SunTrust 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

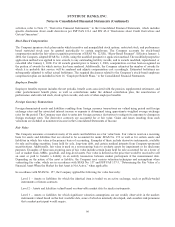

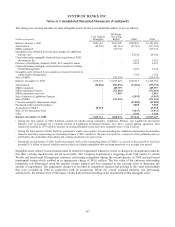

Note 3 - Funds Sold and Securities Purchased Under Agreements to Resell

Funds sold and securities purchased under agreements to resell at December 31 were as follows:

(Dollars in thousands) 2008 2007

Federal funds $134,000 $400,300

Resell agreements 856,614 947,029

Total funds sold and securities purchased

under agreements to resell $990,614 $1,347,329

Securities purchased under agreements to resell are collateralized by U.S. government or agency securities and are carried at

the amounts at which securities will be subsequently resold. The Company takes possession of all securities under

agreements to resell and performs the appropriate margin evaluation on the acquisition date based on market volatility, as

necessary. The Company requires collateral between 100% and 106% of the underlying securities. The total market value of

the collateral held was $866.7 million and $999.0 million at December 31, 2008 and 2007, of which $246.3 million and

$527.8 million was repledged, respectively.

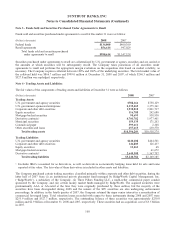

Note 4 - Trading Assets and Liabilities

The fair values of the components of trading assets and liabilities at December 31 were as follows:

(Dollars in thousands) 2008 2007

Trading Assets

U.S. government and agency securities $788,166 $758,129

U.S. government-sponsored enterprises 2,339,469 3,375,361

Corporate and other debt securities 1,538,010 2,821,737

Equity securities 116,788 242,680

Mortgage-backed securities 95,693 938,930

Derivative contracts14,701,782 1,977,401

Municipal securities 159,135 171,203

Commercial paper 399,611 2,368

Other securities and loans 257,615 230,570

Total trading assets $10,396,269 $10,518,379

Trading Liabilities

U.S. government and agency securities $440,408 $404,501

Corporate and other debt securities 146,805 126,437

Equity securities 13,263 68

Mortgage-backed securities -61,672

Derivative contracts12,640,308 1,567,707

Total trading liabilities $3,240,784 $2,160,385

1Excludes IRLCs accounted for as derivatives, as well as derivatives economically hedging loans held for sale and loans

reported at fair value. The fair value of these derivatives is included in other assets and liabilities.

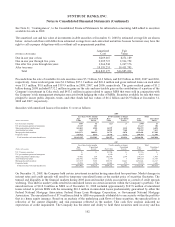

The Company purchased certain trading securities, classified primarily within corporate and other debt securities, during the

latter half of 2007 from (i) an institutional private placement fund managed by RidgeWorth Capital Management, Inc.

(“RidgeWorth”), a subsidiary of the Company, (ii) Three Pillars Funding LLC, a multi-seller commercial paper conduit

sponsored by the Company, and (iii) certain money market funds managed by RidgeWorth. The acquired securities were

predominantly AAA or AA-rated at the time they were originally purchased by these entities, but the majority of the

securities have been downgraded during 2008 and the issuers of the SIV securities are also undergoing enforcement

proceedings. In addition, in the fourth quarter of 2007, the Company retained the super senior interest in a securitization of

commercial leveraged loans. Total valuation losses recorded with respect to these instruments during 2008 and 2007 were

$255.9 million and $527.7 million, respectively. The outstanding balance of these securities was approximately $250.0

million and $2.9 billion at December 31, 2008 and 2007, respectively. These securities had an acquisition cost of $3.5 billion

in 2007.

100