SunTrust 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

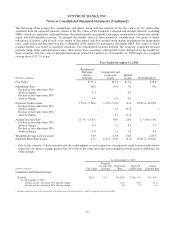

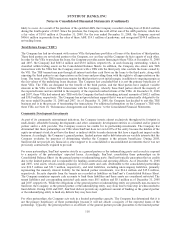

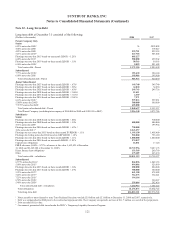

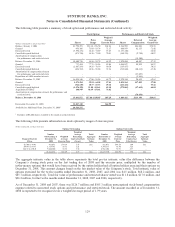

Maturities of long-term debt are: 2009 – $1,536.5 million; 2010 – $3,637.5 million; 2011 – $6,442.8 million; 2012 –

$7,185.5 million; 2013 – $126.7 million; and thereafter—$7,883.4 million. Restrictive provisions of several long-term debt

agreements prevent the Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of

subsidiaries.

Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders’

equity, and maximum borrowings by the Company. As of December 31, 2008, the Company was in compliance with all

covenants and provisions of long-term debt agreements. As currently defined by federal bank regulators, long-term debt of

$2,847.3 million and $2,133.3 million as of December 31, 2008 and 2007, respectively, qualified as Tier 1 capital and long-

term debt of $3,008.3 million and $3,073.2 million as of December 31, 2008 and 2007, respectively, qualified as Tier 2

capital. As of December 31, 2008, the Company had collateral pledged to the FHLB of Atlanta to support $4.5 billion of

available borrowing capacity.

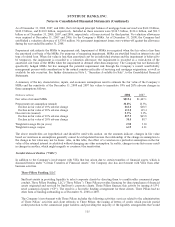

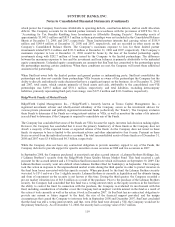

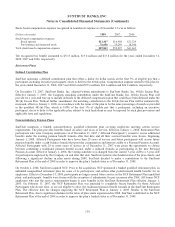

In connection with FIN 46(R), the Company does not consolidate certain wholly-owned trusts which had been formed for the

sole purpose of issuing trust preferred securities. The proceeds from the trust preferred securities issuances were invested in

junior subordinated debentures of the Parent Company and Bank Parent Company. The obligations of these debentures

constitute a full and unconditional guarantee by the Parent Company and Bank Parent Company of the trust preferred

securities.

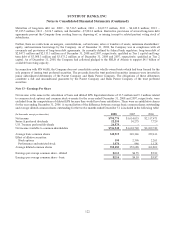

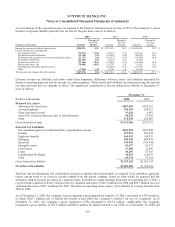

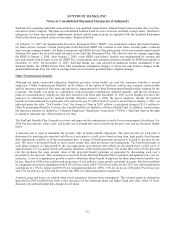

Note 13 - Earnings Per Share

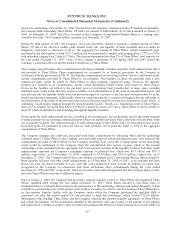

Net income is the same in the calculation of basic and diluted EPS. Equivalent shares of 33.5 million and 9.1 million related

to common stock options and common stock warrants for the years ended December 31, 2008 and 2007, respectively, were

excluded from the computations of diluted EPS because they would have been antidilutive. There were no antidilutive shares

for the year ending December 31, 2006. A reconciliation of the difference between average basic common shares outstanding

and average diluted common shares outstanding for the twelve months ended December 31 is included in the following table:

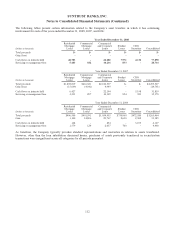

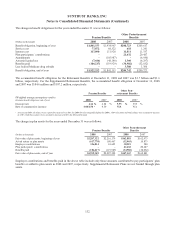

(In thousands, except per share data) 2008 2007 2006

Net income $795,774 $1,634,015 $2,117,471

Series A preferred dividends 22,255 30,275 7,729

U.S. Treasury preferred dividends 26,579 --

Net income available to common shareholders $746,940 $1,603,740 $2,109,742

Average basic common shares 348,919 349,346 359,413

Effect of dilutive securities:

Stock options 190 2,396 2,261

Performance and restricted stock 1,074 946 1,128

Average diluted common shares 350,183 352,688 362,802

Earnings per average common share - diluted $2.13 $4.55 $5.82

Earnings per average common share - basic $2.14 $4.59 $5.87

122