SunTrust 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.party mortgage insurers transferring a portion of their first loss exposure when losses by mortgage origination year exceed

certain thresholds. Effective January 1, 2009, Twin Rivers stopped reinsuring mortgage guaranty insurance on new loans

originated or purchased in 2009 by its parent or affiliate companies. As a result, in the future the reinsurance premiums

assumed by Twin Rivers will be lower than the level in 2008, and Twin Rivers will not experience any claims losses for the

2009 book year business.

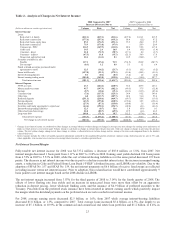

Outside processing and software increased $81.7 million, or 19.9%, compared to 2007 due to higher processing costs

associated with higher transaction volumes in addition to higher software amortization costs and the outsourcing of certain

back-office operations during the third quarter of 2008, which was offset by the corresponding decrease in employee

compensation and benefits.

Amortization/impairment of intangible assets increased $24.6 million, or 25.4%, in 2008. In the second quarter of 2008, we

recorded an impairment charge of $45.0 million related to a customer relationship intangible asset. This change was partially

offset by a decline in amortization of customer intangible assets.

Other staff expense decreased $62.2 million, or 46.9%, in 2008 compared to 2007 primarily related to our E2Program

savings produced in 2008 versus a $45.0 million accrual related to severance costs recorded in the third quarter of 2007

related to the program. For the year ended December 31, 2008, we achieved gross run rate savings of approximately $560.0

million related to our efficiency and productivity initiatives. Further, with the progress obtained in 2008, we believe we are

on target to attain $600 million of cumulative gross savings by the end of 2009. Key contributors to achieving the 2009 goal

include supplier management, outsourcing, and process engineering. Additionally in connection with our E2Program,

consulting and legal expense decreased by 42.1%, or $42.6 million, primarily within the consulting fees and data processing

consulting fees accounts.

Regulatory assessments expense grew from $22.4 million in 2007 to $54.9 million in 2008 as FDIC insurance premiums

increased due to the exhaustion of previously established premium credits and higher premiums. In an attempt by the FDIC

to further strengthen its reserves, future regulatory assessment expense will increase significantly from the level recognized

in 2008 due to an increase in the annual FDIC premium rate as well as a special FDIC assessment in 2009.

Visa litigation expense decreased by $110.4 million, or 143.6%, in 2008 compared to the same period in 2007. We increased

reserves related to the Visa litigation $20.0 million in the third quarter of 2008. However, offsetting the Visa litigation

accrual were reversals totaling $53.5 million related to our portion of the funding by Visa of the litigation escrow account.

Other noninterest expense decreased $51.1 million, or 13.5%, in 2008 compared to 2007. The decrease was due primarily to

write-downs of $19.9 million related to Affordable Housing properties as compared to $63.4 million of related charges in

2007.

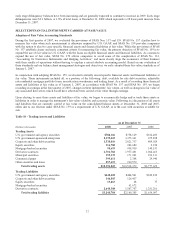

Provision for Income Taxes

The provision for income taxes includes both federal and state income taxes. In 2008, the provision for income taxes was a

benefit of $67.3 million, compared to tax expense of $615.5 million in 2007. The provision represents a negative 9.2%

effective tax rate for 2008 compared to a positive 27.4% for 2007. The decrease in the effective tax rate was primarily

attributable to the lower level of earnings, a higher proportion of tax-exempt income, state tax benefits resulting from

subsidiaries’ net operating losses and tax credits for the year ended December 31, 2008. Additionally, in July 2008, we

contributed 3.6 million shares of Coke common stock to our SunTrust Foundation. This contribution resulted in a release of

the deferred tax liability of approximately $65.8 million (net of valuation allowance) and provided an additional decrease in

the effective tax rate. For additional information on this and the other transactions related to our holdings in Coke, refer to

“Investment in Common Shares of The Coca-Cola Company” within this MD&A.

As of December 31, 2008, our gross cumulative unrecognized tax benefits (“UTBs”) amounted to $330.0 million, of which

$266.7 million (net of federal tax benefit) would affect our effective tax rate, if recognized. As of December 31, 2007, our

gross cumulative UTBs amounted to $325.4 million. Additionally, we recognized a gross liability of $70.9 million and $80.0

million for interest related to our UTBs as of December 31, 2008 and December 31, 2007, respectively. Interest expense

related to UTBs was $22.4 million for the year ended December 31, 2008, compared to $27.7 million for the same period in

2007. We continually evaluate the UTBs associated with our uncertain tax positions. It is reasonably possible that the total

UTBs could significantly increase or decrease during the next 12 months due to completion of tax authority examinations

and the expiration of statutes of limitations. However, an estimate of the range of the reasonably possible change in the total

amount of UTBs cannot currently be made.

We file consolidated and separate income tax returns in the United States federal jurisdiction and in various state

jurisdictions. Our federal returns through 2004 have been examined by the Internal Revenue Service (“IRS”) and issues for

28