SunTrust 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

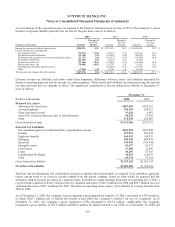

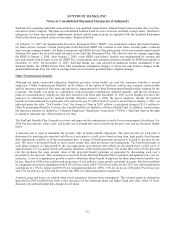

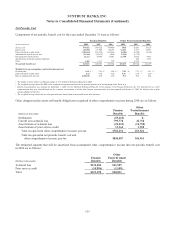

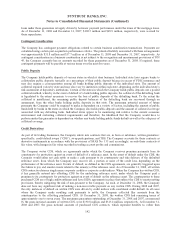

Net Periodic Cost

Components of net periodic benefit cost for the years ended December 31 were as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in thousands) 2008 2007 2006 2008 2007 2006

Service cost $77,872 $68,322 $74,920 $618 $1,241 $3,118

Interest cost 117,090 111,920 110,189 11,811 11,337 10,913

Expected return on plan assets (185,653) (186,356) (165,441) (8,186) (8,194) (8,126)

Amortization of prior service cost (11,166) (10,159) 3,050 (1,558) (1,370) -

Recognized net actuarial loss 22,223 34,849 55,063 12,750 14,286 9,912

Amortization of initial transition obligation ----280 2,322

Other 3,465 11,811 559 -11,586 -

Net periodic benefit cost $23,831 $20,387 $78,340 $15,435 $29,166 $18,139

Weighted average assumptions used to determine net cost

Discount rate26.28 %25.93 % 35.68 % 35.95 % 5.75 % 35.45 % 3

Expected return on plan assets 8.25 8.50 8.50 5.30 45.30 45.30 4

Rate of compensation increase 4.00/4.50 4.50 4.50 N/A N/A N/A

1The charge to Other reflects a settlement charge of $3.5 million to Retirement Benefits in 2008.

2The weighted average shown for 2008 is the weighted average discount rates for the pension benefits as of the beginning of the fiscal year.

3Interim remeasurement was required on September 1, 2006, for the SunTrust Retirement Plan due to the passage of the Pension Protection Act. The discount rate as of the

remeasurement date was selected based on the economic environment as of that date. Interim remeasurement was also required on February 13, 2007 for all plans due to plan

changes adopted at that time.

4The weighted average shown for the other postretirement benefit plan is determined on an after-tax basis.

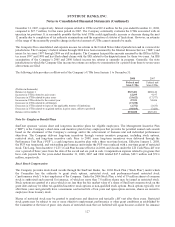

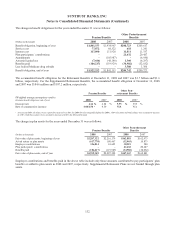

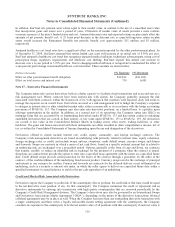

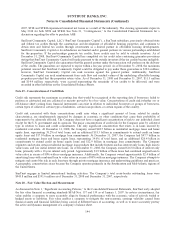

Other changes in plan assets and benefit obligations recognized in other comprehensive income during 2008 are as follows:

(Dollars in thousands)

Pension

Benefits

Other

Postretirement

Benefits

Settlements ($3,465) $-

Current year actuarial loss 795,778 42,718

Amortization of actuarial loss (22,223) (12,750)

Amortization of prior service credit 11,166 1,558

Total recognized in other comprehensive income, pre-tax $781,256 $31,526

Total recognized in net periodic benefit cost and

other comprehensive income, pre-tax $805,087 $46,961

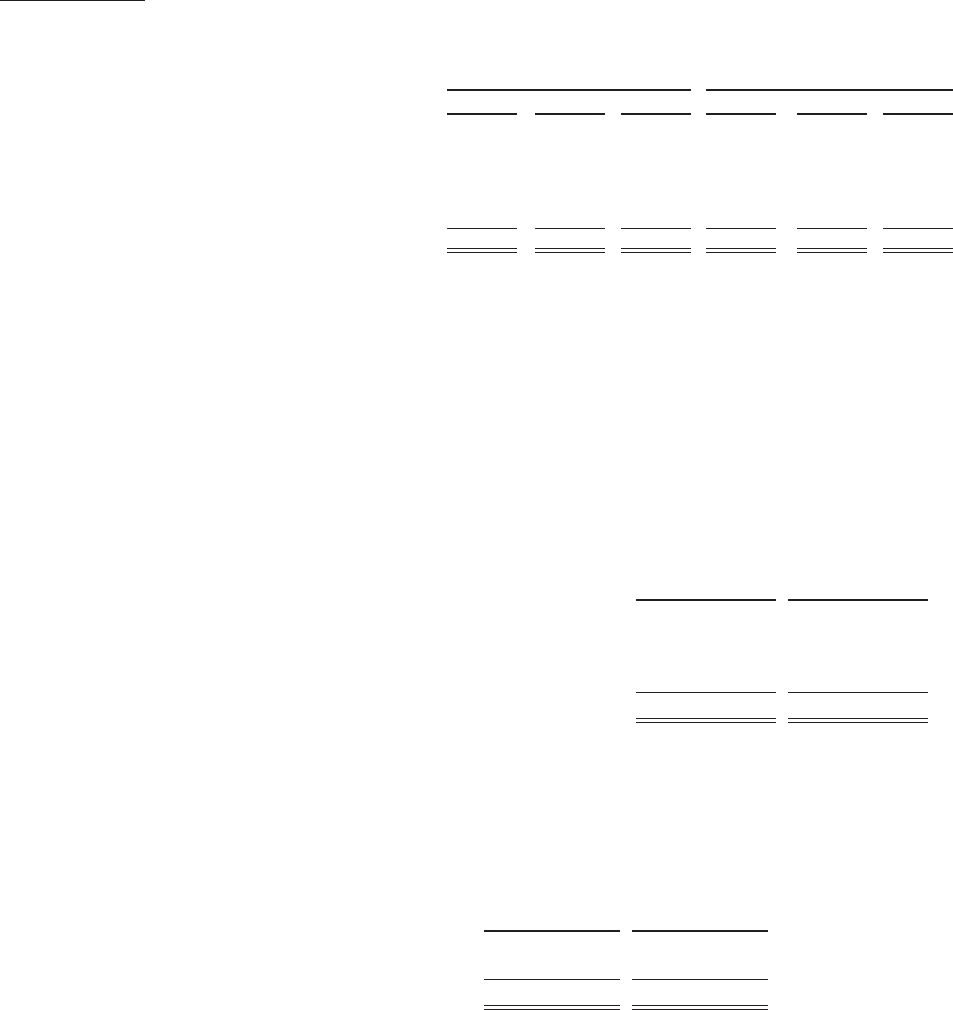

The estimated amounts that will be amortized from accumulated other comprehensive income into net periodic benefit cost

in 2009 are as follows:

(Dollars in thousands)

Pension

Benefits

Other

Postretirement

Benefits

Actuarial loss $132,284 $21,589

Prior service credit (10,886) (1,558)

Total $121,398 $20,031

135