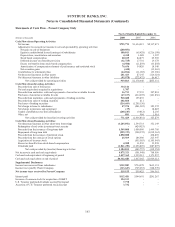

The following tables present the difference between the aggregate fair value and the aggregate unpaid principal balance of

trading assets, loans, loans held for sale, brokered deposits, and long-term debt instruments for which the fair value option

has been elected. For loans and loans held for sale for which the fair value option has been elected, the tables also includes

the difference between aggregate fair value and the aggregate unpaid principal balance of loans that are 90 days or more past

due, as well as loans in nonaccrual status.

(Dollars in thousands)

Aggregate

Fair Value

December 31, 2008

Aggregate

Unpaid Principal

Balance under FVO

December 31, 2008

Fair value

over/(under)

unpaid principal

Trading assets $852,300 $861,239 ($8,939)

Loans 222,221 247,098 (24,877)

Past due loans of 90 days or more 2,018 2,906 (888)

Nonaccrual loans 46,103 81,618 (35,515)

Loans held for sale 2,392,286 2,408,392 (16,106)

Past due loans of 90 days or more 4,663 7,222 (2,559)

Nonaccrual loans 27,483 47,228 (19,745)

Brokered deposits 587,486 627,737 (40,251)

Long-term debt 7,155,684 6,963,085 192,599

154