SunTrust 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

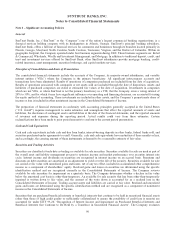

Notes to Consolidated Financial Statements

Note 1 – Significant Accounting Policies

General

SunTrust Banks, Inc. (“SunTrust” or the “Company”) one of the nation’s largest commercial banking organizations, is a

financial services holding company with its headquarters in Atlanta, Georgia. SunTrust’s principal banking subsidiary,

SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in

Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. Within its

geographic footprint, the Company operated under four business segments during 2008. These business segments are: Retail

& Commercial, Wholesale, Wealth and Investment Management, and Mortgage. In addition to traditional deposit, credit, and

trust and investment services offered by SunTrust Bank, other SunTrust subsidiaries provide mortgage banking, credit-

related insurance, asset management, securities brokerage, and capital markets services.

Principles of Consolidation and Basis of Presentation

The consolidated financial statements include the accounts of the Company, its majority-owned subsidiaries, and variable

interest entities (“VIEs”) where the Company is the primary beneficiary. All significant intercompany accounts and

transactions have been eliminated. Results of operations of companies purchased are included from the date of acquisition.

Results of operations associated with companies or net assets sold are included through the date of disposition. Assets and

liabilities of purchased companies are stated at estimated fair values at the date of acquisition. Investments in companies

which are not VIEs, or where SunTrust is not the primary beneficiary in a VIE, that the Company owns a voting interest of

20% to 50%, and for which it may have significant influence over operating and financing decisions, are accounted for using

the equity method of accounting. These investments are included in other assets, and the Company’s proportionate share of

income or loss is included in other noninterest income in the Consolidated Statements of Income.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States

(“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts

of revenues and expenses during the reporting period. Actual results could vary from these estimates. Certain

reclassifications have been made to prior period amounts to conform to the current period presentation.

Cash and Cash Equivalents

Cash and cash equivalents include cash and due from banks, interest-bearing deposits in other banks, federal funds sold, and

securities purchased under agreements to resell. Generally, cash and cash equivalents have maturities of three months or less,

and accordingly, the carrying amount of these instruments is deemed to be a reasonable estimate of fair value.

Securities and Trading Activities

Securities are classified at trade date as trading or available for sale securities. Securities available for sale are used as part of

the overall asset and liability management process to optimize income and market performance over an entire interest rate

cycle. Interest income and dividends on securities are recognized in interest income on an accrual basis. Premiums and

discounts on debt securities are amortized as an adjustment to yield over the life of the security. Securities available for sale

are carried at fair value with unrealized gains and losses, net of any tax effect, included in accumulated other comprehensive

income as a component of shareholders’ equity. Realized gains and losses on securities are determined using the specific

identification method and are recognized currently in the Consolidated Statements of Income. The Company reviews

available for sale securities for impairment on a quarterly basis. The Company determines whether a decline in fair value

below the amortized cost basis is other-than-temporary. An available for sale security that has been other-than-temporarily

impaired is written down to fair value, and the amount of the write down is accounted for as a realized loss in the

Consolidated Statements of Income. Trading account assets and liabilities are carried at fair value. Realized and unrealized

gains and losses are determined using the specific identification method and are recognized as a component of noninterest

income in the Consolidated Statements of Income.

Securities that are purchased beneficial interests or beneficial interests that continue to be held in securitized financial assets

(other than those of high credit quality or sufficiently collateralized to ensure the possibility of credit loss is remote) are

accounted for under EITF 99-20, “Recognition of Interest Income and Impairment on Purchased Beneficial Interests and

Beneficial Interests that Continue to Be Held by a Transferor in Securitized Financial Assets”. The Company evaluates

90