SunTrust 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

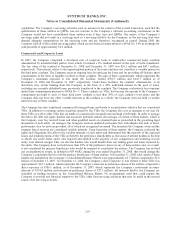

capabilities. The Company’s servicing activities were de minimis in the context of the overall transaction, such that the

qualification of these entities as QSPEs was not relevant to the Company’s ultimate accounting conclusions as the

Company would not have consolidated these entities even if they were not QSPEs. The nature of the Company’s

servicing rights did not result in a servicing asset or a servicing liability for the Company, as the servicing fees were

deemed adequate compensation for the servicing costs and are, therefore, recognized as earned. During 2008, the

Company sold all of the related servicing rights, which are not financial assets subject to SFAS No. 140, in exchange for

cash proceeds of approximately $6.6 million.

Commercial and Corporate Loans

In 2007, the Company completed a structured sale of corporate loans to multi-seller commercial paper conduits

administered by unrelated third parties, from which it retained a 3% residual interest in the pool of loans transferred.

The fair value of the residual at December 31, 2008 and December 31, 2007 was $16.2 million and $45.7 million,

respectively. This interest relates to the unparticipated portion of the loans and does not constitute a variable interest in

the third party conduits. The Company receives ongoing fees for servicing the loans and for providing off-balance sheet

commitments in the form of liquidity facilities to these conduits. The sum of these commitments, which represents the

Company’s maximum exposure to loss under the facilities, totaled $500.7 million and $626.5 million as of

December 31, 2008 and December 31, 2007, respectively. Under these facilities, the conduits’ administrator, at its

discretion, may obtain funding from the Company in the form of a 49% undivided interest in the pool of loans,

excluding any currently defaulted loans, previously transferred to the conduits. The Company evaluates its loss exposure

under these commitments pursuant to SFAS No. 5. These conduits are VIEs, but because the amount of the Company’s

commitment provided to each of these third party conduits is less than 50% of each conduit’s total assets and the

Company does not have any other variable interests in the conduits as a whole, the Company does not hold a variable

interest in any of these conduits.

The Company has also transferred commercial leveraged loans and bonds to securitization vehicles that are considered

VIEs. In addition to retaining certain securities issued by the VIEs, the Company also acts as manager or servicer for

these VIEs as well as other VIEs that are funds of commercial leveraged loans and high yield bonds. In order to manage

the risk to the debt and equity holders and maximize potential returns, the manager of certain of these entities, which is

the Company, may buy and sell loans and other qualified assets on a limited basis as prescribed in the governing legal

documents of each entity. As manager, the Company receives market-based senior fees, subordinate fees and, at times,

performance fees for services provided, all of which are recognized as earned. The securities the Company owns and the

manager fees it receives are considered variable interests. Upon formation of these entities, the Company evaluated the

rights and obligations allocable to the variable interests of each entity and determined that the majority of the expected

losses and residual returns of the VIEs are held by the preference shareholders as that class of interest holders is the first

to absorb any credit losses and is also exposed and entitled to the majority of any compression and widening in each

entity’s net interest margin. They are also the holders who would benefit from any trading gains and losses incurred by

the entity. The Company does not hold more than 20% of the preference shares in any of these entities and, as a result,

is not considered the primary beneficiary who would be required to consolidate the entities. The Company has not had

any reconsideration events, as defined in FIN 46(R), during the year ended December 31, 2008, that would change the

Company’s conclusion that it is not the primary beneficiary of these entities. At December 31, 2008, total assets of these

entities not included on the Company’s Consolidated Balance Sheets were approximately $2.7 billion compared to $2.6

billion at December 31, 2007. At December 31, 2008, the Company’s direct exposure to loss related to these VIEs was

approximately $16.7 million, which represents the Company’s interests in preference shares of the entities compared to

direct exposure of $386.1 million, as of December 31, 2007, which represents the Company’s investment in senior

interests of $358.8 million and interests in preference shares of $27.3 million. All interests held by the Company are

classified as trading securities in the Consolidated Balance Sheets. No arrangements exist that could require the

Company to provide any financial support to the VIEs, other than servicing advances that may be made in the normal

course of its servicing activities.

110