SunTrust 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recent Market and Regulatory Developments. Recent financial market conditions have often made it difficult or

uneconomical for banks and financial institutions to access the debt and equity capital markets. As a result, the United States

Congress, the Treasury, the Federal Reserve, and the FDIC have announced various programs designed to enhance market

liquidity and bank capital.

During the fourth quarter of 2008 the parent company received $4.9 billion of preferred stock proceeds from the Treasury’s

Capital Purchase Program (“CPP”, as described below). By participating in the CPP we are prohibited from increasing our

common stock dividend for three years unless (i) we have redeemed the Treasury’s preferred stock, (ii) the Treasury has

transferred all of such preferred stock, or (iii) the Treasury consents to such increase.

This sale of preferred stock subjects us to certain conditions and agreements. The preferred stock pays a 5% cumulative dividend

for the first five years, after which the dividend rate increases to 9%. The preferred stock is accompanied by 10-year warrants to

purchase up to $727 million of our common stock at market value, based on the 20-day average price prevailing at the time of

issuance. The Treasury may transfer the preferred stock and warrants.

Separately during the fourth quarter, the FDIC implemented the TLGP under which banks and financial institutions can issue

senior, unsecured debt guaranteed by the FDIC. In December 2008, we issued $3.0 billion of bank debt pursuant to the

TLGP. As of December 31, 2008, we retained approximately $1.0 billion of capacity to issue additional debt under the TLGP

rules then in force. We expect to utilize this remaining capacity by issuing approximately $1.0 billion before the TLGP has

been announced to expire on October 31, 2009; however we note that at the time of drafting of this filing, the final

regulations regarding TLGP have not yet been updated and is still scheduled to expire on June 30, 2009.

During the fourth quarter of 2008, we also participated in the Federal Reserve’s TAF and maintained outstanding borrowings

of $2.5 billion as of December 31, 2008. The TAF has provided banks with a source of relatively inexpensive funding with a

term of 84 days or less. We expect to continue to utilize the TAF in the near term so long as the cost of funds remains

attractive and/or financial market conditions remain volatile and uncertain.

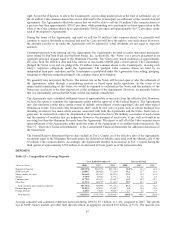

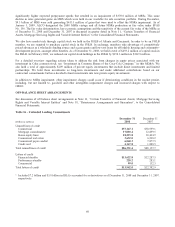

Other Liquidity Considerations. As detailed in Table 16, we had an aggregate potential obligation of $86.4 billion to our

clients in unused lines of credit at December 31, 2008. Commitments to extend credit are arrangements to lend to a customer

who has complied with predetermined contractual obligations. We also had $13.9 billion in letters of credit as of

December 31, 2008, most of which are standby letters of credit which require that we provide funding if certain future events

occur. Approximately $8.7 billion of these letters support variable rate demand obligations (“VRDOs”), municipal securities

remarketed by us and other agents on a regular basis (usually weekly). In the event that we or the other agents are unable to

remarket these securities, we would provide funding under the letters of credit.

Certain provisions of long-term debt agreements and the lines of credit prevent us from creating liens on, disposing of, or

issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations,

certain leases, sales or transfers of assets, and minimum shareholders’ equity ratios. As of December 31, 2008, we were and

expect to remain in compliance with all covenants and provisions of these debt agreements.

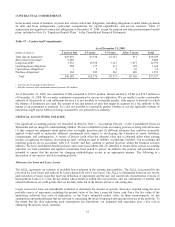

As of December 31, 2008, our cumulative UTBs amounted to $330.0 million. Interest related to UTBs was $70.9 million as

of December 31, 2008. These UTBs represent the difference between tax positions taken or expected to be taken in our tax

returns and the benefits recognized and measured in accordance with FIN 48. The UTBs are based on various tax positions in

several jurisdictions and, if taxes related to these positions are ultimately paid, the payments would be made from our

normal, operating cash flows, likely over multiple years.

56