SunTrust 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which included Alt-A and subprime mortgages, resulting in a decline in market value of these securities. The

decrease in noninterest income was further impacted by market value declines in the mortgage loan warehouse and

securitization and trading assets. The impact of these valuation adjustments was substantially offset by the second

quarter gain recognized on the sale of Coke common stock shares, the gain recognized on sale/leaseback

transactions related to premises, and the market valuation gain on our public debt and related hedges carried at fair

value.

• Noninterest expense increased $353.9 million, or 7.3%, compared to 2006. The increase was primarily driven by an

increase in fraud losses, growth in compensation expense attributable to the election in 2007 to record certain

newly originated mortgage loans held for sale at fair value, litigation expense related to our ownership in Visa,

Inc., and severance expense incurred in association with the E2program.

• Provision for loan losses increased $402.4 million, or 153.3%, compared to 2006. The provision for loan losses

exceeded net charge-offs for the year by $242.1 million, primarily related to higher delinquencies and increased net

charge-offs associated with residential real estate and home equity portfolios.

• Net charge-offs as a percentage of average loans was 0.35% for 2007, up 14 basis points from 2006. The increase

in net charge-offs was primarily related to residential real estate-related loans. Nonperforming assets increased $1.1

billion, compared to December 31, 2006, due primarily to the overall downturn in the housing market.

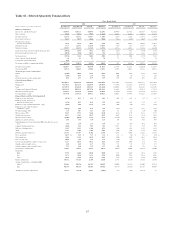

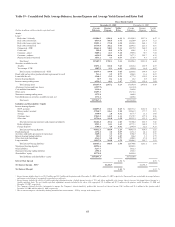

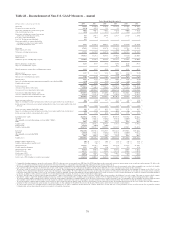

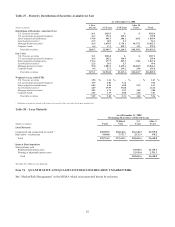

Retail and Commercial

Retail and Commercial net income for the twelve months ended December 31, 2007 was $790.5 million, a decrease of

$139.4 million, or 15.0%, compared to the same period in 2006. This decrease was primarily the result of higher provision

expense and lower net interest income primarily related to deposit spreads partially offset by higher noninterest income.

Net interest income decreased $94.7 million, or 3.2%, driven by a shift in deposit mix and compressed spreads as deposit

competition and the interest rate environment encouraged clients to migrate into higher yielding interest bearing accounts.

Average deposit balances decreased $120.5 million, or 0.2%, reducing net interest income by $3.2 million, while deposit

spreads decreased 10 basis points driving an $81.2 million decrease in net interest income. Average loan balances increased

$701.5 million, or 1.4%, increasing net interest income by $19.6 million, while loan spreads decreased 5 basis points causing

a $28.5 million decline in net interest income.

Provision for loan losses increased $175.2 million over the same period in 2006. The provision increase was most

pronounced in home equity lines, indirect auto and commercial loans (primarily commercial clients with annual revenue of

less then $5 million), reflecting the negative impact from the deterioration in certain segments of the consumer portfolio,

primarily related to the residential real estate market.

Total noninterest income increased $55.4 million, or 4.6%, over the same period in 2006. This increase was driven primarily

by a $52.8 million, or 7.8%, increase in service charges on deposit accounts from both consumer and business deposit

accounts primarily due to higher NSF fees. Interchange fees increased $21.4 million, or 11.8%. These increases were

partially offset by a decrease in gains on sales of student loans.

Total noninterest expense increased $13.3 million, or 0.5%, from the same period in 2006. A 1.8% increase in personnel

expense and other expenses related to investments in the branch distribution network and business banking were partially

offset by decreases in amortization of core deposit intangibles and new loan production expense.

Wholesale

Wholesale’s net income for the twelve months ended December 31, 2007 was $196.1 million, a decrease of $180.3 million,

or 47.9%, from 2006. The decrease was driven by write-downs and losses primarily in structured products due to capital

markets volatility created by turmoil in the mortgage industry, lack of loan liquidity, and widening credit spreads as well as

increased Affordable Housing related noninterest expense, partially offset by lower provision expense.

Net interest income decreased $21.0 million, or 3.6%, year over year. Average loan balances increased $277.9 million, or

0.9%. The increase in loan balances was offset by compressing spreads, resulting in a $23.8 million, or 4.9%, decrease in

loan related net interest income. The increase in balances was despite a $1.9 billion structured asset sale of corporate loans in

the first quarter of 2007, which was partially offset by growth in construction loans, corporate banking loans, lease financing

assets and the move of middle market clients from the Commercial line of business during the fourth quarter 2007. Average

deposits increased $472.5 million, or 9.3%, driven by an increase in higher cost corporate money market accounts offset in

part by a decline in demand deposits. Deposit related net interest income was down $1.1 million, or 0.8%, as the shift to

higher cost money market accounts compressed deposit spreads.

76