SunTrust 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

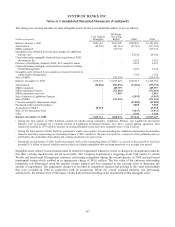

The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-term debt) were not

significant at December 31, 2008 and 2007.

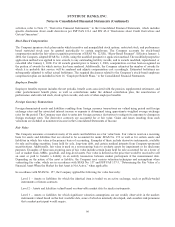

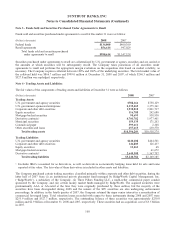

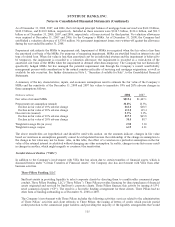

Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in

excess of one year. Minimum payments, by year and in aggregate, as of December 31, 2008 were as follows:

(Dollars in thousands)

Operating

Leases

Capital

Leases

2009 $208,014 $2,375

2010 195,966 2,487

2011 179,305 2,536

2012 163,190 1,903

2013 150,251 1,947

Thereafter 727,665 12,793

Total minimum lease payments $1,624,391 24,041

Amounts representing interest 7,980

Present value of net minimum lease payments $16,061

Net premises and equipment included $9.4 million and $10.5 million at December 31, 2008 and 2007, respectively, related to

capital leases. Aggregate rent expense (principally for offices), including contingent rent expense, amounted to $213.2

million, $182.8 million, and $169.5 million for 2008, 2007, and 2006, respectively. Depreciation/amortization expense for

the years ended December 31, 2008, 2007, and 2006 totaled $195.8 million, $216.2 million, and $209.4 million, respectively.

The Company manages certain community development projects that generate tax credits and help it meet the requirements

of the Community Reinvestment Act. The related interests in these projects are recorded within the other assets line item on

the Consolidated Balance Sheets. During 2007, the Company completed a strategic review of these properties and

determined that the sale of certain properties was possible, which resulted in the Company recording a $57.7 million

impairment charge in other noninterest expense within the Retail and Commercial line of business. Total impairment charges

recorded in 2008 totaled $19.9 million.

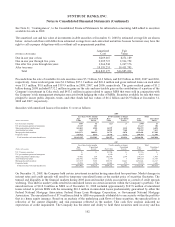

Note 9 – Goodwill and Other Intangible Assets

Under U.S. GAAP, goodwill is required to be tested for impairment on an annual basis or as events occur or circumstances

change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. In 2008, the

Company’s reporting units were comprised of Retail, Commercial, Commercial Real Estate, Mortgage, Corporate and

Investment Banking, Wealth and Investment Management, and Affordable Housing. The Company completed its 2008

annual review based on information that was as of September 30, 2008. The review utilized discounted cash flow analysis, as

well as guideline company and guideline transaction information, where available, to estimate the fair value of each reporting

unit. The estimates, specific to each reporting unit, that were incorporated in the valuations included projections of future

cash flows, discount rates, and applicable valuation multiples based on the guideline information. The assumptions

considered the current market conditions in developing short and long-term growth expectations and discount rates. The

estimated fair value of each reporting unit as of September 30, 2008 exceeded its respective carrying value; therefore, the

Company determined there was no impairment of goodwill as of that date. The degree by which the fair value of the

reporting unit exceeded its carrying value varied by reporting unit and ranged between approximately 10% and 300%, with

the Mortgage and Commercial Real Estate reporting units having the least amount of excess fair value.

As a result of continued deterioration in the economy during the fourth quarter of 2008, the Company determined that it was

more likely than not that the fair value of the Mortgage, Commercial Real Estate, and Corporate and Investment Banking

reporting units was less than their respective carrying value as of December 31, 2008, due to their exposure to residential real

estate and capital markets. As a result, the Company performed the second step of the goodwill impairment evaluation, which

involved calculating the implied fair value of the goodwill for those reporting units. The implied fair value of goodwill is

determined in the same manner as the amount of goodwill recognized in a business combination. The fair value of the

reporting unit’s assets and liabilities, including unrecognized intangible assets, is individually evaluated. The excess of the

fair value of the reporting unit over the fair value of the reporting unit’s net assets is the implied fair value of goodwill. The

Company estimated the fair value of each reporting unit’s assets and liabilities, including previously unrecognized intangible

105