SunTrust 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

loans under these guarantees is largely driven by borrower payment performance under the terms of the mortgage loans.

As of December 31, 2008 and December 31, 2007, $100.5 million and $49.9 million, respectively, were accrued for

these repurchases.

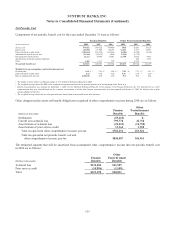

Contingent Consideration

The Company has contingent payment obligations related to certain business combination transactions. Payments are

calculated using certain post-acquisition performance criteria. The potential liability associated with these arrangements

was approximately $31.8 million and $37.7 million as of December 31, 2008 and December 31, 2007, respectively. As

contingent consideration in a business combination is not subject to the recognition and measurement provisions of FIN

45, the Company currently has no amounts recorded for these guarantees as of December 31, 2008. If required, these

contingent payments will be payable at various times over the next five years.

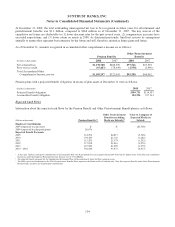

Public Deposits

The Company holds public deposits of various states in which it does business. Individual state laws require banks to

collateralize public deposits, typically as a percentage of their public deposit balance in excess of FDIC insurance and

may also require a cross-guarantee among all banks holding public deposits of the individual state. The amount of

collateral required varies by state and may also vary by institution within each state, depending on the individual state’s

risk assessment of depository institutions. Certain of the states in which the Company holds public deposits use a pooled

collateral method, whereby in the event of default of a bank holding public deposits, the collateral of the defaulting bank

is liquidated to the extent necessary to recover the loss of public deposits of the defaulting bank. To the extent the

collateral is insufficient, the remaining public deposit balances of the defaulting bank are recovered through an

assessment, from the other banks holding public deposits in that state. The maximum potential amount of future

payments the Company could be required to make is dependent on a variety of factors, including the amount of public

funds held by banks in the states in which the Company also holds public deposits and the amount of collateral coverage

associated with any defaulting bank. Individual states appear to be monitoring risk relative to the current economic

environment and evaluating collateral requirements and therefore, the likelihood that the Company would have to

perform under this guarantee is dependent on whether any banks holding public funds default as well as the adequacy of

collateral coverage.

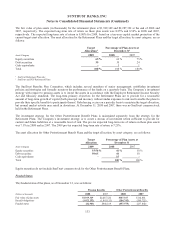

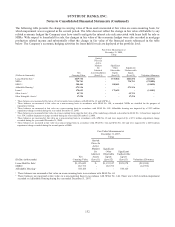

Credit Derivatives

As part of its trading businesses, the Company enters into contracts that are, in form or substance, written guarantees:

specifically, credit default swaps (“CDS”), swap participations, and TRS. The Company accounts for these contracts as

derivative instruments in accordance with the provisions of SFAS No. 133 and, accordingly, records these contracts at

fair value, with changes in fair value recorded in trading account profits and commissions.

The Company writes CDS, which are agreements under which the Company receives premium payments from its

counterparty for protection against an event of default of a reference asset. In the event of default under the CDS, the

Company would either net cash settle or make a cash payment to its counterparty and take delivery of the defaulted

reference asset, from which the Company may recover all, a portion or none of the credit loss, depending on the

performance of the reference asset. Events of default, as defined in the CDS agreements, are generally triggered upon

the failure to pay and similar events related to the issuer(s) of the reference asset. As of December 31, 2008, all written

CDS contracts reference single name corporate credits or corporate credit indices. When the Company has written CDS,

it has generally entered into offsetting CDS for the underlying reference asset, under which the Company paid a

premium to its counterparty for protection against an event of default on the reference asset. The counterparties to these

purchased CDS are of high creditworthiness and have ISDA agreements in place that subject the CDS to master netting

provisions, thereby mitigating the risk of non-payment to the Company. As such, at December 31, 2008, the Company

does not have any significant risk of making a non-recoverable payment on any written CDS. During 2008 and 2007,

the only instances of default on written CDS were driven by credit indices with constituent credit default. In all cases

where the Company made resulting cash payments to settle, the Company collected like amounts from the

counterparties to the offsetting purchased CDS. At December 31, 2008, the written CDS had remaining terms of

approximately one to seven years. The maximum guarantees outstanding at December 31, 2008 and 2007, as measured

by the gross notional amounts of written CDS, were $190.8 million and $313.4 million, respectively. At December 31,

2008 and 2007, the gross notional amounts of purchased CDS contracts, which represent benefits to, rather than

142