SunTrust 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

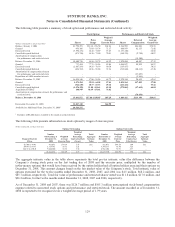

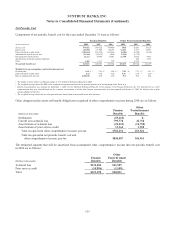

expense related to net settlements on interest rate swaps accounted for as fair value hedges. This hedging strategy

resulted in trading losses from hedge ineffectiveness of $5.0 million for the year ended December 31, 2006. No gains

and losses of swaps designated as fair value hedges were excluded from the assessment of effectiveness. Upon the

adoption of SFAS No. 159 effective January 1, 2007, the Company elected to carry at fair value all recognized liabilities

that had previously been designated in qualifying fair value hedges. In conjunction with this election, all fair value

hedges were dedesignated and opening retained earnings was reduced by $197.2 million, thus no discount or premium

on the debt resulting from hedge accounting remained to be amortized. See Note 20, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements for more information.

The Company maintains a risk management program to manage interest rate risk and pricing risk associated with its

mortgage lending activities. The risk management program includes the use of forward contracts and other derivatives

that are recorded in the financial statements at fair value and are used to offset changes in value of the mortgage

inventory due to changes in market interest rates. A portion of these derivative instruments were documented as fair

value hedges of specific pools of loans that met the similar assets test. The pools of loans were matched with a certain

portion of the derivative instruments so that the expected changes in market value would inversely offset within a range

of 80% to 125%. The qualifying pools of hedged loans were recorded in the financial statements at their fair value. This

hedging strategy resulted in ineffectiveness that reduced earnings by $0.3 million and $21.1 million for the years ended

December 31, 2007 and 2006, respectively. This hedge accounting designation was terminated in 2007 as a result of the

Company’s adoption of SFAS No. 159 and its decision to elect fair value accounting for a substantial portion of the

loans held for sale.

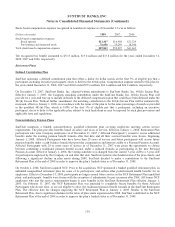

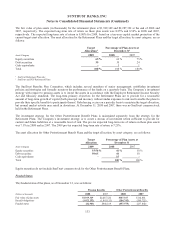

Cash Flow Hedges

The Company has designated interest rate swaps and options as cash flow hedges of probable forecasted transactions

related to recognized assets and liabilities. Specifically, these derivatives have been designated as hedging the exposure

to the benchmark interest rate risk associated with floating rate loans, certificates of deposit, and floating rate debt. The

maximum range of hedge maturities for asset hedges is approximately five to seven years, with the weighted average

being approximately four years; such maximum range for liability hedges is less than one year, with the weighted

average being approximately 0.5 years. The Company recognized net interest income of $180.7 million for the year

ended December 31, 2008 and net interest expense of $25.6 million and $40.9 million for the years ended December 31,

2007 and 2006, respectively, related to the effective portion of interest rate swaps and options that were designated as

cash flow hedges. During the years ended December 31, 2008, 2007, and 2006, $0.0 million, $0.4 million, and $2.2

million, respectively, were recognized as trading losses from hedge ineffectiveness of swaps and options and amounts

excluded from the assessment of effectiveness of option hedges. As of December 31, 2008, $225.0 million, net of tax, of

the deferred net gains on derivatives that are recorded in accumulated other comprehensive income are expected to be

reclassified to net interest income in the next twelve months in connection with the recognition of interest income or

interest expense on the hedged item.

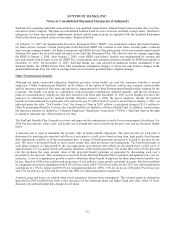

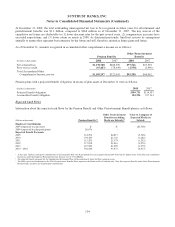

During the third quarter of 2008, the Company executed equity forward agreements (the “Agreements”) on 30 million

shares of Coke. A consolidated subsidiary of SunTrust Banks, Inc. owns approximately 22.9 million Coke shares and a

consolidated subsidiary of SunTrust Bank owns approximately 7.1 million Coke shares. These two subsidiaries entered

into separate Agreements on their respective holdings of Coke common shares with a large, unaffiliated financial

institution (the “Counterparty”). Execution of the Agreements (including the pledges of the Coke shares pursuant to the

terms of the Agreements) did not constitute a sale of the Coke shares under U.S. GAAP for several reasons, including

that ownership of the shares was not legally transferred to the Counterparty. The Agreements, in their entirety, are

derivatives based on the criteria in SFAS No. 133. The Agreements resulted in zero cost equity collars pursuant to the

provisions of SFAS No. 133. In accordance with the provisions of SFAS No. 133, the Company has designated the

Agreements as cash flow hedges of the Company’s probable forecasted sales of its Coke shares, which are expected to

occur in approximately six to six and a half years, for overall price volatility below the strike prices on the floor

(purchased put) and above the strike prices on the ceiling (written call). Although the Company is not required to deliver

its Coke shares under the Agreements, the Company has asserted that it is probable, as defined by SFAS No. 133, that it

will sell all of its Coke shares at or around the settlement date of the Agreements. The Federal Reserve’s approval for

Tier 1 Capital was significantly based on this expected disposition of the Coke shares under the Agreements or in

another market transaction. Both the sale and the timing of such sale remain probable to occur as designated. At least

quarterly, the Company assesses hedge effectiveness and measures hedge ineffectiveness with the effective portion of

the changes in fair value of the Agreements generally recorded in accumulated other comprehensive income and any

ineffective portions generally recorded in trading gains and losses. None of the components of the Agreements’ fair

138