SunTrust 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

December 31, 2007, respectively. Interest expense related to UTBs was $22.4 million for the year ended December 31, 2008,

compared to $27.7 million, for the same period in 2007. The Company continually evaluates the UTBs associated with its

uncertain tax positions. It is reasonably possible that the total UTBs could significantly increase or decrease during the next

12 months due to completion of tax authority examinations and the expiration of statutes of limitations. However, an estimate

of the range of the reasonably possible change in the total amount of UTBs cannot currently be made.

The Company files consolidated and separate income tax returns in the United States federal jurisdiction and in various state

jurisdictions. The Company’s federal returns through 2004 have been examined by the Internal Revenue Service (“IRS”) and

issues for tax years 1997 through 2004 are still in dispute. The Company has paid the amounts assessed by the IRS in full for

tax years 1997 and 1998 and has filed refund claims with the IRS related to the disputed issues for those two years. An IRS

examination of the Company’s 2005 and 2006 federal income tax returns is currently in progress. Generally, the state

jurisdictions in which the Company files income tax returns are subject to examination for a period from three to seven years

after returns are filed.

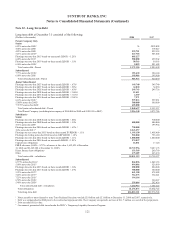

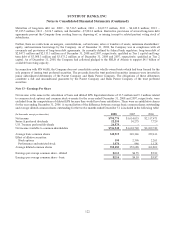

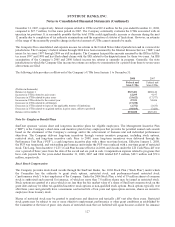

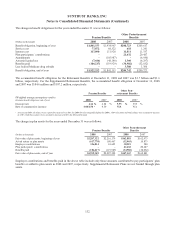

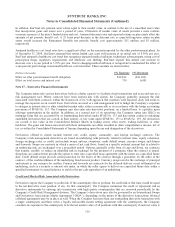

The following table provides a rollforward of the Company’s UTBs from January 1 to December 31:

2008 2007

Federal and

State UTBs

Federal and

State UTBs

(Dollars in thousands)

Balance at January 1 $325,401 $288,146

Increases in UTBs related to prior years 12,295 9,197

Decreases in UTBs related to prior years (24,622) (17,577)

Increases in UTBs related to the current year 47,521 54,696

Decreases in UTBs related to settlements (17,258) -

Decreases in UTBs related to lapse of the applicable statutes of limitations (2,752) (1,635)

Decreases in UTBs related to acquired entities in prior years, offset to goodwill (10,565) (7,426)

Balance at December 31 $330,020 $325,401

Note 16 - Employee Benefit Plans

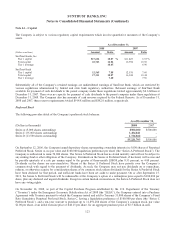

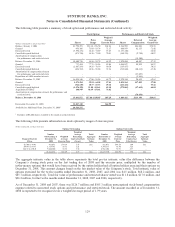

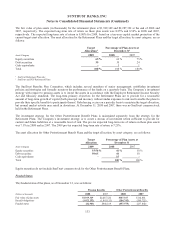

SunTrust sponsors various short and long-term incentive plans for eligible employees. The Management Incentive Plan

(“MIP”) is the Company’s short-term cash incentive plan for key employees that provides for potential annual cash awards

based on the attainment of the Company’s earnings and/or the achievement of business unit and individual performance

objectives. The Company delivers long-term incentives through various incentive programs, including stock options,

restricted stock, and long-term incentive cash. Prior to 2008, some long-term incentives were delivered through the

Performance Unit Plan (“PUP”), a cash long-term incentive plan with a three year time horizon. Effective January 1, 2008,

the PUP was terminated, and outstanding performance units under the PUP were replaced with a one-time grant of restricted

stock. The Long-Term Incentive (“LTI”) Cash Plan became effective in 2008, and awards under the LTI Cash Plan cliff vest

over a period of three years from the date of the award and are paid in cash. Compensation expense related to programs that

have cash payouts for the years ended December 31, 2008, 2007 and 2006 totaled $47.5 million, $48.5 million and $72.6

million, respectively.

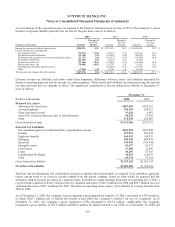

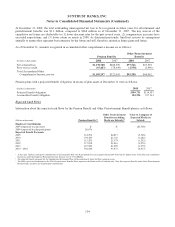

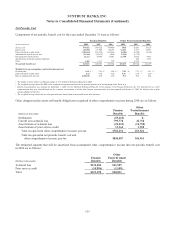

Stock Based Compensation

The Company provides stock-based awards through the SunTrust Banks, Inc. 2004 Stock Plan (“Stock Plan”) under which

the Committee has the authority to grant stock options, restricted stock, and performance-based restricted stock

(“performance stock”) to key employees of the Company. Under the 2004 Stock Plan, a total of 19 million shares of common

stock is authorized and reserved for issuance, of which no more than 7.8 million shares may be issued as restricted stock.

Stock options are granted at a price which is no less than the fair market value of a share of SunTrust common stock on the

grant date and may be either tax-qualified incentive stock options or non-qualified stock options. Stock options typically vest

after three years and generally have a maximum contractual life of ten years and upon option exercise, shares are issued to

employees from treasury stock.

Shares of restricted stock may be granted to employees and directors and typically cliff vest after three years. Restricted

stock grants may be subject to one or more objective employment, performance or other grant conditions as established by

the Committee at the time of grant. Any shares of restricted stock that are forfeited will again become available for issuance

127