SunTrust 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

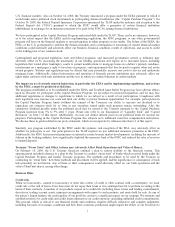

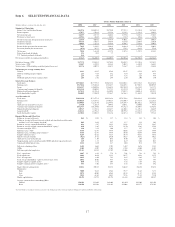

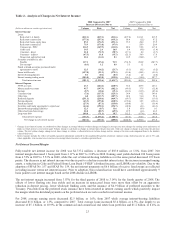

Item 6. SELECTED FINANCIAL DATA

Twelve Months Ended December 31

(Dollars in millions, except per share and other data) 2008 2007 2006 2005 2004 2003

Summary of Operations

Interest, fees, and dividend income $8,327.4 $10,035.9 $9,792.0 $7,731.3 $5,218.4 $4,768.8

Interest expense 3,707.7 5,316.4 5,131.6 3,152.3 1,533.2 1,448.5

Net interest income 4,619.7 4,719.5 4,660.4 4,579.0 3,685.2 3,320.3

Provision for loan losses 2,474.2 664.9 262.5 176.9 135.6 313.6

Net interest income after provision for loan losses 2,145.5 4,054.6 4,397.9 4,402.1 3,549.6 3,006.7

Noninterest income 4,473.5 3,428.7 3,468.4 3,155.0 2,604.4 2,303.0

Noninterest expense 5,890.5 5,233.8 4,879.9 4,690.7 3,897.0 3,400.6

Income before provision for income taxes 728.5 2,249.5 2,986.4 2,866.4 2,257.0 1,909.1

Provision (benefit) for income taxes (67.3) 615.5 869.0 879.2 684.1 576.8

Net income 795.8 1,634.0 2,117.4 1,987.2 1,572.9 1,332.3

Series A preferred dividends 22.3 30.3 7.7 - - -

U.S. Treasury preferred dividends 26.6 -----

Net income available to common shareholders $746.9 $1,603.7 $2,109.7 $1,987.2 $1,572.9 $1,332.3

Net interest income - FTE 1$4,737.2 $4,822.2 $4,748.4 $4,654.5 $3,743.6 $3,365.3

Total revenue - FTE 19,210.7 8,250.9 8,216.8 7,809.5 6,348.0 5,668.3

Total revenue - FTE excluding securities (gains)/losses, net 8,137.4 8,007.8 8,267.3 7,816.7 6,389.7 5,544.4

Net income per average common share

Diluted $2.13 $4.55 $5.82 $5.47 $5.19 $4.73

Diluted, excluding merger expense 2.13 4.55 5.82 5.64 5.25 4.73

Basic 2.14 4.59 5.87 5.53 5.25 4.79

Dividends paid per average common share 2.85 2.92 2.44 2.20 2.00 1.80

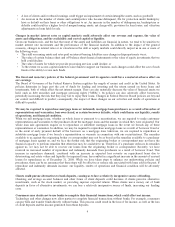

Selected Average Balances

Total assets $175,848.3 $177,795.5 $180,315.1 $168,088.8 $133,754.3 $122,325.4

Earning assets 152,748.6 155,204.4 158,428.7 146,639.8 117,968.8 108,094.9

Loans 125,432.7 120,080.6 119,645.2 108,742.0 86,214.5 76,137.9

Consumer and commercial deposits 101,332.8 98,020.2 97,175.3 93,355.0 77,091.5 69,443.7

Brokered and foreign deposits 14,743.5 21,856.4 26,490.2 17,051.5 10,041.4 10,595.3

Total shareholders’ equity 18,480.9 17,808.0 17,546.7 16,526.3 11,469.5 9,083.0

As of December 31

Total assets $189,138.0 $179,573.9 $182,161.6 $179,712.8 $158,869.8 $125,250.5

Earning assets 156,016.5 154,397.2 159,063.8 156,640.9 137,813.4 111,266.5

Loans 126,998.4 122,319.0 121,454.3 114,554.9 101,426.2 80,732.3

Allowance for loan and lease losses 2,351.0 1,282.5 1,044.5 1,028.1 1,050.0 941.9

Consumer and commercial deposits 105,275.7 101,870.0 99,775.9 97,572.4 92,109.7 72,924.6

Brokered and foreign deposits 8,052.7 15,972.6 24,245.7 24,480.8 11,251.6 8,264.9

Long-term debt 26,812.4 22,956.5 18,992.9 20,779.2 22,127.2 15,313.9

Total shareholders’ equity 22,388.1 18,052.5 17,813.6 16,887.4 15,986.9 9,731.2

Financial Ratios and Other Data

Return on average total assets 0.45 % 0.92 % 1.17 % 1.18 % 1.18 % 1.09 %

Return on average total assets less net realized and unrealized securities gains

and the Coca-Cola Company dividend 10.05 0.81 1.17 1.17 1.19 1.01

Return on average common shareholders’ equity 4.26 9.27 12.13 12.02 13.71 14.67

Return on average realized common shareholders’ equity 10.19 8.65 12.72 12.70 15.65 15.98

Net interest margin - FTE 13.10 3.11 3.00 3.17 3.17 3.11

Efficiency ratio - FTE 163.95 63.43 59.39 60.06 61.39 59.99

Efficiency ratio, excluding merger expense 163.95 63.43 59.39 58.80 60.94 59.99

Tangible efficiency ratio 162.64 62.26 58.13 58.54 60.17 58.86

Effective tax rate (benefit) (9.23) 27.36 29.10 30.67 30.31 30.21

Allowance to year-end total loans 1.86 1.05 0.86 0.90 1.04 1.17

Nonperforming assets to total loans plus OREO and other repossessed assets 3.49 1.35 0.49 0.29 0.40 0.47

Common dividend payout ratio 134.4 64.0 41.7 40.0 38.4 37.9

Full-service banking offices 1,692 1,682 1,701 1,657 1,676 1,183

ATMs 2,582 2,507 2,569 2,782 2,804 2,225

Full-time equivalent employees 29,333 32,323 33,599 33,406 33,156 27,578

Tier 1 capital ratio 10.87 % 6.93 % 7.72 % 7.01 % 7.16 % 7.85 %

Total capital ratio 14.04 10.30 11.11 10.57 10.36 11.75

Tier 1 leverage ratio 10.45 6.90 7.23 6.65 6.64 7.37

Total average shareholders’ equity to total average assets 10.51 10.02 9.73 9.83 8.58 7.43

Tangible equity to tangible assets 18.40 6.31 6.03 5.56 5.68 6.82

Tangible common equity to tangible assets 15.53 6.02 5.75 5.56 5.68 6.82

Book value per common share $48.42 $50.38 $48.78 $46.65 $44.30 $34.52

Market price:

High 70.00 94.18 85.64 75.77 76.65 71.73

Low 19.75 60.02 69.68 65.32 61.27 51.44

Close 29.54 62.49 84.45 72.76 73.88 71.50

Market capitalization 10,472 21,772 29,972 26,338 26,659 20,157

Average common shares outstanding (000s)

Diluted 350,183 352,688 362,802 363,454 303,309 281,434

Basic 348,919 349,346 359,413 359,066 299,375 278,295

1See Non-GAAP reconcilements in Tables 22 and 23 of the Management’s Discussion and Analysis of Financial Condition and Results of Operations.

17