SunTrust 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

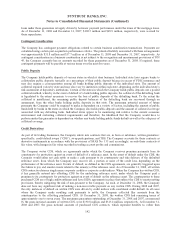

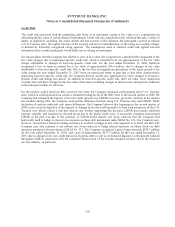

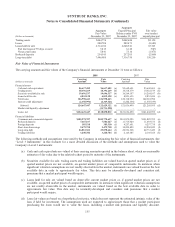

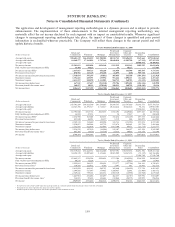

The following tables present financial assets and financial liabilities measured at fair value on a recurring basis and the

change in fair value for those specific financial instruments in which fair value has been elected. The tables do not reflect the

change in fair value attributable to the related economic hedges the Company used to mitigate the interest rate risk associated

with the financial instruments. The changes in the fair value of economic hedges were also recorded in trading account

profits and commissions or mortgage production related income, as appropriate, and are designed to partially offset the

change in fair value of the financial instruments referenced in the tables below. The Company’s economic hedging activities

are deployed at both the instrument and portfolio level.

Fair Value Measurements at

December 31, 2008,

Using

Fair Value Gain/(Loss) for the Year Ended

December 31, 2008, for Items Measured at Fair Value

Pursuant to Election of the Fair Value Option

(Dollars in thousands)

Assets/Liabilities

Measured at

Fair Value

December 31, 2008

Quoted

Prices In

Active

Markets for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Trading Account

Profits and

Commissions

Mortgage

Production

Related

Income

Total

Changes in

Fair Values

Included in

Current-

Period

Earnings2

Assets

Trading assets $10,396,269 $149,321 $8,855,563 $1,391,385 ($6,598) $- ($6,598)

Securities available for sale 19,696,537 1,485,364 16,721,569 1,489,604 - - -

Loans held for sale 2,424,432 - 1,936,987 487,445 - 268,3863268,386

Loans 270,342 - - 270,342 (4,195) (26,066) (30,261)

Other assets 1109,600 775 35,231 73,594 - - -

Liabilities

Brokered deposits 587,486 - 587,486 - 46,007 - 46,007

Trading liabilities 3,240,784 440,436 2,800,348 - - - -

Other short-term borrowings 399,611 - 399,611 - - - -

Long-term debt 7,155,684 - 3,659,423 3,496,261 (65,322) - (65,322)

Other liabilities 172,911 - 71,738 1,173 - - -

1This amount includes IRLCs and derivative financial instruments entered into by the Mortgage line of business to hedge its interest rate risk. Beginning in 2008, IRLCs were recorded gross, instead

of net, in other assets or liabilities.

2Changes in fair value for the year ended December 31, 2008 exclude accrued interest for the period then ended. Interest income or interest expense on trading assets, loans, loans held for sale,

brokered deposits and long-term debt that have been elected to be carried at fair value under the provisions of SFAS No. 159 or SFAS No. 155 are recorded in interest income or interest expense in

the Consolidated Statements of Income based on their contractual coupons. Certain trading assets do not have a contractually stated coupon and, for these securities, the Company records interest

income based on the effective yield calculated upon acquisition of those securities. For the year ended December 31, 2008, the changes in fair value related to accrued interest income on loans and

loans held for sale were a decrease of $0.1 million and $3.0 million, respectively. For the year ended December 31, 2008, the changes in fair value related to accrued interest expense on brokered

deposits and long-term debt were an increase of approximately $18.7 million and $0.4 million, respectively.

3For the year ended December 31, 2008, these amounts include $464.6 million related to MSR assets recognized upon the sale of the loans.

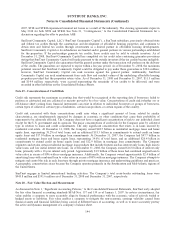

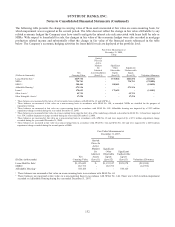

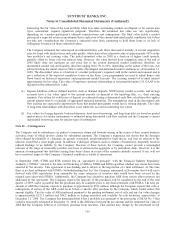

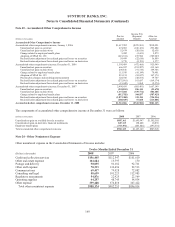

Fair Value Measurements at

December 31, 2007,

Using

Fair Value Gain/(Loss) for the Year Ended

December 31, 2007, for Items Measured at Fair Value Pursuant

to Election of the Fair Value Option

(Dollars in thousands)

Assets/Liabilities

Measured at

Fair Value

December 31, 2007

Quoted

Prices In

Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Trading Account

Profits and

Commissions

Mortgage

Production

Related

Income

Total

Changes in

Fair Values

Included in

Current-

Period

Earnings1

Assets

Trading assets $10,518,379 $294,412 $7,273,822 $2,950,145 ($151,695) $- ($151,695)

Securities available for sale 16,264,107 2,815,488 12,578,912 869,707 - - -

Loans held for sale 6,325,160 - 5,843,833 481,327 - 81,561281,561

Loans 220,784 - - 220,784 - (1,712) (1,712)

Other assets369,405 2,781 66,624 - - - -

Liabilities

Brokered deposits 234,345 - 234,345 - 7,686 - 7,686

Trading liabilities 2,160,385 592,678 1,567,707 - - - -

Long-term debt 7,446,980 - 7,446,980 - (70,927) - (70,927)

Other liabilities356,189 73 36,513 19,603 - - -

1Changes in fair value for the twelve months ended December 31, 2007 exclude accrued interest for the period then ended. Interest income or interest expense on trading assets, loans held for sale, brokered

deposits and long-term debt that have been elected to be carried at fair value under the provisions of SFAS No. 159 or SFAS No. 155 are recorded in interest income or interest expense in the Consolidated

Statements of Income based on their contractual coupons. Certain trading assets do not have a contractually stated coupon and, for these securities, the Company records interest income based on the effective

yield calculated upon acquisition of those securities. For the twelve months ended December 31, 2007, the change in fair value related to accrued interest income on loans held for sale was an increase of

$11.1 million and the change in fair value related to accrued interest expense on brokered deposits and long-term debt was an increase of $8.7 million and an increase of $4.2 million, respectively.

2This amount includes $214.6 million related to MSR assets recognized upon the sale of the loans.

3This amount includes interest rate lock commitments and derivative financial instruments entered into by the Mortgage line of business to hedge its interest rate risk. Beginning in 2008, interest rate lock

commitments were recorded gross, instead of net, in other assets or other liabilities. Had SunTrust recorded interest rate lock commitments gross as of year end, the Company would have recorded an asset of

$6.8 million and a liability of $26.4 million.

151