SunTrust 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

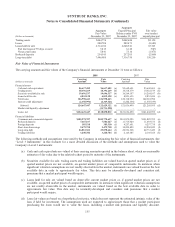

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

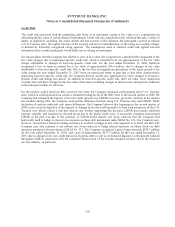

In accordance with SFAS No. 159, the Company has elected to record specific financial assets and financial liabilities at fair

value. These instruments include all, or a portion, of the following: fixed rate debt, loans and loans held for sale, brokered

deposits, and trading loans. The following is a description of each financial asset and liability class as of December 31, 2008

for which fair value has been elected, including the specific reasons for electing fair value and the strategies for managing the

financial assets and liabilities on a fair value basis.

Fixed Rate Debt

The debt that the Company initially elected to carry at fair value was all of its fixed rate debt that had previously been

designated in qualifying fair value hedges using receive fixed/pay floating interest rate swaps, pursuant to the provisions

of SFAS No. 133. As of December 31, 2008, the fair value of such fixed rate debt was comprised of $3.7 billion of fixed

rate Federal Home Loan Bank advances and $3.5 billion of publicly-issued debt. The Company elected to record this

debt at fair value in order to align the accounting for the debt with the accounting for the derivative without having to

account for the debt under hedge accounting, thus avoiding the complex and time consuming fair value hedge

accounting requirements of SFAS No. 133. This move to fair value introduced earnings volatility due to changes in the

Company’s credit spread that was not required to be valued under the SFAS No. 133 hedge designation. Most of the

debt, along with certain of the interest rate swaps previously designated as hedges under SFAS No. 133, continues to

remain outstanding; however, in February 2009, the Company repaid all of the FHLB advances outstanding and closed

out its exposures on the interest rate swaps. Approximately $150.3 million of FHLB stock was redeemed in conjunction

with the repayment of the advances.

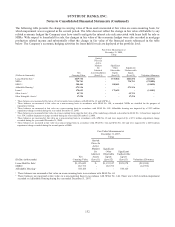

During the year ended December 31, 2007, the Company consummated two fixed rate debt issuances. On September 10,

2007, the Company issued $500 million of Senior Notes, which carried a fixed coupon rate of 6.00% and had a term of

10 years. The Company did not enter into any derivatives to hedge this debt and, therefore, did not elect to carry the

debt at fair value. On November 5, 2007, the Company issued $500 million of Senior Notes, which carried a fixed

coupon rate of 5.25% and had a term of 5 years. The Company entered into interest rate swaps in connection with this

debt issuance and, as a result, elected to carry this debt at fair value.

During the year ended December 31, 2008, the Company consummated two fixed rate debt issuances and repurchased

certain debt carried at fair value. On March 4, 2008, the Company issued $685 million of trust preferred securities,

which carried a fixed coupon rate of 7.875% and had a term of 60 years. The Company did not enter into any derivatives

to hedge this debt and, therefore, did not elect to carry the debt at fair value. On March 17, 2008, the Company issued

$500 million of subordinated notes, which carried a fixed coupon rate of 7.25% and had a term of 10 years. The

Company entered into interest rate swaps in connection with this debt issuance and, as a result, elected to carry this debt

at fair value. During the year ended December 31, 2008, $294.2 million of the Company’s fair value debt matured, and

the Company repurchased principal amounts of approximately $384 million of debt carried at fair value to mitigate

volatility from credit spread changes.

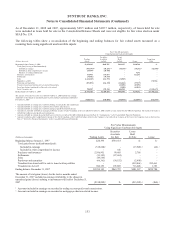

In September 2008, the Federal Reserve Bank of Boston (the “Fed”) instituted the ABCP MMMF Liquidity Facility

program (the “Program”) that allows eligible depository institutions, bank holding companies and affiliated broker/

dealers to purchase certain asset-backed commercial paper (“ABCP”) from certain money market mutual funds (the

“MMMF”). These purchases will be made by the participating institution at a price equal to the MMMF’s amortized

cost. The Fed will then make a fixed rate non-recourse loan to the participating institution that will mature on the same

date as the ABCP that was purchased with a specific draw. As of December 31, 2008, SunTrust Robinson Humphrey

(“STRH”) owned $400 million of eligible ABCP at a price of $399.6 million. At December 31, 2008, this ABCP had a

weighted average maturity of 9 days and a risk weighting of 0% for regulatory capital purposes. Per the terms of the

Program, STRH also had outstanding loans from the Fed in the amount of $399.6 million. Subsequent to December 31,

2008 all of this ABCP matured, STRH collected 100% of the par amount of this ABCP from the issuer and repaid the

loan to the Fed. At December 31, 2008, this ABCP was classified within trading assets and carried at fair value, and the

loans from the Fed were elected to be carried at fair value pursuant to the provisions of SFAS No. 159 and classified

within other short-term borrowings. Because of the non-recourse nature of the loan, the Company did not recognize

through earnings any differences in fair value between the loans and the ABCP.

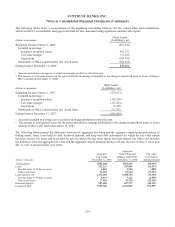

Brokered Deposits

Prior to adopting SFAS No. 159, the Company had adopted the provisions of SFAS No. 155 and elected to carry certain

certificates of deposit at fair value. These debt instruments include embedded derivatives that are generally based on

underlying equity securities or equity indices, but may be based on other underlyings that are generally not clearly and

145