SunTrust 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

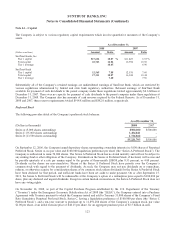

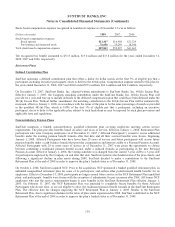

The Company is subject to certain restrictions on its ability to increase the dividend as a result of participating in the Capital

Purchase Program. Prior to November 14, 2011, unless the Company has redeemed the Series C and Series D Preferred Stock

or the Treasury has transferred the Series C and Series D Preferred Stock to a third party, the consent of Treasury will be

required for the Company to declare or pay any dividend or make any distribution on its common stock (other than regular

quarterly cash dividends of not more than $0.77 per share of common stock) or redeem, purchase or acquire any shares of its

common stock or other equity or capital securities, other than in connection with benefit plans consistent with past practice

and certain other circumstances specified in the Purchase Agreement. Prior to December 31, 2011, unless the Company has

redeemed the Series D Preferred Stock or the Treasury has transferred the Series D Preferred Stock to a third party, the

consent of the Treasury will be required for the Company to declare or pay any dividend or make any distribution on its

common stock (other than regular quarterly cash dividends of not more than $0.77 per share of common stock) or redeem,

purchase or acquire any shares of its common stock or other equity or capital securities, other than in connection with benefit

plans consistent with past practice and certain other circumstances specified in the Purchase Agreement. In addition, if the

Company increases its dividend above $0.54 per share per quarter prior to the tenth anniversary of its participation in the

Capital Purchase Program, then the anti-dilution warrants issued in connection with the Company’s participation in the

Capital Purchase Program will require the exercise price and number of shares to be issued upon exercise to be

proportionately adjusted. The amount of such adjustment is determined by a formula and depends in part on the extent to

which the Company raises its dividend. The formulas are contained in the warrant agreements which are filed as exhibits to

this report.

During the years ended December 31, 2008 and 2007, the SunTrust Board of Directors declared and paid cash dividends on

perpetual preferred stock totaling $48.8 million and $30.3 million, respectively.

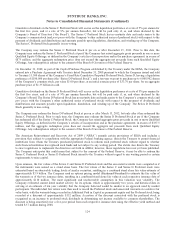

Accelerated Share Repurchase Agreement

On May 31, 2007, SunTrust entered into an accelerated share repurchase (“ASR”) agreement with a global investment bank

to purchase $800 million (gross of settlement costs) of SunTrust’s common stock. On June 7, 2007, the global investment

bank delivered to SunTrust 8,022,254 shares of SunTrust common stock, in exchange for the aforementioned consideration.

During the third quarter of 2007, SunTrust completed this ASR when the Company received, without additional payment, an

additional 1,462,091 shares.

Note 15 - Income Taxes

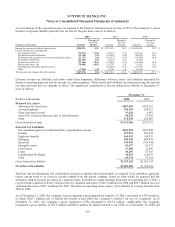

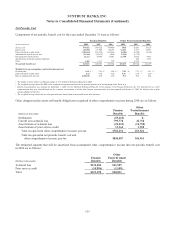

The components of income tax expense (benefit) included in the Consolidated Statements of Income were as follows:

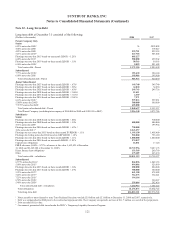

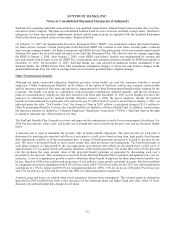

(Dollars in thousands) Years ended December 31,

Current income tax expense (benefit) 2008 2007 2006

Federal $140,484 $697,628 $753,523

State 13,480 65,644 7,481

Total $153,964 $763,272 $761,004

Deferred income tax expense (benefit)

Federal ($93,895) ($110,760) $105,906

State (127,340) (36,998) 2,060

Total ($221,235) ($147,758) $107,966

Total income tax expense (benefit) ($67,271) $615,514 $868,970

The Company’s income from international operations, before provision for income taxes, was not significant. Additionally,

the tax effects of unrealized gains and losses on securities available for sale, unrealized gains and losses on certain derivative

financial instruments, and other comprehensive income related to certain retirement plans were recorded in other

comprehensive income and had no effect on income tax expense (see Note 23, “Accumulated Other Comprehensive

Income,” to the Consolidated Financial Statements).

125