SunTrust 2008 Annual Report Download - page 78

Download and view the complete annual report

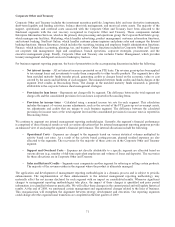

Please find page 78 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2007 ceased to accrue additional benefits under the existing pension benefit formula and their accrued benefits

were frozen. Beginning January 1, 2008, participants who had fewer than 20 years of service and future participants accrue

future pension benefits under a cash balance formula that provides compensation and interest credits to a Personal Pension

Account. Participants with 20 or more years of service as of December 31, 2007 were given the opportunity to choose

between continuing a traditional pension benefit accrual under a reduced formula or participating in the new Personal

Pension Account. The plan population decreased through 2008 due to the effects of a reorganization announced during 2007.

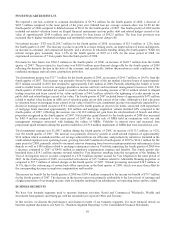

Discount Rate

The discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is

determined by matching the expected cash flows of each plan to a yield curve based on long term, high quality fixed income

debt instruments available as of the measurement date, December 31, 2008. The discount rate for each plan is reset annually

on the measurement date to reflect current market conditions.

If we were to assume a 0.25% increase/decrease in the discount rate for all retirement and other postretirement plans, and

keep all other assumptions constant, the benefit cost would decrease/ increase by approximately $11 million.

Expected Long-term Rate of Return on Plan Assets

Based on historical experience and market projection of the target asset allocation set forth in the investment policy for the

Retirement Plans, the pre-tax expected rate of return on plan assets was 8.50% for 2007 and 8.25% for 2008. This expected

rate of return is dependent upon the asset allocation decisions made with respect to plan assets. We modified the pre-tax

expected rate of return on plan assets for 2009 to be 8.00% to reflect the reduction in pension trust equity exposure.

Annual differences, if any, between expected and actual returns are included in the unrecognized net actuarial gain or loss

amount. We generally amortize any unrecognized net actuarial gain or loss in excess of a 10% corridor, as defined in SFAS

No. 87, “Employers’ Accounting for Pensions,” in net periodic pension expense over the average future service of active

employees, which is approximately seven years, or average future lifetime for plans with no active participants that are

frozen. See Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements for details on changes in the

pension benefit obligation and the fair value of plan assets.

If we were to assume a 0.25% increase/decrease in the expected long-term rate of return for the retirement and other

postretirement plans, holding all other actuarial assumptions constant, the benefit cost would decrease/increase by

approximately $5 million.

Recognition of Actual Asset Returns

SFAS No. 87 allows for the use of an asset value that smoothes investment gains and losses over a period up to five years.

However, we have elected to use a preferable method in determining pension cost. This method uses the actual market value

of the plan assets. Therefore, we will experience more variability in the annual pension cost, as the asset values will be more

volatile than companies who elected to “smooth” their investment experience.

Other Actuarial Assumptions

To estimate the projected benefit obligation, actuarial assumptions are required about factors such as mortality rate, turnover

rate, retirement rate, disability rate, and the rate of compensation increases. These factors do not tend to change significantly

over time, so the range of assumptions, and their impact on pension cost, is generally limited. We periodically review the

assumptions used based on historical and expected future experience. The interest crediting rate applied to each Personal

Pension Account was 6.28% in 2008.

Healthcare Cost

Assumed healthcare cost trend rates also have an impact on the amounts reported for the postretirement plans. Due to

changing medical inflation, it is important to understand the effect of a one percent change in assumed healthcare cost trend

rates. If we were to assume a one percent increase in healthcare cost trend rates, the effect on the other postretirement benefit

obligation and total interest and service cost would be a $12.8 million and $0.7 million increase, respectively. If we were to

assume a one percent decrease in healthcare trend rates, the effect on the other postretirement benefit obligation and total

interest and service cost would be a $11.2 million and $0.6 million decrease, respectively.

To estimate the projected benefit obligation as of December 31, 2008, we projected forward the benefit obligations from

January 1, 2008 to December 31, 2008, adjusting for benefit payments, expected growth in the benefit obligations, changes in

key assumptions and plan provisions, and any significant changes in the plan demographics that occurred during the year,

including (where appropriate) subsidized early retirements, salary changes different from expectations, entrance of new

participants, changes in per capita claims cost, Medicare Part D subsidy, and retiree contributions.

66