SunTrust 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

values are excluded from the Company’s assessments of hedge effectiveness. Potential sources of ineffectiveness

include changes in market dividends and certain early termination provisions. The Company did not recognize any

ineffectiveness during 2008. Other than potential measured hedge ineffectiveness, no amounts will be reclassified from

accumulated other comprehensive income over the next twelve months and any remaining amounts recorded in

accumulated other comprehensive income will be reclassified to earnings when the probable forecasted sales of the

Coke shares occur.

Economic Hedging Activities

Outside of its normal derivatives trading activities for its clients, the Company enters into derivative contracts as end user to

economically hedge risks associated with certain non-derivative instruments. These risks include interest rate risk, foreign

exchange risk, credit risk, and overall price risk associated with certain mortgage assets as discussed below:

• The Company is subject to interest rate risk in connection with its fixed rate debt. When market interest rates move,

the market value of the Company’s debt is affected. To protect against this risk on certain debt issuances that the

Company has elected to carry at fair value, the Company has entered into pay variable-receive fixed interest rate

swaps (in addition to entering into certain non-derivative instruments) that decrease in value in a rising rate

environment and increase in value in a declining rate environment. The Company is also exposed to interest rate

risk associated with MSRs that the Company hedges at times with certain derivative financial instruments such as

swaptions.

• The Company is exposed to foreign exchange rate risk associated with certain senior notes denominated in euros

and pound sterling. This risk is economically hedged by entering into cross currency swaps which are received as

either euros or pound sterling/pay U.S. dollars. The foreign exchange rate impacts interest expense on the

Consolidated Statement of Income while the impact of the economic hedging activity is included within trading

account profits and commissions.

• The Company enters into credit derivatives, primarily credit default swaps, to hedge credit risk associated with

certain loans held within its Wholesale Banking and Wealth and Investment Management segments, which provide

income in cases of default.

• The Company also hedges overall price risk related to IRLCs, mortgage loans held for sale, and mortgage loans

held for investment designated at fair value under SFAS No. 159. Fair value changes occur as a result of interest

rate movements as well as changes in the value of the associated servicing. Derivative instruments used include

MBS options and forward sale agreements. The Company also entered into interest rate swaps, futures contracts,

and eurodollar options to mitigate interest rate risk associated with IRLCs, mortgage loans held for sale, and

mortgage loans held for investment designated at fair value under SFAS No. 159.

Trading Activities on Behalf of Clients

The Company also enters into various derivative contracts with its clients and generally manages the risk associated with

these contracts within the framework of its value-at-risk (“VaR”) approach that monitors total exposure daily and seeks to

manage the exposure on an overall basis. These trading positions primarily include interest rate swaps, equity derivatives,

credit default swaps, TRS, futures, options, and foreign currency contracts. Derivatives entered into on behalf of clients are

accounted for as trading assets or liabilities and any gain or loss in market value is recorded in trading account profits and

commissions. See Note 18, “Reinsurance Arrangements and Guarantees,” to the Consolidated Financial Statements for

specific discussion related to credit derivatives.

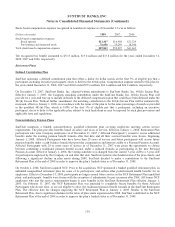

Note 18 – Reinsurance Arrangements and Guarantees

Reinsurance

The Company provides mortgage reinsurance on certain mortgage loans through contracts with several primary mortgage

insurance companies. Under these contracts, the Company provides aggregate excess loss coverage in a mezzanine layer in

exchange for a portion of the pool’s mortgage insurance premium. As of December 31, 2008, approximately $17.9 billion of

mortgage loans were covered by such mortgage reinsurance contracts. The reinsurance contracts are intended to place limits

139